Xero : Xero

**New Year Sale: Up To 98% OFF** 7-in-1 Bundle | FREE PDF Certificate + Transcript + Student ID | Video Tutorials

Course Cloud

Summary

- Certificate of completion - Free

- Tutor is available to students

Overview

♧♧ Excel your career by enhancing Xero : Xero skills with Course Cloud and get noticed by recruiters in this Hiring season! ♧♧

Are you looking for Xero : Xero skills that will assist you in landing a job and help you secure a higher salary? If yes, then you have come to the right place. Our comprehensive course on Xero : Xero will assist you to produce the best possible outcome by mastering the necessary Xero : Xero skills and enhancing your chances of landing your dream job in the relevant sector.

Develop in-demand professional skills by enrolling in our Xero : Xero bundle & get 7 premium courses with a single payment.

Courses included in this Xero : Xero Complete Bundle:

- Xero Course 01: Xero Accounting and Bookkeeping

- Xero Course 02: Accounting Basics

- Xero Course 03: Introduction to Business Finance

- Xero Course 04: Tax Accounting

- Xero Course 05: Complete Banking and Finance Accounting Statements Financial Analysis

- Xero Course 06: Sage 50 Accounts

- Xero Course 07: Microsoft Excel from A-Z: Beginner To Expert

Learn Xero : Xero at your own pace from the comfort of your home, as the rich learning materials of these Xero : Xero courses are accessible from any place at any time. The advanced Xero : Xero course curriculums are divided into tiny bite-sized video modules by industry specialists with years of experience behind them. Throughout your Xero : Xero learning journey with Course Cloud, you'll receive expert tutor support, and our friendly customer service is available 24/7 to answer any questions you may have.

Our Xero : Xero course is CPD accredited, and upon completion, you'll be awarded a CPD accredited certificate to showcase your expertise on Xero : Xero. Boost your resume and stand out in the crowd by adding these valuable skills & kickstart your career in the right direction.

So, enrol on our Xero : Xero today & do your best! As what you plant now, you will harvest later. Become the person who would attract the results you seek. Grab this opportunity and start learning!

Why would you choose Course Cloud:

- Get 7 premium Xero : Xero courses at a single price

- Xero : Xero PDF Certificate, Xero : Xero Transcript and a Student ID all included

- Lifetime access to Xero : Xero courses materials

- Full tutor support is available from Monday to Friday with the Xero : Xero courses

- Learn Xero : Xero skills at your own pace from the comfort of your home

- Gain a complete understanding of Xero : Xero courses

- Accessible, informative video modules on Xero : Xero taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Xero : Xero bundle

- Study Xero : Xero in your own time through your computer, tablet or mobile device.

- Improve your chance of gaining professional skills and better earning potential by completing the Xero : Xero bundle

**** Additional GIFTS ****

- Free PDF Certificate

- Free Transcript

- Free Student ID

- 24/7 Tutor Support

- Lifetime Access To Course Materials From Anywhere

CPD

Course media

Description

The curriculum of the Xero : Xero Bundle

Course 01: Xero Accounting and Bookkeeping

- Xero : Xero : Xero : Xero -Introduction

- Xero : Xero : Xero : Xero -Getting Started

- Xero : Xero : Xero : Xero -Invoices and Sales

- Xero : Xero : Xero : Xero -Bills and Purchases

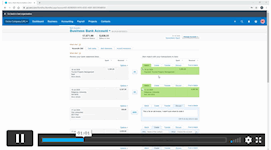

- Xero : Xero : Xero : Xero -Bank Accounts

- Xero : Xero : Xero : Xero -Products and Services

- Xero : Xero : Xero : Xero -Fixed Assets

- Xero : Xero : Xero : Xero -Payroll

- Xero : Xero : Xero : Xero -VAT Returns

Course 02: Accounting Basics

Section 01: Accounting Fundamental

- Xero : Xero : Xero : Xero -What is Financial Accounting

- Xero : Xero : Xero : Xero -Accounting Double Entry System and Fundamental Accounting Rules

- Xero : Xero : Xero : Xero -Financial Accounting Process and Financial Statements Generates

