KYC Demystified: The Complete Guide to Streamlining Compliance and Boosting Customer Trust

FREE PDF Certificate | Audio Visual Training | 10 CPD Points | Tutor Support | Lifetime Access

Summary

- Tutor is available to students

Add to basket or enquire

Overview

Better Route for Quicker Growth Opportunity with Limited Time; Grab This Offer Now!

Have you given up looking for a course that can improve your understanding and help you to bloom? If so, you've come to the right spot because our tactfully crafted KYC course will help you go one step closer to achieving your goal.

Get our premium course with a Free PDF Certificate at an unbelievable price

Each session in this course is thorough and easy-to-understand. The extensive course materials of KYC are accessible at any time and from any location, allowing you to study at your own speed in the comfort of your own home. Throughout the course, you will receive tutor support, and our helpful customer service is available around-the-clock to help you with any problems you might face while studying the KYC.

What You Get Out Of Studying With Janets

- Free PDF certificate upon successful completion of the course

- Full one-year access to course materials

- Instant assessment results

- Full tutor support available from Monday to Friday

- Study the course at your own pace

- Accessible, informative modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the training

- Study at your own time through your computer, tablet or mobile device

- Improve your chance of gaining valuable skills by completing the course

✦✦✦ Enrol in the KYC course to find out more about the topic and get one step closer to reaching your desired success ✦✦✦

CPD

Course media

Description

The course is delivered through Janets’ online learning platform. The KYC has no formal teaching deadlines, meaning you are free to complete the course at your own pace.

Course Modules

Module 01:

Introduction to KYC

- What is KYC?

- Objectives of KYC

- What is Compliance?

- Who Needs Compliance?

- Benefits of Compliance

- How can Protect Global business?

- Components of KYC

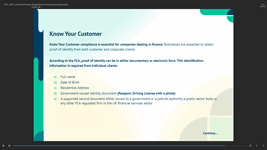

- Customer Identification Program (CIP)

- Customer due diligence

- Ongoing monitoring

- What is in Banking?

- What is eKYC?

- Document verification

- Video verification

- Facial recognition and liveness detection

- What is Mobile KYC?

- Importance of KYC

- Verification Process

- Collection of Information

- Ask the user to Upload an Evidence

- Verification of information

- Summary

Module 02:

Customer Due Diligence

- What is Customer Due Diligence?

- Main Elements of a Customer Due Diligence Programme

- Enhanced Due Diligence

- Enhanced Due Diligence for Higher-Risk Customers

- Account Opening, Customer Identification and Verification

- Consolidated Customer Due Diligence

- Summary

Module 03:

AML (Anti-Money Laundering)

- What is Money Laundering?

- What are the Differences Between Money Laundering And Terrorist Financing?

- How is Money Laundering Done?

- What are the Sanctions?

- What is AML?

- What is AML Compliance?

- Why is AML compliance important?

- AML Compliance Program

- AML Monitoring

- AML Client Onboarding Process

- What is Ongoing AML?

- Why is Ongoing Monitoring Important?

- Summary

Module 04:

KYC, AML, and Data Privacy Regulations for Businesses Operations in the United Kingdom

- Regulations

- AML Regulations

- Establishing a Business Relation

- The Changing Circumstances of Your Customers

- When Is It Necessary to Do Additional Due Diligence?

- Regulatory Bodies Governing AML And Compliance in Different Industries

- Data Privacy

- Your Rights

- Summary

Module 05:

Regulations to be Complied by Industries

- Penalties of Non-Compliance

- £163 million charge – Deutsche Bank

- £102,163,200 — Standard Chartered Bank

- £215,000 fine — Countrywide estate agents

- Financial Sector

- FinTech

- Gaming

- Cryptocurrency

- Real Estate

- E-Commerce

- Summary

Module 06:

Methods for carrying out and AML and the Future of Compliance

- A Private or Public Database

- Online Authentication Using ID Documents

- Two-factor Authentication (2FA)

- Knowledge-Based Authentication (KBA)

- How will Compliance Look in the Future?

- Summary

Method of Assessment

To successfully complete the course, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the course.

After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Certification

All students who successfully complete the course can instantly download their free e-certificate. You can also purchase a hard copy of the certificate, which will be delivered by post for £9.99.

Who is this course for?

The course is ideal for those who are interested or already working in this sector.

Requirements

No prior qualifications are needed for Learners to enrol on this course.

Career path

This KYC course will assist you to get your desired job in the relevant field. The course will also progress your career, regardless of your present job status.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Provider

Janets, is a popular and respected online platform where learners can access a range of affordable business-related courses. Our hardworking and experienced team are proud to present an extensive catalogue of courses that can be studied both flexibly and conveniently. You can learn anywhere, anytime, using any internet device. What’s more, successful completion of any course will lead to a fully-accredited qualification and e-certificate, demonstrating the learner’s commitment to ongoing professional development.

Our business courses - which include business administration and management, business branding training, business etiquette training, business ethics training, and many more - are designed to help people develop their professional skills and knowledge to find a job, gain a promotion, change career, or simply to add to their qualifications in a way that fits in with a busy life. It doesn’t matter if you want to gain the qualification or your employers want you to. Whatever the case, we can help.

Legal information

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.