UK Conveyancing, Property Law and Tax

CPD Accredited | 2 Free PDF & Hardcopy Certificate | Instant Access | Free Retake Exam | Lifetime Access

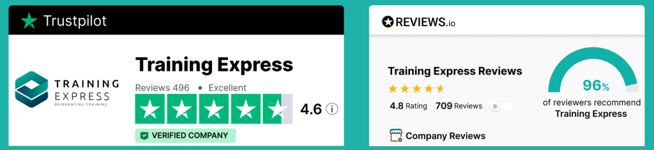

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Picture yourself at the forefront of the ever-evolving UK property market, navigating the complex world of conveyancing with ease and confidence. With property transactions on the rise and a growing demand for experts who understand the legal, financial, and tax-related aspects of property law, there has never been a better time to enhance your expertise in this thriving industry. In fact, the UK conveyancing sector has seen a 4% increase in transactions over the past year, signaling a greater need for individuals equipped to handle the demands of the market. And with salaries ranging from £25,000 to £60,000 depending on experience, the opportunities are as vast as they are rewarding.

Introducing the UK Conveyancing, Property Law, and Tax course—a gateway to mastering the art of conveyancing and property law. Imagine gaining the knowledge that can propel you to the forefront of this exciting industry. From the foundations of conveyancing to advanced taxation strategies, this course will immerse you in every crucial aspect, empowering you to take on property transactions with authority.

As the property market continues to grow, with a 2% increase in transaction values and an expanding property registry, the demand for skilled conveyancing professionals is more significant than ever. Whether you’re looking to deepen your knowledge in property law, conveyancing procedures, or taxation, this course offers you the chance to become an expert in the field and stand out in a competitive market.

Are you ready to embark on a journey that could reshape your future in property law and conveyancing?

Learning Outcomes of UK Conveyancing, Property Law and Tax Courses

By the end of the UK Conveyancing, Property Law and Tax course, learners will be able to:

- Get comprehensive insight into conveyancing and its key fundamentals

- Know land registry laws and laws of contracts

- Get to know the accounting procedures for conveyancing transactions

- Gain in-depth knowledge on property law and taxation

- Learn how to prove principal private residence

- Know about various changes in the UK property market

Key Features of UK Conveyancing, Property Law and Tax Course

- CPD Accredited UK Conveyancing, Property Law and Tax Courses

- Instant 2 FREE e-certificate and hard copy included

- Fully online, interactive UK Conveyancing, Property Law and Tax course

- Developed by qualified professionals in the field

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

Corporate Training

- Designed Specifically To Meet The Needs Of Corporate Training Programs

- Industry-standard Course Lengths Aligned With Market Standards

- Trusted By 10,000+ Businesses Worldwide

- Boost Learning, Cut Costs

- Strategic Alignment With Business Goals

- Data-driven Insights And Industry Benchmarks To Adapt Training To Evolving Needs

- Current & Relevant Content Regularly Updated To Stay Relevant

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

CPD

Course media

Resources

- Training Express Brochure - download

Description

UK Conveyancing, Property Law and Tax Diploma Course Curriculum

Course 01: Conveyancing

- Module 01: Introduction to Conveyancing

- Module 02: Key Fundamentals of Conveyancing

- Module 03: Property Law & Practice

- Module 04: Land Registry Updates and Law

- Module 05: Law of Contract

- Module 06: Landlord and Tenant

- Module 07: Standard Transactions

- Module 08: Understanding Accounting Procedures for Transactions

- Module 09: Preparing Legal Documents for Conveyancing

- Module 10: Taxation Issues of Conveyancing

Course 02: Property Law and Taxation

The detailed curriculum outline of our Property Law and Taxation course is as follows:

- Module 01: The Property Law and Practice

- Module 02: Ownership and Possession of the Property

- Module 03: Co-Ownership in Property

- Module 04: Property Taxation on Capital Gains

- Module 05: VAT on Property Taxation

- Module 06: Property Taxation Tips for Accountants and Lawyers

- Module 07: Changes in the UK Property Market

Accreditation

All of our courses are fully accredited, including this UK Conveyancing, Property Law and Tax Course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in UK Conveyancing, Property Law and Tax.

Certification

Once you’ve successfully completed your UK Conveyancing, Property Law and Tax Course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our UK Conveyancing, Property Law and Tax Course certification has no expiry dates, although we do recommend that you renew them every 12 months.

Who is this course for?

This UK Conveyancing, Property Law and Tax Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this UK Conveyancing, Property Law and Tax Course is ideal for:

- Legal assistants looking to specialise in property law.

- Accountants working with property transactions and tax.

- Estate agents aiming to understand the legal aspects of conveyancing.

- New entrants into the UK conveyancing industry.

- Professionals seeking a deeper understanding of property taxation.

Requirements

Learners do not require any prior qualifications to enrol on this UK Conveyancing, Property Law and Tax Course. You just need to have an interest in UK Conveyancing, Property Law and Tax Course.

Career path

After completing this UK Conveyancing, Property Law and Tax Course you will have a variety of careers to choose from. The following job sectors of UK Conveyancing, Property Law and Tax Course are:

- Conveyancer

- Letting Agents

- Estate Manager

- Property Conveyancer

- UK Property Tax Lawyer

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.