AAT Level 4 Diploma in Professional Accounting PL

Sepera College

Distance learning based course with polish study materials and additional online

Summary

- Certificate of completion - Free

- Certificate of completion - Free

Add to basket or enquire

AI Overview

AI generated content may contain mistakes

The AAT Professional Diploma in Accounting is a comprehensive program designed to enhance the skills developed from the AAT Advanced Diploma in Accounting. This qualification covers high-level accounting and finance topics, enabling students to maximize opportunities in their current or new employment within a wider accountancy context.

Through this course, students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategy, and constructing and presenting complex management accounting reports. They will also explore specialist areas such as tax, auditing, credit management, and cash and treasury management.

The AAT Professional Diploma in Accounting is ideal for anyone wishing to pursue or progress their career in accountancy and finance. The assessments are computer-based with a time restriction, presenting students with a range of question types and formats, including multiple-choice, numeric gap-fill, and workplace-simulated activities.

To achieve this qualification, students must successfully complete the three mandatory unit assessments and two optional unit assessments from a choice of five. While the AAT does not set any prerequisites, a good standard of English and maths, along with any relevant school, college, or accounting experience, will be beneficial for the best chance of success.

This distance learning course offers flexibility for learners wanting to study around their work and life commitments, making it a suitable option for those seeking a self-paced and independent learning experience.

Overview

Qualification

AAT Professional Diploma in Accounting - Level 4

Certificates

Certificate of completion

Hard copy certificate - Included

Certificate will be sent once the course has been completed via post

Certificate of completion

Digital certificate - Included

Easily accessible certificates upon completion,

allowing your qualification to be verified within seconds via a QR code

Course media

Description

Students will look at and become comfortable with a wide range of financial management skills and applications, and gain competencies in drafting financial statements for limited companies; recommending accounting systems strategy, and constructing and presenting complex management accounting reports. Students will also learn about specialist areas such as tax, auditing, credit management, and cash and treasury management.

The assessments in this qualification are computer based with a time restriction. Students will be presented with a range of question types and formats in the assessment. These may include multiple-choice questions, numeric gap-fill questions, or question tools that replicate workplace activities such as making entries in a journal.

Students must successfully complete the three mandatory unit assessments and plus unit assessments for two optional units to achieve this qualification.

The AAT Professional Diploma in Accounting covers high-level accounting and finance topics and tasks. This qualification comprises three mandatory units and two specialist units selected from a choice of five options.

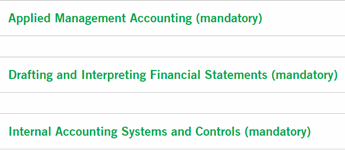

The mandatory units are:

- Applied Management

Accounting - Drafting and Interpreting

Financial Statements - Internal Accounting Systems

and Controls

The optional units are:

- Business Tax

- Personal Tax

- Audit and Assurance

- Cash and Financial Management

- Cash and Debt Management

If you are interested in this course, write to us.

You will receive a discount code, which gives you a special reduced

price for our courses.

Who is this course for?

AAT Professional Diploma in Accounting maximises opportunities for employment within a wider accountancy context. This qualification offers technical training in accounting and is ideal for anyone wishing to pursue or progress their career in accountancy and or finance.

Requirements

AAT does not set any prerequisites for the study of the AAT Professional Diploma in Accounting. However, for the best chance of success, we recommend that students begin their studies with a good standard of English and maths.

If students do have any other relevant school or college qualifications, a degree or some accounting experience, these will be of immense help. They may in certain circumstances entitle students to claim exemptions.

Career path

- Professional accounting technician

- Assistant auditor

- Assistant management accountant

- Payroll manager

- Senior bookkeeper

- Senior financial officer

- Accounts payable and expenses supervisor

- Assistant financial accountant

- Cost accountant

- Fixed asset accountant

- Indirect tax manager

- Payments and billing manager

- Senior fund accountant

- Tax supervisor

- VAT accountant.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.