Investment Advisor Certification (IAC)

Level 4 - Online course Including Units 1, 2 and 3 with lifetime access

CIFA Education Management Ltd

Summary

- Certificate of Achievement - Free

- Exam(s) / assessment(s) not included in price, and must be purchased separately

- Tutor is available to students

Add to basket or enquire

Overview

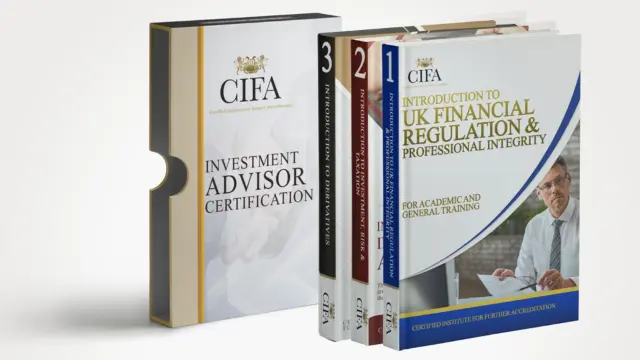

The CIFA Investment Advisor Certificate (IAC) programme is an in-depth, graduate entry-level certification designed to give our financial students a structured e-learning programme that introduces them to the UK regulations and professional ethics; investment risk and taxation; and derivatives - all of which are critical elements of continuing professional development within the investment profession.

Consisting of three units, "Introduction to UK Regulations and Professional Integrity", "Introduction to Investment Risk and Taxation" and "Introduction to Derivatives", the Investment Advisor Certification (IAC), provides students with comprehensive knowledge and a good understanding.

Approximate total study time is 140 hours per unit.

CPD

Description

The CIFA Investment Advisor Certificate (IAC) is suitable for graduates, beginning their career, who need to enhance their knowledge and showcase their commitment to further development in the financial industry, prior to undertaking FCA regulated qualifications.

Unit 1 "Introduction to UK Financial Regulation & Professional Integrity" consists of 10 chapters covering:

UK Financial Markets

UK Financial Services & Risk

Contract & Trust: Legal Framework

Professionalism and Ethics

Regulators of the K Financial Services

Governance, Principles & Regulations (FCA & PRA)

Competence of Companies & Individuals (FCA & PRA)

Regulations Relating to Financial Crime

Complaints & Redress

COBS: Conduct of Business Sourcebook of the FCA

Unit 2 "Introduction to Investment Risk & Taxation" consists of 8 chapters covering:

Various Types of Asset Classes

The Macroeconomic Environment

Investment Risk & Return: The Basic Principles

Investor & Investment Taxation

Types of Investment Products

Planning and Constructing Portfolios

Providing Investment Advice

Performance & Reviewing of Portfolios

Unit 3 "Derivatives" consists of 10 chapters covering:

Derivatives – An Overview

Underlying Assets

Exchange-Traded Futures and Options

Over-the-Counter (OTC) Derivatives

Clearing

Delivery and Settlement

Researching and Constructing Portfolios

Trading, Hedging and Investment Strategies

Selection and Administration of Investments

Regulatory Requirements

Additional Study Support materials such as Webinars and PowerPoint presentations are available for each chapter of the unit at an additional fee.

Who is this course for?

The CIFA Investment Advisor Certificate (IAC) is suitable for graduates, beginning their career, who need to enhance their knowledge and showcase their commitment to further development in the financial industry, prior to undertaking FCA regulated qualifications.

Requirements

Level 3 qualification or equivalent e.g. A levels

Questions and answers

If examination is not included in £1,119, it means, the amount is only for the purchase of the book.

Answer:Dear Olusegun, thank you for your enquiry. The exams fees are separate from the course materials. However, we have a special offer for the exams. Kindly send us an email at info@cifa.ac and you will receive more information with regard to that.

This was helpful.Are the exams sat online? Are there scheduled dates for the exams?

Answer:Dear Prospective Student, the examinations are indeed taken online, students are not required to visit a test centre and can take the examinations at any date, any anytime.

This was helpful.hi wouid i be able to access and begin the course after the first installmental payment

Answer:Hello Omotola, Upon payment of the first instalment you will have full access to the course material and can start whenever you choose.

This was helpful.

Certificates

Certificate of Achievement

Digital certificate - Included

Students will only be issued a Certificate of Achievement after sitting and passing the exam successfully.

*Exam fees are not included in the course fees.

Students will not be charged any additional fees to receive their Certificate upon completing and passing the exam successfully.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.