Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance

CPD UK Certified | Level 6 Endorsed Diploma| 150 CPD Points | Expert Support [1000+ Enrollment] | 24/7 Tutor Support

One Education

Summary

- Certificate of completion - £9

- Certificate of completion - £119

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Discover the power of accounting with our 6-in-1 Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance Bundle course – start learning today!

Over 3 million people use Sage 50 Accounts daily for all small and large businesses. This Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance high-demand skillset is available for everyone at an affordable price and with compact training. Be an expert today and get started with a secured & promising career ahead.

Our Sage 50 course is endorsed by the Quality Licence Scheme, ensuring your newly acquired skills will enhance your professional development. The Sage 50 course is accredited by CPD Certification Service (CPD UK), with 150 CPD points available as proof of your achievement.

Bundle includes:

- Course 01: Sage 50

- Course 02: Payroll Administrator System

- Course 03: HR Management

- Course 04: UKPension

- Course 05: UK Tax Accounting

- Course 06: Finance and Finance

Key Features & Benefits:

- Quality Licence Scheme (QLS) endorsed

- CPD Certification Service Accredited (CPD UK)

- Lifetime Access & 24/7 Support on weekdays (Monday to Friday)

- Self-paced course modules

- Course materials feature captivating voice-overs and visuals

Achievement

Certificates

Certificate of completion

Digital certificate - £9

Certificate of completion

Hard copy certificate - £119

QLS Endorsed Certificate

Hardcopy of this certificate of achievement endorsed by the Quality Licence Scheme can be ordered and received straight to your home by post, by paying —

- Within the UK: £119

- International: £119 + £10 (postal charge) = £129

CPD Certification Service Accredited Certification

- Hardcopy Certificate (within the UK): £15

- Hardcopy Certificate (international): £15 + £10 (postal charge) = £25

CPD

Course media

Description

What you will discover in this Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance Courses:

- Gain a holistic understanding and practical skills of using the Sage 50 software.

- Learn to set up accounts, undertake Month End and Year-End Processes, create, modify and review the chart of accounts and accurately observe the financial state of your company with the software.

- Create customer invoices, check bank accounts and nominal and understand invoice management for products utilising various useful platforms.

- Understand nominal ledger, bank transfers, setting up, processing and deleting prepayments & deal with accruals.

- Learn the advanced principles of preparing financial statements and VAT returns and preparing for Audit with the course.

- Discover how to manage the delivery system for your clients on an elaborate scale, create and check BOMs, and manage product transfers.

- Learn how to calculate the cost of sales correctly, stock value, utilise stock wizard and set up departments, departmental balance sheet, use report wizard, and many more.

Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance course is the perfect opportunity to gain a deeper understanding of the software and its functionalities. From setting up accounts to generating financial reports, you'll become a pro at navigating Sage 50 with ease. Don't miss out on the chance to enhance your accounting skills with this comprehensive Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance course.

Module Attributes:

Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance course has been meticulously designed to deliver maximum information in minimum time. This approach enables learners to easily comprehend the core concepts and confidently apply them to diverse real-life scenarios.

Course 01: Sage 50 Course Curriculum:

- Sage 50 Accounts

- Sage 50 Bookkeeper – Coursebook

- Introduction and TASK 1

- TASK 2 Setting up the System

- TASK 3 a Setting up Customers and Suppliers

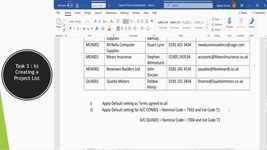

- TASK 3 b Creating Projects

- TASK 3 c Supplier Invoice and Credit Note

- TASK 3 d Customer Invoice and Credit Note

- TASK 4 Fixed Assets

- TASK 5 a and b Bank Payment and Transfer

- TASK 5 c and d Supplier and Customer Payments and DD STO

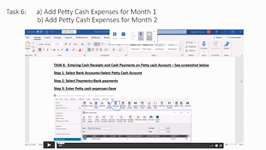

- TASK 6 Petty Cash

- TASK 7 a Bank Reconnciliation Current Account

- TASK 7 b Bank Reconciliation Petty Cash

- TASK 7 c Reconciliation of Credit Card Account

- TASK 8 Aged Reports

- TASK 9 a Payroll

- TASK 9 b Payroll Journal

- TASK 10 Value Added Tax – Vat Return

- TASK 11 Entering opening balances on Sage 50

- TASK 12 a Year end journals – Depre journal

- TASK 12 b Prepayment and Deferred Income Journals

- TASK 13 a Budget

- TASK 13 b Intro to Cash flow and Sage Report Design

- TASK 13 c Preparation of Accountants Report & correcting Errors (1)

