Payroll Administrator Advanced Diploma

Winter Deal - 7 Premium Courses > 100% Pass Rate | UKRLP Registered Provider | Lifetime Access

StudyHub

Summary

- Certificate of completion - £4.99

- Hard copy certificate - £8

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Demand for Payroll Administrators in the UK is generally strong. The payroll function is an essential part of any organisation, and as such, there is a consistent need for skilled Payroll Administrators to manage and process payrolls.

Additionally, changes in legislation and technology have made it increasingly important for companies to ensure that their payroll systems are compliant and up-to-date, which has also driven demand for payroll professionals. Overall, the outlook for payroll professionals in the UK is positive, and employment opportunities in this field are expected to continue to be available.

On average, a Payroll Administrator can earn a salary in the range of £20,000 to £35,000 per year. However, with more experience, the salary can go up to £40,000 or more. Payroll managers and senior payroll professionals can earn £45,000 to £70,000 per year.

This Payroll Administrator Training Bundle consists of the following career-oriented courses:

- Course 01: Payroll (UK Payroll System, Payee, Tax, NI, Pension)

- Course 02: Xero Accounting & Bookkeeping

- Course 03: Sage 50 Accounts and Projects Creation Training

- Course 04: Tax Accounting and Administration in the UK

- Course 05: Accountancy

- Course 06: Financial Analysis Methods

Payroll Administrator Learning Outcomes

- Understanding the UK payroll system and the basic components involved

- Knowledge of payroll legislation and compliance requirements in the UK

- Ability to configure and customise payroll settings based on company needs

- Familiarity with pension schemes and their role in the payroll process

- Understanding of pay elements, such as wages, bonuses, and deductions, and their impact on payroll

- Ability to add new and existing employees to the payroll system

- Proficiency in processing payroll, including entering payments and updating records

- Knowledge of pre-update reports and their role in verifying payroll accuracy

Both payroll and tax & pension management are critical for organisations to ensure legal compliance, accurate financial reporting and avoid penalties. It is important for companies to have employees well-trained in these areas to avoid errors and ensure compliance.

So enrol in this exclusive Payroll Administrator bundle and start your journey.

Key Features of this Payroll Administrator Training :

- CPD Accredited Payroll Administrator Training course

- Fully online, interactive Payroll Administrator course with audio voiceover

- Self-paced learning using smart devices, from anywhere in the world

Certificates

Certificate of completion

Digital certificate - £4.99

Hard copy certificate

Hard copy certificate - £8

Hard Copy certificates must be bought separately for an extra £8.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

CPD

Course media

Description

Payroll Administrator

- Payroll System in the UK

- Basics

- Company Settings

- Legislation Settings

- Pension Scheme Basics

- Pay Elements

- The Processing Date

- Adding Existing Employees

- Adding New Employees

- Processing Basics

- Entering Payments

- Pre-Update Reports

- Updating Records

- e-Submissions Basics

- Process Payroll (November)

- Employee Records and Reports

- Editing Employee Records

- Process Payroll (December)

- Resetting Payments

- Quick SSP

- An Employee Leaves

- Final Run

- Reports and Historical Data

- Year-End Procedures

Who is this course for?

There is no formal qualification needed for this Payroll Administrator Training course.

Requirements

There is no formal qualification needed for this Payroll Administrator course.

Career path

This Payroll Administrator Bundle is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore various career opportunities.

- Payroll Administrator

- Xero Accountant

- Sage 50 Accountant

Questions and answers

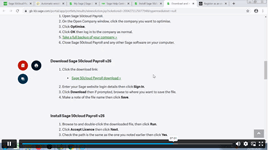

I would like to ask about needing software for this payroll course as it mentions sage and excel and other software that I do not have.

Answer:Hi Julie, This is a bundle of 7 courses designed for improving a learner's skills and knowledge. This bundle does not come with the software. Therefore, you will need to make arrangements for the software by yourself to do the courses. Thank You.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.