Insurance Principles & Underwriting Process

15 Courses Bundle | CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

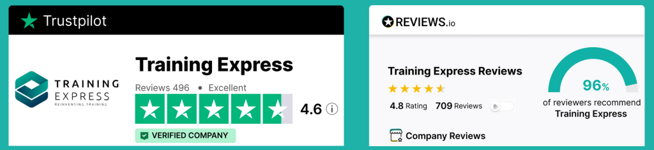

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

✩ Trusted by Over 10K Business Partners & 1 Million Students Around the World! ✩

[Updated 2025]

Insurance Principles & Underwriting Process

Step into the dynamic world of insurance with confidence! The insurance industry is experiencing steady growth, with 7% projected expansion over the next five years. Professionals in this field earn between £25,000 and £50,000 annually, making it an exciting and rewarding career path.

Our Insurance Principles & Underwriting Process course is your gateway to mastering the essential knowledge and skills required in this thriving sector. This CPD-accredited training is designed to prepare you for the demands of the insurance industry, combining core principles with advanced financial and legal expertise.

Here’s what you’ll gain from this course:

- Master Insurance Fundamentals: Learn the principles of insurance, risk management, and underwriting processes.

- Develop Financial Expertise: Dive into advanced accounting, payroll, and financial modelling tailored for startups.

- Enhance Analytical Skills: Build data analysis proficiency with Excel and efficient data entry techniques.

- Navigate Regulations with Confidence: Understand GDPR compliance, anti-money laundering laws, and UK employment law.

- Boost Problem-Solving Abilities: Strengthen your critical thinking and crisis management skills to handle challenges effectively.

This course equips you with a comprehensive understanding of the insurance industry and its related fields, opening doors to career opportunities in underwriting, financial analysis, and risk management.

Don’t miss your chance to excel in a fast-growing sector. Enroll today and gain the knowledge and skills needed to thrive in the insurance and financial industries. Your journey to success starts here!

This Bundle Includes:

- Course 01: Insurance

- Course 02: Accounting and Finance

- Course 03: Payroll

- Course 04: Advanced Accounting & Bookkeeping

- Course 05: Microsoft Excel in Accounting

- Course 06: UK Employment Law

- Course 07: Anti-Money Laundering Regulation Training

- Course 08: Financial Modelling: Financial Modelling for Startups

- Course 09: Corporate Risk And Crisis Management

- Course 10: Corporate Tax Return UK

- Course 11: Efficient Data Entry Course

- Course 12: Data Analysis In Excel

- Course 13: General Data Protection Regulation (GDPR) Awareness

- Course 14: Touch Typing Essentials

- Course 15: Problem-Solving Skills

Key Features

- Accredited by CPD

- Instant e-certificate

- FREE PDF + Hardcopy certificate

- Easy payment method

- Fully online, interactive course with audio voiceover

- Self-paced learning and laptop, tablet, smartphone-friendly

- Learn Anytime, Anywhere

- 24/7 Learning Assistance

- Best Value Price

- Discounts on bulk purchases

Enrol now in this Insurance Principles & Underwriting Process course to excel!

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

CPD

Course media

Resources

- Training Express Brochure - download

Description

Learning Outcomes

- Understand key principles of insurance and underwriting processes comprehensively.

- Gain knowledge of UK accounting, finance, and payroll systems effectively.

- Learn advanced accounting, bookkeeping, and Microsoft Excel applications.

- Explore corporate tax processes and anti-money laundering regulations in-depth.

- Develop skills in efficient data entry, GDPR, and touch typing.

- Enhance problem-solving and financial modelling skills for startups.

Accreditation

All of our courses are fully accredited, including this Insurance Principles & Underwriting Process Course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in Insurance Principles & Underwriting Process.

Certification

Once you’ve successfully completed your Insurance Principles & Underwriting Process Course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our Insurance Principles & Underwriting Process Course certification has no expiry dates, although we do recommend that you renew them every 12 months.

Who is this course for?

This Insurance Principles & Underwriting Process Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Insurance Principles & Underwriting Process Course is ideal for:

- Individuals aspiring to work in insurance and underwriting sectors.

- Beginners seeking foundational knowledge in accounting, finance, and payroll.

- Those looking to improve data analysis, financial modelling, and crisis management skills.

- Employees aiming to understand UK employment law and GDPR compliance.

- Professionals interested in upgrading their touch typing and problem-solving abilities.

Requirements

Learners do not require any prior qualifications to enrol on this Insurance Principles & Underwriting Process Course. You just need to have an interest in Insurance Principles & Underwriting Process Course.

Career path

After completing this Insurance Principles & Underwriting Process Course you will have a variety of careers to choose from. The following job sectors of Insurance Principles & Underwriting Process Course are:

- Insurance Underwriter - £26K to £50K/year.

- Financial Analyst - £30K to £55K/year.

- Risk Manager - £40K to £70K/year.

- Payroll Specialist - £25K to £45K/year.

- Data Analyst - £28K to £60K/year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.