Introduction to UK Anti Money Laundering Regulation (AML) and Professional Integrity

Online 6 Courses Bundle | 6 CPD Accredited PDF & HARDCOPY Certificates | Free Retake Exam | Lifetime Access

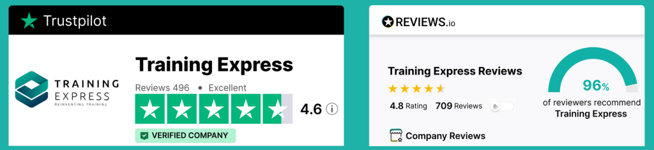

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

**6 FREE CPD Accredited Certificates and Included with Lifetime Access**

Indulge in our 6-course bundle, originally priced at £120, now available for a limited time at the exclusive rate of £100. Enjoy an instant savings of £20! Ready to forge a path where compliance meets character? Join us in this amazing quest for financial vigilance and professional honour with our Introduction to UK Anti Money Laundering Regulation (AML) and Professional Integrity course bundle.

This bundle consists of the following CPD Endorsed Courses:

- ➥ Course 01: Anti Money Laundering (AML)

- ➥ Course 02: Fraud Awareness and Prevention Training

- ➥ Course 03: Know Your Customer (KYC)

- ➥ Course 04: CRM - Customer Relationship Management

- ➥ Course 05: GDPR UK Training

- ➥ Course 06: Corporate Governance

Key Features

- 6 FREE CPD Accredited Certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

Certificates

Digital certificate

Digital certificate - Included

Hard copy certificate

Hard copy certificate - Included

Hardcopy Certificate (UK Delivery):

For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99.

Hardcopy Certificate (International Delivery):

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

CPD

Course media

Resources

- Training Express Brochure - download

Description

In a world where financial landscapes are evolving, staying ahead of the game is not just an advantage; it's a necessity. Dive into the heart of financial security and ethical practice as we demystify the realm of Anti Money Laundering (AML) Regulation with a touch of professional finesse.

Explore the dynamic world of Anti Money Laundering, where you'll gain a profound understanding of the mechanisms employed to combat financial crime. Elevate your awareness and vigilance through Fraud Awareness and Prevention Training, equipping yourself with the tools to safeguard against deceptive practices.

Uncover the essentials of Know Your Customer (KYC), essential in fostering responsible and ethical business relationships.Navigate the realms of Customer Relationship Management (CRM), honing your skills in building enduring client connections.

Master the intricacies of GDPR UK Training, ensuring compliance with data protection regulations. Lastly, explore the foundations of Corporate Governance, understanding the principles that underpin ethical business practices.

Join us in this learning experience, where regulations become your allies, and professional integrity becomes your hallmark. Don't just comply; lead with integrity. Enrol now and let the journey begin!

Learning Outcomes:

- Implement effective anti-money laundering measures in financial transactions.

- Detect and prevent fraudulent activities, safeguarding organisational assets.

- Execute thorough Know Your Customer (KYC) procedures for enhanced due diligence.

- Strengthen customer relationships through adept Customer Relationship Management (CRM).

- Navigate GDPR regulations for data protection in the UK.

- Uphold ethical business practices through a deep understanding of Corporate Governance.

Certificate

After completing this course, you will be able to claim your FREE PDF and Hardcopy certificates, which are CPD accredited.

Job Vacancies

There are currently over 10,000 job vacancies in the UK for Anti Money Laundering Regulation (AML) and Professional Integrity professionals. The most popular roles include:

- Sanctions Analyst

- Fraud Investigator

- Financial Intelligence Analyst

- Compliance Manager

- Money Laundering Reporting Officer (MLRO)

- Regulatory Reporting Officer

Future Job Openings

The UK Anti Money Laundering Regulation (AML) and Professional Integrity sector is expected to grow in the coming years. There are a number of reasons for the strong demand for UK Anti Money Laundering Regulation (AML) and Professional Integrity professionals. The increasing complexity of financial regulations and the growing importance of corporate governance are a contributing factor for the demand.

The rising focus on ethical business practices along with the increasing threat of terrorism financing has led to an increased demand for qualified professionals who can carry out these tasks. The job market for this profession is strong, with a predicted 20% growth in employment by 2025.

Salaries in the UK

The salaries for UK Anti Money Laundering Regulation (AML) and Professional Integrity professionals vary depending on their experience and qualifications. However, most professionals in this field can expect to earn a competitive salary. The average salary for an Anti Money Laundering Officer in the UK is £40,000 per year.

Satisfaction

A recent survey found that 87% of Anti Money Laundering Regulation (AML) and Professional Integrity professionals are satisfied with their jobs. The most common reasons given for job satisfaction were:

- The opportunity to make a difference in the world by helping to prevent crime and protect the financial system

- The chance to work with complex and challenging issues

- The opportunity to learn and grow in a dynamic field

- The good work-life balance

- The strong earning potential

Who is this course for?

- Finance professionals seeking regulatory compliance knowledge.

- Legal professionals aiming to expand expertise in financial law.

- Business managers responsible for customer relations and data protection.

- Risk management professionals enhancing their skill set.

- Compliance officers ensuring adherence to legal frameworks.

- Entrepreneurs committed to ethical business conduct.

- Auditors evaluating corporate governance practices.

- Students pursuing careers in finance, law, or business management.

Career path

- Financial Compliance Officer

- Fraud Investigator

- KYC Analyst

- CRM Specialist

- GDPR Consultant

- Corporate Governance Advisor

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.