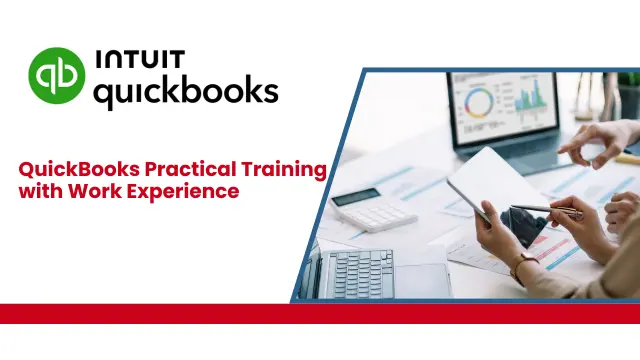

Finance / Accounts Assistant - Job Ready Program + Career Support & Money Back Guarantee

StudyHub

Personalised Job Search Assistance, Expertly Crafted CV, Strategic Placement, Consultation Sessions & More

- Online

- 3 months · Self-paced

- Certificate(s) included

- 250 CPD points

- Tutor support

Are you looking for a career in finance? Do you want to learn the skills you need to succeed in this exciting field? If so, then the Finance Assistant / Accounts Assistant - Career Mentoring & Support with Job Opportunity program is perfect for you! Enrol today and earn upto

…