- Xero : Xero : Xero : Xero -Basic Accounting Equation and Four Financial Statements

- Xero : Xero : Xero : Xero -Define Chart of Accounts and Classify the accounts

- Xero : Xero : Xero : Xero -External and Internal Transactions with companies

- Xero : Xero : Xero : Xero -Short Exercise to Confirm what we learned in this section

Section 02: Accounting Policies

- Xero : Xero : Xero : Xero -What are Major Accounting Policies need to be decided by companies

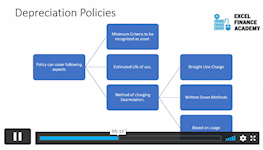

- Xero : Xero : Xero : Xero -Depreciation Policies

- Xero : Xero : Xero : Xero -Operational Fixed Asset Controls

- Xero : Xero : Xero : Xero -Inventory Accounting and Controls

- Xero : Xero : Xero : Xero -Revenue Accounting and Controls

- Xero : Xero : Xero : Xero -Expenses Accounting and Working Capital

Course 03: Introduction to Business Finance

- Xero : Xero : Xero : Xero -What is Business Finance?

- Xero : Xero : Xero : Xero -Why Businesses Fail

- Xero : Xero : Xero : Xero -The Principles of Business Finance Part 1

- Xero : Xero : Xero : Xero -The Principles of Business Finance Part 2

- Xero : Xero : Xero : Xero -The Balance Sheet

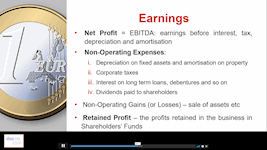

- Xero : Xero : Xero : Xero -The Income Statement

- Xero : Xero : Xero : Xero -The Cashflow Statement

- Xero : Xero : Xero : Xero -A Business Finance Exercise

- Xero : Xero : Xero : Xero -Financial Performance Indicators

- Xero : Xero : Xero : Xero -Investment Analysis

- Xero : Xero : Xero : Xero -Investment Analysis Exercise

- Xero : Xero : Xero : Xero -Key Learning Points in Business Finance

Course 04: Tax Accounting

- Xero : Xero : Xero : Xero -Tax System and Administration in the UK

- Xero : Xero : Xero : Xero -Tax on Individuals

- Xero : Xero : Xero : Xero -National Insurance

- Xero : Xero : Xero : Xero -How to Submit a Self-Assessment Tax Return

- Xero : Xero : Xero : Xero -Fundamental of Income Tax

- Xero : Xero : Xero : Xero -Advanced Income Tax

- Xero : Xero : Xero : Xero -Payee, Payroll and Wages

- Xero : Xero : Xero : Xero -Value Added Tax

- Xero : Xero : Xero : Xero -Corporation Tax

- Xero : Xero : Xero : Xero -Capital Gain Tax

- Xero : Xero : Xero : Xero -Inheritance Tax

- Xero : Xero : Xero : Xero -Import and Export

- Xero : Xero : Xero : Xero -Double Entry Accounting

- Xero : Xero : Xero : Xero -Management Accounting and Financial Analysis

- Xero : Xero : Xero : Xero -Career as a Tax Accountant in the UK

Course 05: Complete Banking and Finance Accounting Statements Financial Analysis

- Xero : Xero : Xero : Xero -Introduction and Welcome to the Course

- Xero : Xero : Xero : Xero -Introduction to Accounting

- Xero : Xero : Xero : Xero -Introduction to Financial Statements

- Xero : Xero : Xero : Xero -Understanding Working Capital

- Xero : Xero : Xero : Xero -Introduction to Financial Analysis

- Xero : Xero : Xero : Xero -Financial Analysis - Case Study and Assignment

- Xero : Xero : Xero : Xero -Financial Ratio Analysis in Corporate Finance

- Xero : Xero : Xero : Xero -Financial Modelling for Mergers and Acquisitions

- Xero : Xero : Xero : Xero -Course Summary and Wrap Up

Course 06: Sage 50 Accounts

- Xero : Xero : Xero : Xero -Sage 50 Accounts – Coursebook

- Xero : Xero : Xero : Xero -Introduction and TASK 1

- Xero : Xero : Xero : Xero -TASK 2 Setting up the System

- Xero : Xero : Xero : Xero -TASK 3 a Setting up Customers and Suppliers

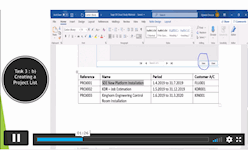

