Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance

50% OFF - Flash Sale | 5 Courses Bundle | 5 FREE PDF Certificates | FREE Assessment | Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Excellent accounting skills can land you lucrative job opportunities. However, it is a competitive sector. Therefore, you must ensure you are ahead of the crowd. The Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course can help you out with it. It will provide you with quality training and assist you in acquiring skills others don't possess.

The Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course aims to help you get a proper grip on Xero, Quickbooks and Sage50 Payroll. This Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course will teach you the ins and outs of these accounting software. The step-by-step learning process will allow you to handle invoices and sales. Here, you will gain the expertise to manage the payroll effectively. The highly informative modules will educate you on VAT returns. Furthermore, you will understand the procedure for keeping abs on the bills and purchases.

Upon completion of the Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course, you will receive an accredited certificate of achievement. This certificate will add significant value to your resume and boost your employability. Join now and fast-track your career!

Learning Outcomes

- Get introduced to the core principles of Xero

- Understand how to manage the invoices and sales

- Develop the skills to keep track of the payroll and bank accounts

- Enrich your understanding of VAT returns

- Build expertise in keeping track of the bills, purchases, products and services

What You Get Out Of Studying Xero With Janets

- Free PDF certificate upon successful completion of the Xero course

- Full one-year access to course materials

- Instant assessment results

- Full tutor support available from Monday to Friday

- Study the Xero course at your own pace

- Accessible, informative modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the training

- Study at your own time through your computer, tablet or mobile device

- Improve your chance of gaining valuable skills and better-earning potential by completing the Xero course

CPD

Course media

Description

Dive into the Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance Course and master the art of proficient accounting software use. Kick-off with an introductory session, paving the way to understanding foundational aspects like initiating the software, handling invoices, sales management, and efficiently overseeing bills. Explore the intricacies of bank account management, products, services, and fixed assets. Moreover, navigate the complexities of payroll, ensure compliant VAT returns, and conclude with enlightening bonus content, preparing you for subsequent endeavours.

Course Curriculum:

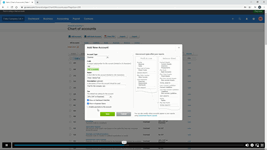

**Xero Accounting and Bookkeeping Course**

- Introduction to Xero

- Getting Started

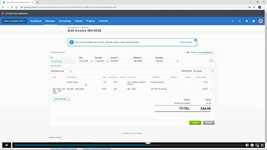

- Invoices and Sales

- Bills and Purchases

- Bank Accounts

- Products and Services

- Fixed Assets

- Payroll

- Vat Returns

- Next Steps and Bonus Lesson

**Sage 50 Payroll Complete Course**

Sage 50 Payroll for Beginners

- Module 1: Payroll Basics

- Module 2: Company Settings

- Module 3: Legislation Settings

- Module 4: Pension Scheme Basics

- Module 5: Pay Elements

- Module 6: The Processing Date

- Module 7: Adding Existing Employees

- Module 8: Adding New Employees

- Module 9: Payroll Processing Basics

- Module 10: Entering Payments

- Module 11: Pre-Update Reports

- Module 12: Updating Records

- Module 13: e-Submissions Basics

- Module 14: Process Payroll (November)

- Module 15: Employee Records and Reports

- Module 16: Editing Employee Records

- Module 17: Process Payroll (December)

- Module 18: Resetting Payments

- Module 19: Quick SSP

- Module 20: An Employee Leaves

- Module 21: Final Payroll Run

- Module 22: Reports and Historical Data

- Module 23: Year-End Procedures

Sage 50 Payroll Intermediate Level

- Module 1: The Outline View and Criteria

- Module 2: Global Changes

- Module 3: Timesheets

- Module 4: Departments and Analysis

- Module 5: Holiday Schemes

- Module 6: Recording Holidays

- Module 7: Absence Reasons

- Module 8: Statutory Sick Pay

- Module 9: Statutory Maternity Pay

- Module 10: Student Loans

- Module 11: Company Cars

- Module 12: Workplace Pensions

- Module 13: Holiday Funds

- Module 14: Roll Back

- Module 15: Passwords and Access Rights

- Module 16: Options and Links

- Module 17: Linking Payroll to Accounts

**Quickbooks Online Training**

- quickbooksonline – 1

- quickbooksonline – 2

- quickbooksonline – 3

- quickbooksonline – 4

- quickbooksonline – 5

- quickbooksonline – 6

- uickbooksonline – 7

- quickbooksonline – 8

**Tax Accounting**

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamentals of Income Tax

- Module 06: Advanced Income Tax

- Module 07: Payee, Payroll and Wages

- Module 08: Capital Gain Tax

- Module 09: Value Added Tax

- Module 10: Import and Export

- Module 11: Corporation Tax

- Module 12: Inheritance Tax

- Module 13: Double Entry Accounting

- Module 14: Management Accounting and Financial Analysis

- Module 15: Career as a Tax Accountant in the UK

**Accounting and Finance Course for Managers**

- Introduction

- First Transactions

- T Accounts introduction

- T-Accounts conclusion

- Trial Balance

- Income Statement

- Balance Sheet

- Balance Sheet Variations

- Accounts in practise

- Balance Sheets what are they

- Balance Sheet Level 2

- Income Statement Introduction

- Are they Expenses, or Assets

- Accounting Jargon

- Accruals Accounting is Fundemental

- Trial Balance 3 days ago More

- Fixed Assets and how it is shown in the Income Statement

- Stock movements and how this affects the financials

- Accounts Receivable

- How to calculate the Return on Capital Employed

- Transfer Pricing – International Rules

Method of Assessment

To successfully complete the bundle, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the courses.

After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Who is this course for?

The Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course is suitable for:

- Anyone who wants to develop accounting skills

- Aspiring professional in the relevant sectors

- Individuals who want to add a valuable skill set to their resume

- Small business owners who wish to manage their accounts by themselves

- Professionals working in the relevant fields and looking for an opportunity to polish their skills

Requirements

The Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course is open to all students and has no formal entry requirements.

Career path

The Xero Accounting & Bookkeeping with Sage 50, Quickbooks & Tax Accounting and Finance course will take your accounting skills to the next level. It will assist you in pursuing a career in the following sectors

- Accountant

- Bookkeeper

- Client Experience Specialist

- Accounting Advisory Apprentice

- Finance Manager

Questions and answers

hello can you please tell me the price for QLS endorsed certificate for this course?

Answer:Hi, Thanks for your query. The fee for the endorsed level 5 certificate is £99, and it will be delivered to you in a hard copy. You will get the CPD PDF certificate free of charge for all the courses in the bundle.

This was helpful.do we get all these 5 certificates in this price or is it only one certificate and we have to purchase each certificate separately?

Answer:Dear K, Good Afternoon. The PDF certificate for all 5 courses is included in the price; you will get it free of charge.

This was helpful.After completing this course what level certification will be this..?

Answer:Dear Konik, Thanks for your interest. This bundle consists of 5 courses. The level of each course is provided below: Xero Accounting and Bookkeeping Course - QLS Endorsed Level 7 Sage 50 Payroll Complete Course - QLS Endorsed Level 7 Quickbooks Online Training - Level 3/ Intermediate Tax Accounting - QLS Endorsed Level 5 Accounting and Finance Course - QLS Endorsed Level 3 Thanks

This was helpful.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.