Course 02: Payroll Administrator

- Module 01: Payroll System In The UK

- Module 02: Payroll Basics

- Module 03: Company Settings

- Module 04: Legislation Settings

- Module 05: Pension Scheme Basics

- Module 06: Pay Elements

- Module 07: The Processing Date

- Module 08: Adding Existing Employees

- Module 09: Adding New Employees

- Module 10: Payroll Processing Basics

- Module 11: Entering Payments

- Module 12: Pre-Update Reports

- Module 13: Updating Records

- Module 14: E-Submissions Basics

- Module 15: Process Payroll (November)

- Module 16: Employee Records And Reports

- Module 17: Editing Employee Records

- Module 18: Process Payroll (December)

- Module 19: Resetting Payments

- Module 20: Quick SSP

- Module 21: An Employee Leaves

- Module 22: Final Payroll Run

- Module 23: Reports And Historical Data

- Module 24: Year-End Procedures

Course 03: HR Management

- Introduction to Human Resources

- Employee Recruitment and Selection Procedure

- Employee Training and Development Process

- Performance Appraisal Management

- Employee Relations

- Motivation and Counselling

- Ensuring Health and Safety at the Workplace

- Employee Termination

- Employer Records and Statistics

- Essential UK Employment Law

Course 04: UK Pension

- Module 01: Overview Of The UK Pension System

- Module 02: Type Of Pension Schemes

- Module 03: Pension Regulation

- Module 04: Pension Fund Governance

- Module 05: Law And Regulation Of Pensions In The UK

- Module 06: Key Challenges In UK Pension System

Course 05: UK Tax Accounting

- Module 01: Introduction To Accounting

- Module 02: Income Statement And Balance Sheet

- Module 03: Tax System And Administration In The UK

- Module 04: Tax On Individuals

- Module 05: National Insurance

- Module 06: How To Submit A Self-Assessment Tax Return

- Module 07: Fundamentals Of Income Tax

- Module 08: Payee, Payroll And Wages

- Module 09: Value Added Tax

- Module 10: Corporation Tax

- Module 11: Double Entry Accounting

- Module 12: Career As A Tax Accountant In The UK

Course 06: Accounting and Finance

- Module 01: Introduction To Accounting And Finance

- Module 02: The Role Of An Accountant

- Module 03: Accounting Process And Mechanics

- Module 04: Introduction To Financial Statements

- Module 05: Financial Statement Analysis

- Module 06: Budgeting And Budgetary Control

- Module 07: Financial Markets

- Module 08: Financial Risk Management

- Module 09: Investment Management

- Module 10: Auditing

Course Assessment

Upon completing an online Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%.

Who is this course for?

This Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance course is designed to enhance your expertise and boost your CV. Learn key skills and gain a certificate of achievement to prove your newly-acquired knowledge.

This course particularly effective for-

- Proprietors of businesses.

- Accounting specialists.

- Students of accounting.

- Anyone interested in learning to account software.

Requirements

Please Note: For practice purpose, you should have software installed on your PC. The software is not included with this course. Sage provides a free online trial version of the software, which is more than suitable to study this course and learn how to use the software. You will get the full instructions for downloading free Software on your course.

Career path

Upon successfully completing the Sage 50, Payroll, HR, Pension, UK Tax Accounting and Finance Course, learners will be equipped with:

- Accounting Technician (£18,000 to £32,000)

- Management Accountant (£25,000 to £100,000)

- Sales Manager (£22,000 to £70,000)

- Sage 50 Accountant (£20,000 to £60,000)

- Bookkeeper - Sage 50 (£23,000 to £60,000)

Questions and answers

How long is this course? Thank you

Answer:Dear Isa, Thanks for reaching out. The total course length is 41 hours. However, once you purchase the course, you will have a one-year access into the course. Therefore, you can complete it anytime within a year. Regards, Help Desk.

This was helpful.What kind of experience do I need to have to do the course?

Answer:Hi Gardiner, The course is open to all and there is no formal qualification or any previous experience needed. You will learn everything needed from the course directly. Thanks.

This was helpful.Can I complete the course with the trial version of Sage?

Answer:Hi Walker, Thanks for the question. Yes, you can complete the course with the trial version. The course is designed in a way that you don’t need to have the full version software. It’s fully theoretical and the exam will only cover theoretical topics that are discussed in the course. Thanks.

This was helpful.

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.