- Jobs posted on Reed.co.uk saw a 17% increase on May – the highest level of vacancies since the Reed Job Index starting-benchmark in January 2020 *up 24%*

- All sectors and regions saw a month-on-month increase in vacancies except Health & Medicine, at -6% from May and -33% year-on-year

- Transport & Logistics vacancies continued to increase at +20% compared to May

- Customer Service and Leisure & Tourism are the stand-out sectors in opportunity growth, at +34% and +24% month-on-month, respectively, as the country continues ‘unlocking’

- Regionally, the North, Wales, Scotland and Northern Ireland have seen the most significant uplift in jobs posted

- Applications-per-vacancy have seen a steady decline in line with the increase of vacancies as the number and diversity of vacancies increased across the country

- Salaries in Customer Service, Retail and Transport & Logistics saw a promising increase year-on-year of +29%, 31% and 37%, respectively, showing a correlation between the three sectors and the current climate

- The Reed Job Index suggests hiring confidence is growing in Customer Service, Leisure & Tourism, Hospitality, Retail and Transport & Logistics, but attracting suitable applicants remains a challenge

Jobs posted

Highest level of open vacancies across the board since pre-pandemic

Job postings continued to increase across sectors; +17% from May to June and the highest level since the onset of the pandemic. This data shows consistent confidence from employers looking to recoup losses or grow their business as restrictions begin to ease further.

Despite being a prominent victim of the pandemic, hospitality opportunities continue to grow. With events such as Wimbledon and the UEFA Euro 2020 given the go-ahead and hospitality venues opening up nationwide, vacancies in the sector exploded – a 92% uplift on June 2020 and 47% higher than January 2020 – before the pandemic took hold.

Where hospitality businesses have had to diversify, and entrepreneurs take up new roles in food, delivery and at-home restaurant services to survive, they can now take the opportunity to expand past their restricted vision of last year.

When looking at the entire UK labour market, companies and organisations across the board have made cutbacks during the pandemic. However, countless roles are now live and teams are rebuilding in line with lockdown restrictions easing. Consequently, job roles across the UK saw a record-breaking increase in June.

Applicants per vacancy (APV)

The direct-to-consumer boom fuels job opportunities while diluting the competition for applicants in key sectors

The online retail and virtual norms of the last 12 months have led businesses to continue to serve customers at home and meet the demands of ‘need it now’ consumerism. The sectors that serve this increase in supply and demand have seen a very healthy rise in open vacancies. However, applications are not keeping up with hiring demand when compared to June 2020 as competition for roles was diluted:

|

Sector |

Jobs posted | APV |

|

Customer Service |

+87% |

-494% |

|

FMCG |

+72% |

-321% |

|

Hospitality |

+92% |

-489% |

|

Manufacture |

+73% |

-278% |

| Retail | +79% |

-376% |

Nearly all sectors saw a dramatic decrease in applicants per vacancy, particularly in business support sectors like Human Resources (at -319%) and Admin & Secretarial (at -375%). Non-white collar sectors were down significantly too, for example in Motoring & Automotive (at -510%) and Construction & Property (at -328%). This is a very visible sign of hiring demand far exceeding candidate appetite across the board.

These figures come much closer to pre-pandemic conditions, for the first time since January 2020, highlighting potentially inflated applicant numbers due to the overall shortage of jobs in the midst of the pandemic when compared with this time last year.

The only sector to experience significantly greater competition for applicants month-on-month is Health & Medicine which saw job postings fall by 6% and applicants-per-vacancy up by 10%.

