Xero : Xero

CPD QS Accredited Advanced Xero Training | **Gifts : [5 more courses as GIFT + 6 FREE PDF & Hard Copy Certificates]

Course Cloud

Summary

- Certificate of completion - Free

- Tutor is available to students

Overview

Xero Accounting and Bookkeeping:

Xero Accounting and Bookkeeping will help you manage your business by recording your sales and expenses and simplifying both your daily accounting and your annual Bookkeeping.

With Xero Accounting and Bookkeeping Course, you will learn

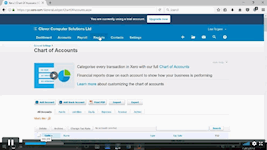

- Xero: Various common functions using Xero software.

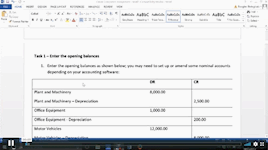

- Xero: Learn to enter the opening balances.

- Xero: Know how to post customer invoices and credit notes to the sales ledger.

- Xero: Know how to post supplier invoices and credit notes to the purchase ledger.

- Xero: Learn how to enter the supplier cheques and record the customer receipts.

- Xero: Know how to post petty cash transactions.

- Xero: Know how to prepare the VAT return.

- Xero: Learn how to post the wages journal.

- Xero: Know how to post adjustments to the accounts and produce month-end reports.

Xero is cloud-based accounting software. Xero is used to manage assets, liabilities, and equity for small or medium-sized companies. Xero is the best accounting software for growing companies. Xero Accounting and Bookkeeping is designed to teach you how to use Xero for keeping the records of transactions and use common functions.

Bookkeeping provides you with a rich understanding of the recording of transactions. The Xero bundle course discusses the additional steps necessary for preparing accurate financial statements. This Xero bundle course is great for bookkeepers of all skill levels and small business owners.

Master how to enter the opening balances, amending nominal ledger, add new customers, add supplier details, post customer and supplier invoices, credit notes to the sales ledger and purchase ledger, prepare the VAT return and more.

The objective of the Xero Accounting and Bookkeeping course is to teach you how to use Xero software for accounting and bookkeeping purposes.

Our Xero Accounting and Bookkeeping course is packed with 58 modules, and you can complete the entire course in just 6 hours and 27 minutes of study.

Besides that, our experienced tutors will help you throughout the comprehensive syllabus of the Xero Accounting and Bookkeeping course and answer all your queries through email.

Enrol in the Xero bundle today, and learn valuable Xero skills that will help you see a real-time view of your cash flow, along with other modules and tools so that you can keep your finances under control.

Why would you choose Xero : Xero course from Course Cloud:

- Get 6 premium Xero : Xero courses at a single price

- Lifetime access to Xero : Xero courses materials

- Full tutor support is available from Monday to Friday with the Xero : Xero courses

- Learn Xero : Xero skills at your own pace from the comfort of your home

- Gain a complete understanding of Xero : Xero courses

- Accessible, informative video modules on Xero : Xero taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Xero : Xero bundle

- Study Xero : Xero in your own time through your computer, tablet or mobile device.

- Improve your chance of gaining professional skills and better earning potential by completing the Xero : Xero bundle

**** Additional GIFTS ****

- Free PDF Certificate

- Free Hard Copy Certificate

- Lifetime Access To Xero : Xero Course Materials From Anywhere

CPD

Course media

Description

*** Course 01: Xero Accounting and Bookkeeping ***

- Xero - Xero - Xero : Xero - Xero : Xero - Introduction

- Xero - Xero - Xero : Xero - Xero : Xero - Getting Started

- Xero - Xero - Xero : Xero - Xero : Xero - Invoices and Sales

- Xero - Xero - Xero : Xero - Xero : Xero - Bills and Purchases

- Xero - Xero - Xero : Xero - Xero : Xero - Xero Accounting and Bookkeeping - Bank Accounts

