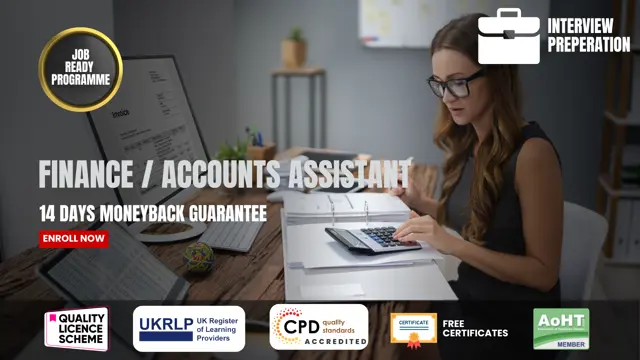

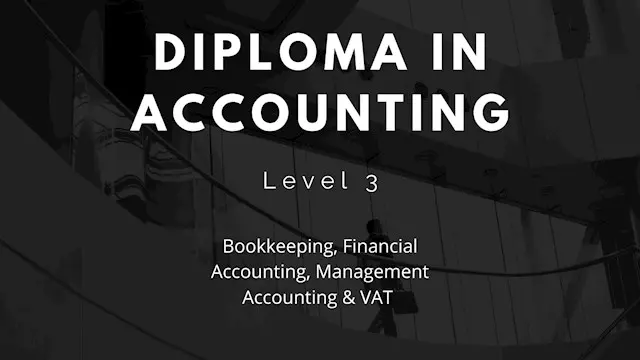

Accountant - Job Ready Program with Career Support & Money Back Guarantee

Janets

Mid-Year Sale! (was 1799) | Market Analysis | Portfolio, CV & Enrolment Letter | 24/7 Support & Access to 3000+ Courses

- 111 students

- Online

- 3 months · Self-paced

- Certificate(s) included

- 250 CPD points

- Tutor support

Great service

Earn Up To £50,000-£70,000 in 3 Months! The gap between supply and demand for Finance and Accounting skills is widening as we speak! The statistics are insane! In the next decade, the accounting and finance industry will have a million more job openings than now in the

…