- Certificate of Achievement - Free

- Exam(s) / assessment(s) not included in price, and must be purchased separately

- Tutor is available to students

Digital certificate - Included

Students will only be issued a Certificate of Achievement after sitting and passing the exam successfully.

*Exam fees are not included in the course fees.

Students will not be charged any additional fees to receive their Certificate upon completing and passing the exam successfully.

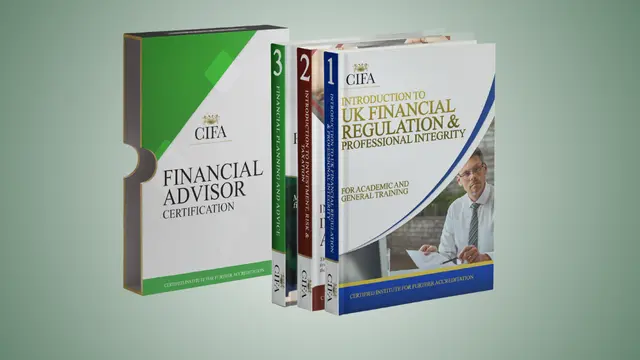

This certification is comprised of three units: "Introduction to UK Financial Regulation & Professional Integrity", "Introduction to Investment, Risk & Taxation" and "Introduction to Financial Planning & Advice". You will learn to apply an interdisciplinary and integrated approach to defining, analysing and solving problems in finance. On completion, you will have gained a sound working knowledge and understanding of the financial world.

As a comprehensive course focusing on the UK financial services industry and its role in serving the consumer, the qualification develops specialist knowledge and skills by introducing you to the application of financial services regulation and the responsibilities of a regulated adviser. As part of this, it will provide you with an insight into the application and review of risk and ethics.

The certification will also equip you with the knowledge and skills required to offer financial advice as well as create, implement and maintain financial plans.

Currently there are no Q&As for this course. Be the first to ask a question.

Currently there are no reviews for this course. Be the first to leave a review.

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.

Interest free credit agreements provided by Zopa Bank Limited trading as DivideBuy are not regulated by the Financial Conduct Authority and do not fall under the jurisdiction of the Financial Ombudsman Service. Zopa Bank Limited trading as DivideBuy is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, and entered on the Financial Services Register (800542). Zopa Bank Limited (10627575) is incorporated in England & Wales and has its registered office at: 1st Floor, Cottons Centre, Tooley Street, London, SE1 2QG. VAT Number 281765280. DivideBuy's trading address is First Floor, Brunswick Court, Brunswick Street, Newcastle-under-Lyme, ST5 1HH. © Zopa Bank Limited 2026. All rights reserved.