- Xero : Xero : Xero : Xero -TASK 3 b Creating Projects

- Xero : Xero : Xero : Xero -TASK 3 c Supplier Invoice and Credit Note

- Xero : Xero : Xero : Xero -TASK 3 d Customer Invoice and Credit Note

- Xero : Xero : Xero : Xero -TASK 4 Fixed Assets

- Xero : Xero : Xero : Xero -TASK 5 a and b Bank Payment and Transfer

- Xero : Xero : Xero : Xero -TASK 5 c and d Supplier and Customer Payments and DD STO

- Xero : Xero : Xero : Xero -TASK 6 Petty Cash

- Xero : Xero : Xero : Xero -TASK 7 a Bank Reconnciliation Current Account

- Xero : Xero : Xero : Xero -TASK 7 b Bank Reconciliation Petty Cash

- Xero : Xero : Xero : Xero -TASK 7 c Reconciliation of Credit Card Account

- Xero : Xero : Xero : Xero -TASK 8 Aged Reports

- Xero : Xero : Xero : Xero -TASK 9 a Payroll

- Xero : Xero : Xero : Xero -9 b Payroll Journal

- Xero : Xero : Xero : Xero -TASK 10 Value Added Tax – Vat Return

- Xero : Xero : Xero : Xero -Task 11 Entering opening balances on Sage 50

- Xero : Xero : Xero : Xero -TASK 12 a Year end journals – Depre journal

- Xero : Xero : Xero : Xero -TASK 12 b Prepayment and Deferred Income Journals

- Xero : Xero : Xero : Xero -TASK 13 a Budget

- Xero : Xero : Xero : Xero -TASK 13 b Intro to Cash flow and Sage Report Design

Course 07: Microsoft Excel from A-Z: Beginner To Expert

- Xero : Xero : Xero : Xero - Excel from A-Z Course Introduction

- Xero : Xero : Xero : Xero - Getting Started With Excel

- Xero : Xero : Xero : Xero - Values, Referencing and Formulas

- Xero : Xero : Xero : Xero - Intro to Excel Functions

- Xero : Xero : Xero : Xero - Adjusting Excel Worksheets

- Xero : Xero : Xero : Xero - Visually Pleasing Cell Formatting

- Xero : Xero : Xero : Xero - Excel’s Printing Options

- Xero : Xero : Xero : Xero - Benefits of Using Excel Templates

And Many More...

Certification

Once you have successfully completed the Xero : Xero course, you will be awarded a PDF certificate for FREE as evidence of your achievement. Hardcopy certificates are £9.99 each, and other PDF certificates are available for just £6 apiece.

Note: Delivery of the hardcopy certificates inside the UK is £4.99 each; international students have to pay a total of £14.99 to get a hardcopy certificate.

Who is this course for?

The Xero : Xero Bundle course is primarily for motivated learners looking to add a new skill to their CV and stand head and shoulders above the competition. Anyone of any academic background can enrol on this Xero : Xero course. However, this Xero course is preferable for:

- Bookkeepers and Accountants.

- Accounting students who want practical knowledge of how to use accounting software.

- Learners who want to earn skills of bookkeeping and small business owners.

Requirements

There is no prior requirement or experience needed to enrol in our Xero : Xero. You only need the willingness to learn new Xero skills and eagerness to practise. You can access the Xero course materials at any time with any internet-enabled device and keep developing new skills.

Career path

Anyone with an interest in Xero will find our comprehensive course beneficial. Master the necessary skills to take a step closer to success with our Xero bundle. Enhance your skills and explore opportunities such as —

- Xero Specialist Bookkeeper / Payroller (£26k - £32k Per Annum)

- Xero Management Accountant (£28k - £35k Per Annum)

- Management Accountant/Bookkeeper (£30k - £35k Per Annum)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.