- Exam(s) / assessment(s) is included in price

- Tutor is available to students

- TOTUM card available but not included in price What's this?

Level 3 Diploma in Banking with Official Certification

Accredited by The Quality License Scheme | Endorsed Certificate Included | Unlimited Access for 365 Days | Tutor Support

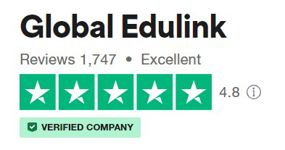

Global Edulink

Summary

Overview

Level 3 Diploma in Banking with Official Certification

This course is endorsed under the Quality Licence Scheme.

Develop a strong foundation in the principle of banking with the Diploma in Banking at QLS Level 3 course. Understand accounting principles and develop critical skills that can take your career in banking to the next level. It is perfect course for individuals who want to have a career in the banking industry or students who want to become bankers.

Banking is an in-demand industry, and more and more workers with knowledge in banking are required to take on a myriad of job positions. The course offers learners an overview of the essence of banking and bank models. Upon completion of the course, learners will be fully equipped with the skills to be efficient bankers within an organisation. The course is designed to provide learners with highly developed techniques and trends in banking and finance.

The Diploma in Banking at QLS Level 3 is a popular course for individuals who want to be efficient in their job role as bankers and auditors. It is a unique course that offers key benefits to understand the principles and procedures of banking in the real-world.

The Quality Licence Scheme, endorses high-quality, non-regulated provision and training programmes. This means that Global Edulink has undergone an external quality check to ensure that the organisation and the courses it offers, meet defined quality criteria. The completion of this course alone does not lead to a regulated qualification but may be used as evidence of knowledge and skills gained. The Learner Unit Summary may be used as evidence towards Recognition of Prior Learning if you wish to progress your studies in this subject. To this end the learning outcomes of the course have been benchmarked at Level 3 against level descriptors published by Quality Licence Scheme, to indicate the depth of study and level of demand/complexity involved in successful completion by the learner.

This course has been endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. This course is not regulated by Ofqual and is not an accredited qualification. We will be able to advise you on any further recognition, for example progression routes into further and/or higher education. For further information please visit the Learner FAQs on the Quality Licence Scheme website.

Why Choose Global Edulink?

Global Edulink offers the most convenient path to gain skills and training that will give you the opportunity to put into practice your knowledge and expertise in an IT or corporate environment. You can study at your own pace at Global Edulink and you will be provided with all the necessary material, tutorials, qualified course instructor, narrated e-learning modules and free resources which include Free CV writing pack, free career support and course demo to make your learning experience more enriching and rewarding.

Achievement

Course media

Description

Access Duration

The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time.

COURSE CURRICULUM

Module 01 : Essence of Banking

Module 02 : Money Creation

Module 03 : Risk in Banking

Module 04 : Bank Models

Module 05 : End Notes

Method of Assessment

In order to complete the Diploma in Banking – Level 3 successfully, all students are required to complete a series of assignments. The completed assignments must be submitted via the online portal. Your instructor will review and evaluate your work and provide your feedback based on how well you have completed your assignments.

Certification

Those who successfully complete the course will be issued the Diploma in Banking at QLS Level 3 by the Quality Licence Scheme.

Course Code: QLS-04478

Endorsed by

The Quality Licence Scheme is part of the Skills and Education Group, a charitable organisation that unites education and skills-orientated organisations that share similar values and objectives. With more than 100 years of collective experience, the Skills and Education Group’s strategic partnerships create opportunities to inform, influence and represent the wider education and skills sector.

The Skills and Education Group also includes two nationally recognised awarding organisations; Skills and Education Group Awards and Skills and Education Group Access. Through our awarding organisations we have developed a reputation for providing high-quality qualifications and assessments for the education and skills sector. We are committed to helping employers, organisations and learners cultivate the relevant skills for learning, skills for employment, and skills for life.

Our knowledge and experience of working within the awarding sector enables us to work with training providers, through the Quality Licence Scheme, to help them develop high-quality courses and/or training programmes for the non-regulated market.

Other Benefits

- Written and designed by the industry’s finest expert instructors with over 15 years of experience

- Repeat and rewind all your lectures and enjoy a personalised learning experience

- Unlimited 12 months access from anywhere, anytime

- Excellent Tutor Support Service (Monday to Friday)

- Save time and money on travel

- Learn at your convenience and leisure

- Eligible for TOTUM discount card

Who is this course for?

- Financial Officer

- Accountant, Finance Managers

- Students studying Finance

Requirements

- Learners should be age 19 or over, and must have a basic understanding of Maths, English, and ICT.

- A recognised qualification at level 2 or above in any discipline.

Career path

- Accountant - £28,612 per annum

- Banker - £24K per annum

- Relationship Banker - £29,703 per annum

- Accounts Executive - £22,196 per annum

- Staff Accountant - £25,261 per annum

Others jobs you can get

- Accounting Assistant

- Accounting Officer

- Staff Auditor

- Internal Auditor

Questions and answers

Hi, I am interested for the Banking course, level 3. I have customer service level 1 and financial seminars abroad. Could I attend this course?

Answer:Dear Christina, Thank you for your query. Yes you can attend this course. The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time. Regards, Student Support Team

This was helpful.Hi there! I am interested in the course for the Level 3 Banking Diploma with Official Certification. When will the diploma be issued? Thank very much

Answer:Dear Sarah Thank you very much for your query. Once you complete the course and the assignments you will recieve the certificate asap. Hurry up to grab the discount, As it ends soon. Regards, Student Support Team.

This was helpful.I have statistics degree from abroad and I want to change my career from now I retail to banking .can I start this course directly?

Answer:Dear Urshita Thank you very much for your query. Yes you can enroll. The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time. Regards, Student Support Team.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.

FAQs

Interest free credit agreements provided by Zopa Bank Limited trading as DivideBuy are not regulated by the Financial Conduct Authority and do not fall under the jurisdiction of the Financial Ombudsman Service. Zopa Bank Limited trading as DivideBuy is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, and entered on the Financial Services Register (800542). Zopa Bank Limited (10627575) is incorporated in England & Wales and has its registered office at: 1st Floor, Cottons Centre, Tooley Street, London, SE1 2QG. VAT Number 281765280. DivideBuy's trading address is First Floor, Brunswick Court, Brunswick Street, Newcastle-under-Lyme, ST5 1HH. © Zopa Bank Limited 2024. All rights reserved.