- Xero - Xero - Xero : Xero - Xero : Xero - Products and Services

- Xero - Xero - Xero : Xero - Xero : Xero - Fixed Assets

- Xero - Xero - Xero : Xero - Xero : Xero - Payroll

- Xero - Xero - Xero : Xero - Xero : Xero - VAT Returns

*** Course 02: Accounting and Finance ***

Module: 01

- Xero - Xero - Xero : Xero - Xero : Xero - Accounting for Beginners Promo

- Xero - Xero - Xero : Xero - Xero : Xero - Introduction

- Xero - Xero - Xero : Xero - Xero : Xero - First Transactions

- Xero - Xero - Xero : Xero - Xero : Xero - T Accounts introduction

- Xero - Xero - Xero : Xero - Xero : Xero - T-Accounts conclusion

- Xero - Xero - Xero : Xero - Xero : Xero - Trial Balance

- Xero - Xero - Xero : Xero - Xero : Xero - Income Statement

- Xero - Xero - Xero : Xero - Xero : Xero - Balance Sheet

Module: 02

- Xero - Xero - Xero : Xero - Xero : Xero - Balance Sheet Variations

- Xero - Xero - Xero : Xero - Xero : Xero - Accounts in practise

- Xero - Xero - Xero : Xero - Xero : Xero - Balance Sheets what are they

- Xero - Xero - Xero : Xero - Xero : Xero - Balance Sheet Level 2

- Xero - Xero - Xero : Xero - Xero : Xero - Income Statement Introduction

- Xero - Xero - Xero : Xero - Xero : Xero - Are they Expenses, or Assets

- Xero - Xero - Xero : Xero - Xero : Xero - Accounting Jargon

Module: 03

- Xero - Xero - Xero : Xero - Xero : Xero - Accruals Accounting is Fundamental

- Xero - Xero - Xero : Xero - Xero : Xero - Trial Balance 3 days ago More

- Xero - Xero - Xero : Xero - Xero : Xero - Fixed Assets and how it is shown in the Income Statement

- Xero - Xero - Xero : Xero - Xero : Xero - Stock movements and how this affects the financials

- Xero - Xero - Xero : Xero - Xero : Xero - Accounts Receivable

- Xero - Xero - Xero : Xero - Xero : Xero - How to calculate the Return on Capital Employed

- Xero - Xero - Xero : Xero - Xero : Xero - Transfer Pricing – International Rules

*** Course 03: Diploma in Tax Accounting ***

- Xero - Xero - Xero : Xero - Xero : Xero - Promo

- Xero - Xero - Xero : Xero - Xero : Xero - The Requirements

- Xero - Xero - Xero : Xero - Xero : Xero - The Timeline: 2017-2020

- Xero - Xero - Xero : Xero - Xero : Xero - Planning – Checklist

- Xero - Xero - Xero : Xero - Xero : Xero - Getting / Providing Support – Things to Consider

- Xero - Xero - Xero : Xero - Xero : Xero - Changes Ahead for Accounting Firms

- Xero - Xero - Xero : Xero - Xero : Xero - Final Words

*** Course 04: Financial Analysis Level 3 ***

- Xero - Xero - Xero : Xero - Xero : Xero - Introduction

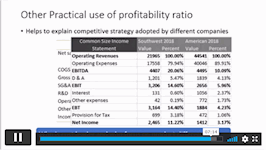

- Xero - Xero - Xero : Xero - Xero : Xero - Profitability

- Xero - Xero - Xero : Xero - Xero : Xero - Return Ratio

- Xero - Xero - Xero : Xero - Xero : Xero - Liqudity Ratio

- Xero - Xero - Xero : Xero - Xero : Xero - Operational Analysis

- Xero - Xero - Xero : Xero - Xero : Xero - Detecting Manipulation

*** Course 05: Bookkeeping Course for All ***

- Xero - Xero - Xero : Xero - Xero : Xero - Introduction

- Xero - Xero - Xero : Xero - Xero : Xero - Basic Accounting Terms

- Xero - Xero - Xero : Xero - Xero : Xero - Common Transactions

- Xero - Xero - Xero : Xero - Xero : Xero - Practice

*** Course 06: Introduction to Accounting ***

- Xero - Xero - Xero : Xero - Xero : Xero - Introduction

- Xero - Xero - Xero : Xero - Xero : Xero - Capital Assets

- Xero - Xero - Xero : Xero - Xero : Xero - More Accounts

- Xero - Xero - Xero : Xero - Xero : Xero - The Mechanics

- Xero - Xero - Xero : Xero - Xero : Xero - Making Entries

- Xero - Xero - Xero : Xero - Xero : Xero - Accounting Computer Software Demonstration

- Xero - Xero - Xero : Xero - Xero : Xero - Conclusion

Certification

Once you have successfully completed the Xero : Xero course, you will be awarded PDF and Hardcopy certificates for FREE as evidence of your achievement.

Note: Delivery of the hardcopy certificates inside the UK is £4.99 each; international students have to pay a total of £14.99 to get a hardcopy certificate.

Who is this course for?

The Xero Bundle course is primarily for motivated learners looking to add a new skill to their CV and stand head and shoulders above the competition. Anyone of any academic background can enrol on this Xero course. However, this course is preferable for:

- Bookkeepers and Accountants.

- Accounting students who want practical knowledge of how to use accounting software.

- Learners who want to earn skills of bookkeeping and small business owners.

Requirements

- Access to Xero accounts online.

- Previous knowledge of accounting is not a requirement.

- Must have access to a PC, laptop, tablet or smartphone with Wi-Fi

- There are no specific entry requirements for this Xero course, which can be studied on a part-time or full-time basis

Career path

Anyone with an interest in Xero will find our comprehensive course beneficial. Master the necessary skills to take a step closer to success with our Xero bundle. Enhance your skills and explore opportunities such as —

- Xero Specialist Bookkeeper / Payroller (£26k - £32k Per Annum)

- Xero Management Accountant (£28k - £35k Per Annum)

- Management Accountant/Bookkeeper (£30k - £35k Per Annum)

Questions and answers

The requirements say access to Xero required, can I do the course without access as I wish to do it independently?

Answer:Thank you for your query. Yes, you can.

This was helpful.

Certificates

Certificate of completion

Digital certificate - Included

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.