Xero, QuickBooks and Sage 50 Payroll for Accounting & Bookkeeping

19% OFF - Flash Sale | 4 CPD Certified Courses | FREE PDF Certificates | FREE Exams | Tutor Support | Lifetime Access

Janets

Summary

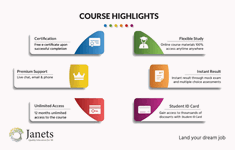

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Keeping records of financial transactions has been around since the dawn of civilisation. For as long as the human species traded with each other, bookkeeping was an integral part of financial affairs. From clay tablets and papyrus scrolls - as evident in the ancient Sumerian and Egyptian relics - to software, keeping track of transactional activities is even more critical today. To keep your career on the right track, we present you with this comprehensive Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle.

Everything has undergone a technological revolution, and accounting and bookkeeping are no exception. Modern accounting software like Xero, Quickbooks and Sage 50 makes it possible for the system to handle complicated accounting terms like debits and credits.

This Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle is the ultimate pathway to redemption for you from boring paperwork. Our Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle is organised to start from the very basics.

So, what are you waiting for? Enrol in the Xero, Quickbooks, and Sage 50 Payroll for the Accounting & Bookkeeping bundle now and become an efficient bookkeeper!

This Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle includes the following 4 courses:

- Course 01: Xero Accounting and Bookkeeping Course

- Course 02: Sage 50 Payroll Complete Course

- Course 03: Quickbooks Desktop Training

- Course 04: Quickbooks Online Training

Learning Outcomes

Upon successful completion of the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle, you will be able to:

- Find out how to input the opening balances.

- Understand how to enter customer invoices into the sales ledger.

- Comprehend how to record customer receipts accurately.

- Recognise small-change transactions.

- Discover how to complete the vat return.

- Know how to produce month-end reports.

- Learn the basics of Quickbooks and Sage 50.

What You Get Out Of Studying Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle With Janets

- Free PDF certificate upon successful completion of the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeepingbundle

- Full one-year access to Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle course materials

- Instant assessment results

- Full tutor support is available from Monday to Friday

- Study the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeepingbundle at your own pace

- Accessible, informative modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle

- Study the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle at your own time through your computer, tablet or mobile device

- Improve your chance of gaining valuable skills and better earning potential by completing Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping bundle

CPD

Course media

Description

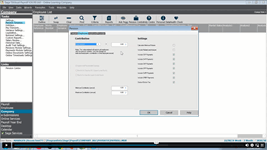

In the beginning, you'll learn how to install a Xero system from scratch and grasp how to input opening balances, post client invoices, reconcile bank and credit card statements, create a VAT return, manage payroll functions, create credit notes, and much more. In addition, the Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping course cover the basics of Quickbooks and Sage 50 software as well.

Xero, Quickbooks and Sage 50 Payroll for Accounting & Bookkeeping Course Curriculum:

Xero Accounting and Bookkeeping Course

- Introduction

- Getting Started

- Invoices and Sales

- Bills and Purchases

- Bank Accounts

- Products and Services

- Fixed Assets

- Payroll

- Vat Returns

Next Steps and Bonus Lesson

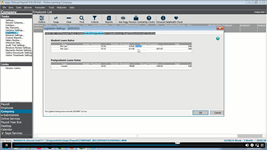

- Quickbooks Desktop Training

- Quickbooks Online Training

- Sage 50 Payroll for Beginners

- Sage 50 Payroll Intermediate Level

Please Note: For practice purpose, you should have Xero and Sage 50 software installed on your PC. The software is not included in this Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle.

Who is this course for?

The Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle is designed for:

- Aspiring accountants and bookkeepers seeking to enhance their skills.

- Small business owners striving to gain control over their financial operations.

- Entrepreneurs looking to streamline their accounting and payroll processes.

- Professionals aiming to upskill and remain competitive in the dynamic financial landscape.

- Individuals seeking a career transition into the accounting or bookkeeping field.

Requirements

The Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle is open to all students and has no formal entry requirements. To study the Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16.

Career path

This Xero, Quickbooks, and Sage 50 Payroll for Accounting & Bookkeeping bundle will lead you to many different career opportunities. Here are a few prospects.

- Bookkeeper - £25,000 to £30,000 per year

- Payroll Administrator - £22,000 to £27,000 per year

- Accounts Assistant - £20,000 to £25,000 per year

- Financial Analyst - £30,000 to £35,000 per year

- Finance Manager - £40,000 to £50,000 per year

Questions and answers

how long will this take to complete?

Answer:Hello Samee, The duration of this course is 16 hours. Thus, you can complete it within a day or two days.

This was helpful.I just want to doublecheck, is it video-based learning? Because I need to be shown what to do rather than having to read.

Answer:Dear Naleta, Thank you for reaching out. Yes, the course is taught through video lessons. Thanks

This was helpful.Hi, I’m interested in taking this course, but. Will the modules be done with each software? Xero, QuickBooks and Sage 50? I am a beginner.

Answer:Dear Naleta, Thanks for reaching out. Yes, the course is laid out to teach the functionalities of the software. You will need to have them on your computer to learn alongside studying.

This was helpful.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.