Salary

Salaries continue to climb despite the uncertain times that lay ahead in the UK

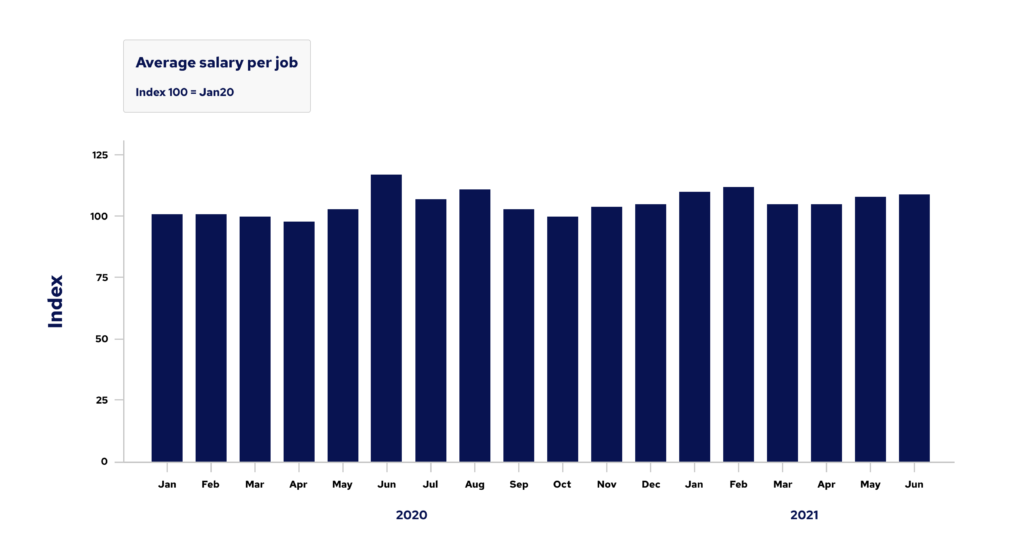

The Reed Job Index data shows salaries steadily increasing during 2021, not dipping less than 6% month-on-month since the start of the year. June continued this upward trend, with a 3% month-on-month increase in average salaries.

Indicative of the current economic climate and considering the rising cost of living, it is optimistic to see salaries rising again – and a clear sign that businesses know they need to offer competitive compensation in this challenging hiring market. The economy is likely to encounter a rise in inflation as pricing and cost of goods and services increases, and so rises in salary will be particularly welcome to help counter this.

Salary increases of note occurred in non-white collar sectors of Retail (31%) and Motoring & Auto (+20%) – both sectors which suffered greatly through the pandemic and subsequent lockdown measures as a result. The standout white collar sector for salary increase, however, was customer service (+29%). This follows the narrative that as more businesses open up and consumer demand increases further, customer service departments will need to grow to keep up. It’s therefore a function that makes an attractive case for itself in a candidate’s market.

Apprenticeships’ is perhaps the most compelling raise in salary, especially where education opportunities may be less in favour compared to an opportunity to earn. At +25%, the healthy increase in apprenticeship salaries gives a strong suggestion that employers are concentrating harder on attracting the best people into their business with a grassroots approach, using attractive remuneration as a key draw.

Focus: Leisure & Tourism and Hospitality employers need to deliver an attractive candidate proposition

As the country opens up, so too has Leisure & Tourism and the supporting sectors and people needed to fuel these industries – reacting directly to shifts in public behaviour and the economy:

|

Sector |

Job Index # |

YOY |

|

Retail |

202 |

+79% |

|

Customer Service |

192 |

+87% |

|

Hospitality |

147 |

+92% |

|

Leisure & Tourism |

247 |

+75% |

|

Transport & Logistics |

771 |

+93% |

To support the increased hiring in these industries, Customer Services and Recruitment consultancy vacancies are opening up significantly, diluting competition for people looking for roles.

While traditional seasonality has been knocked off course due to the pandemic, the easing of restrictions, a boom in UK staycations, and the looming summer break are causing a welcome and significant shift in Hospitality, Leisure & Tourism and the sectors that support them.

The challenge for employers and recruiters in these sectors will be creating an attractive candidate proposition to draw people in.

Though overshadowed by the pandemic, Brexit also needs to be considered within the context of Hospitality and Leisure & Tourism, with potentially less casual staff available for part-time and temporary roles in these sectors. Brexit fallout is evident in labour market data like the Reed Job Index already. With the veil of restrictions lifted, the full effects of Brexit will begin to present themselves over the coming months.

Winners will be those businesses that focus on culture, benefits and purpose, where salaries have declined. However, there must also be a commitment to employees to increase base salaries and opportunities to earn as businesses begin to reap the rewards of a more active summer.

Reed Job Index – methodology

The Reed Job Index is based on data from Reed.co.uk, one of the UK’s leading jobs and careers sites. Every month it tracks the number of jobs (permanent roles only) posted, salaries advertised and applications per job against a baseline of 100 set in January 2020.

January 2020 was set as the baseline as it provides a representative point in the UK labour market to compare pre-and post- pandemic trends.

The Reed Job Index is calculated against a baseline of 100 set in January 2020. A monthly index of 94, for example, illustrates that the data for the month in question is 6% down on the baseline month.