Level 3 Diploma in Sage 50 (Accounts & Payroll) - CPD Certified – Only £17!

Alpha Academy

Summary

Overview

Sage is an extremely popular accounting software worldwide, used by a huge number of businesses and providing a complete accounts processing package. The Level 3 Diploma in Sage 50 (Accounts & Payroll) will enable you to accurately manage your process invoices, sales, supplier’s details, produce financial reports and manage the VAT records. This course allows you to gain a full understanding of using Sage 50 software and prove to employers and recruiters that you’re able to provide accounting duties to the highest standards.

Course Highlights

- The price is for the whole course including final exam – no hidden fees

- Accredited Certificate upon successful completion at an additional cost

- Efficient exam system with instant results

- Track progress within own personal learning portal

- 24/7 customer support via live chat

Level 3 Diploma in Sage 50 (Accounts & Payroll) has been given CPD and IAO accreditation and is one of the best-selling courses available to students worldwide.

This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you’re an individual looking to excel within this field then Level 3 Diploma in Sage 50 (Accounts & Payroll) is for you.

We’ve taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept – from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success.

All our courses offer 3 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full CPD accredited qualification. And, there are no hidden fees or exam charges.

We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response.

Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime.

So, why not improve your chances of gaining professional skills and better earning potential.

CPD

Course media

Description

Course Curriculum:

Sage 50 Accounts for Beginner

- Module 1: Program Basics

- Module 2: Restoring and Backing-up Data

- Module 3: Basic Setting and Details

- Module 4: The Chart of Accounts

- Module 5: Bank Receipts

- Module 6: Bank Payments

- Module 7: Financials

- Module 8: Customers

- Module 9: Suppliers

- Module 10: Working with Lists

- Module 11: Batch Invoices

- Module 12: Service Invoices

- Module 13: Processing Invoices

- Module 14: Product and Services

- Module 15: Stock Control

- Module 16: Product Invoices

- Module 17: Product Credit Notes

- Module 18: Reviewing Your Accounts

- Module 19: Aged Debtors and Statements

- Module 20: Customer Receipts

- Module 21: Customer Activity

- Module 22: Supplier Batch Invoices

- Module 23: Supplier Payments

- Module 24: More about the Nominal Ledger

- Module 25: More about bank accounts

- Module 26: Using the Cash Register

- Module 27: Bank Reconciliation

- Module 28: Recurring Entries

- Module 29: VAT Returns

- Module 30: More About Reports

- Module 31: Using Dashboards

Sage 50 Accounts Intermediate Level

- Module 1: Prepayments and Accruals

- Module 2: Fixed Assets & Depreciation

- Module 3: Delivery Address

- Module 4: Purchase Orders

- Module 5: Memorising Purchase Orders

- Module 6: Recording Deliveries

- Module 7: More About Purchase Orders

- Module 8: BOMs & Product Transfer

- Module 9: Product Pricing Options

- Module 10: Sales Orders

- Module 11: Recurring Sales Orders

- Module 12: Processing Sales Orders

- Module 13: Using Filters and Search

- Module 14: Credit Control

- Module 15: Chasing Debts and Debt Analysis

- Module 16: Disputed Invoices

- Module 17: Customer Refunds

- Module 18: Late Payment Legislation

- Module 19: Writing Off Bad Debts

- Module 20: Cash Flow Forecasting

Sage 50 Accounts Advanced Level

- Module 1: Company Review

- Module 2: Cost of Sales (Closing Stock)

- Module 3: Importing Data

- Module 4: Batch and Global Changes

- Module 5: Customer Discounts

- Module 6: Quotations

- Module 7: Winning and Losing Quotations

- Module 8: Pro Froma Invoices

- Module 9: Contra Entries

- Module 10: The Audit Trail

- Module 11: Corrections

- Module 12: Passwords and Access Rights

- Module 13: Setting a Budget

- Module 14: Setting up Departments

- Module 15: Departmental Budgets

- Module 16: Project Costing

- Module 17: Project Costing Example

- Module 18: Project Completion

- Module 19: Report Designer Basic Skills

- Module 20: Report Designer Wizard

- Module 21: Report Designer Extra

- Module 22: Foreign Trader and Currencies

- Module 23: Invoices and Payments in Euros

- Module 24: Foreign Currency Suppliers and Payments

Sage 50 Payroll for Beginners

- Module 1: Payroll Basics

- Module 2: Company Settings

- Module 3: Legislation Settings

- Module 4: Pension Scheme Basics

- Module 5: Pay Elements

- Module 6: The Processing Date

- Module 7: Adding Existing Employees

- Module 8: Adding New Employees

- Module 9: Payroll Processing Basics

- Module 10: Entering Payments

- Module 11: Pre-Update Reports

- Module 12: Updating Records

- Module 13: e-Submissions Basics

- Module 14: Process Payroll (November)

- Module 15: Employee Records and Reports

- Module 16: Editing Employee Records

- Module 17: Process Payroll (December)

- Module 18: Resetting Payments

- Module 19: Quick SSP

- Module 20: An Employee Leaves

- Module 21: Final Payroll Run

- Module 22: Reports and Historical Data

- Module 23: Year-End Procedures –

Sage 50 Payroll Intermediate Level

- Module 1: The Outline View and Criteria

- Module 2: Global Changes

- Module 3: Timesheets

- Module 4: Departments and Analysis

- Module 5: Holiday Schemes

- Module 6: Recording Holidays

- Module 7: Absence Reasons

- Module 8: Statutory Sick Pay

- Module 9: Statutory Maternity Pay

- Module 10: Student Loans

- Module 11: Company Cars

- Module 12: Workplace Pensions

- Module 13: Holiday Funds

- Module 14: Roll Back

- Module 15: Passwords and Access Rights

- Module 16: Options and Links

- Module 17: Linking Payroll to Accounts

Requirements

Our Level 3 Diploma in Sage 50 (Accounts & Payroll) is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation.

Please Note : For practice purpose, you should have Sage 50 software installed on your PC. The software is not included with this course. Sage provide a free online trial version of the Sage 50 Accounts software, which is more than suitable to study this course and learn how to use the software. You will get the full instructions for downloading free Sage 50 Software in your course page.

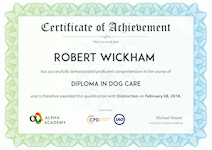

Assessment and Certification

At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39.

Career path

Not only does our CPD and IAO accredited course look good on your CV, setting you apart from the competition, it can be used as a stepping stone to greater things. Further advance your learning, launch a new career or reinvigorate an existing one.

On successful completion of this course, you have the potential to achieve an estimated salary of £19,500.

The sky really is the limit.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.

FAQs

Interest free credit agreements provided by Zopa Bank Limited trading as DivideBuy are not regulated by the Financial Conduct Authority and do not fall under the jurisdiction of the Financial Ombudsman Service. Zopa Bank Limited trading as DivideBuy is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, and entered on the Financial Services Register (800542). Zopa Bank Limited (10627575) is incorporated in England & Wales and has its registered office at: 1st Floor, Cottons Centre, Tooley Street, London, SE1 2QG. VAT Number 281765280. DivideBuy's trading address is First Floor, Brunswick Court, Brunswick Street, Newcastle-under-Lyme, ST5 1HH. © Zopa Bank Limited 2024. All rights reserved.