- Exam(s) / assessment(s) is included in price

Accounts and Payroll with QuickBooks 2016

CPD & IAP Accredited | FREE Digital Certificate | Premium Quality Video Lessons | No Hidden Fees | Globally Recognised

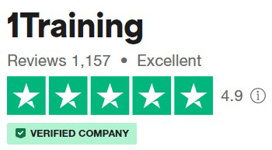

1 Training

Summary

Overview

Accounts and Payroll with QuickBooks 2016

Learning how to use new software can feel overwhelming, and QuickBooks is no different, but it’s not as difficult as it might seem. We can teach you to make the most of QuickBooks in no time.

QuickBooks is mainly aimed at small business owners and can offer an easy accounting solution. It can be used to carry out accounting functions, such as: business payments, the management and payment of bills, and payroll. It is widely used by businesses today, so a qualification proving you can use it to a competent level is very beneficial.

Our learning material is available to students 24/7 anywhere in the world, so it’s extremely convenient. These intensive online courses are open to everyone, as long as you have an interest in the topic! We provide world-class learning led by IAP, so you can be assured that the material is high quality, accurate and up-to-date.

Please Note: This Payroll with QuickBooks Course is Based on USA Standards.

What skills am I going to get from this course?

- In this Accounts and Payroll with QuickBooks course, you’ll understand the process of sales tax and the process of payroll

- This Accounts and Payroll with QuickBooks course will train you to post transactions timely and accurately

- On completion of this course Accounts and Payroll with QuickBooks, you’ll record revenues and sales invoices

- At the end of this Accounts and Payroll with QuickBooks course, you’ll manage budgets and chart of accounts

- After completing this Accounts and Payroll with QuickBooks course, you’ll have a solid understanding of accounting

CPD

Course media

Description

COURSE CURRICULUM : Payroll with QuickBooks

➽ (Module 01) : Payroll with QuickBooks

- The Home Page

- The Icon Bar

- Creating a QuickBooks Company File

- Setting Up Users

- Using Lists

➽ (Module 02) : Payroll with QuickBooks

- The Sales Tax Process

- Creating Sales Tax

- Setting Up Inventory

- Creating a Purchase Order

- Setting Up Items

➽ (Module 03) : Payroll with QuickBooks

- Selecting a Sales Form

- Creating a Sales Receipt

- Using Price Levels

- Creating Billing Statements

- Recording Customer Payments

➽ (Module 04) : Payroll with QuickBooks

- Entering a Vendor Credit

- Using Bank Accounts

- Sales Tax

- Graph and Report Preferences

- Modifying a Report

- Exporting Reports

➽ (Module 05) : Payroll with QuickBooks

- Using Graphs

- Creating New Forms

- Selecting Objects in the Layout Designer

- Creating a job

- Making Purchases for a Job

- Time Tracking

➽ (Module 06) : Payroll with QuickBooks

- Payroll – The Payroll Process

- Payroll – Setting Up Employee Payroll Information

- Payroll – Creating Termination Paycheques

- Payroll – Adjusting Payroll Liabilities

➽ (Module 07) : Payroll with QuickBooks

- Using Credit Card Charges

- Assets and Liabilities

- Creating Fixed Asset Accounts

- Equity Accounts

- Writing Letters with QuickBooks

➽ (Module 08) : Payroll with QuickBooks

- Company Management

- Company File Clean-up

- Using the Portable Company Files

- Creating an Account’s Copy

Module Books

- Module Book- QuickBooks 2016 -Introductory

- Module Book- QuickBooks 2016 – Advanced

Course Duration

Learners will have 365 days access to their course. The course Payroll with QuickBooks is self-paced so you decide how fast or slow the training goes.

Method of Assessment

- At the end of the Accounts and Payroll with QuickBooks course learners will take an online multiple choice question assessment test. This online multiple choice question test is marked automatically so you will receive an instant grade and know whether you have passed the course.

- Those who successfully pass this Accounts and Payroll with QuickBooks course will be awarded a free e-certificate, and only need to pay £19 for your printed certificate.

Certification

Upon the successful completion of the course Payroll with QuickBooks, you will be awarded the “Certificate in Accounts and Payroll with QuickBooks 2016″

Who is this course for?

- Business owner

- Job hunters & School leavers

- New or Temporary staff

- College or University student & graduates

- Account assistant or Account clerk

- Payroll administrator or Payroll clerk

- Accounts manager or Office manager

- Office clerk or Administration Assistant

- Finance controller or Bookkeeping assistant

Requirements

- This Payroll with QuickBooks course requires no formal prerequisites and this certification is open to everyone.

Career path

With this Payroll with QuickBooks diploma, you are able to fulfil various roles, such as:

- Accountant

- Bookkeeper

- Payroll Administrator

- Payroll Clerk

- Office Clerk

- Bookkeeping Assistant

Questions and answers

Hi, will l need to purchase a Quickbook licence to install on my laptop or is it included / provided for within with course fee. Thanks.

Answer:Dear Chris, Thank you for your query. You’ll need a computer or tab with an internet connection and QuickBooks 2016 software installed in it. Also, it’s better to have a notepad & a pen with you. Regards, Student Support team

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.

FAQs

Interest free credit agreements provided by Zopa Bank Limited trading as DivideBuy are not regulated by the Financial Conduct Authority and do not fall under the jurisdiction of the Financial Ombudsman Service. Zopa Bank Limited trading as DivideBuy is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, and entered on the Financial Services Register (800542). Zopa Bank Limited (10627575) is incorporated in England & Wales and has its registered office at: 1st Floor, Cottons Centre, Tooley Street, London, SE1 2QG. VAT Number 281765280. DivideBuy's trading address is First Floor, Brunswick Court, Brunswick Street, Newcastle-under-Lyme, ST5 1HH. © Zopa Bank Limited 2024. All rights reserved.