Sage 50 Computerised Accounting and Bookkeeping

Accredited by CPD & iAP | FREE PDF Certificate | Unlimited Access for 12 Months | 5 in 1 Bundle OFFER | No Hidden Fees

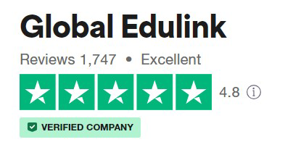

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

- TOTUM card available but not included in price What's this?

Overview

Sage 50 Computerised Accounting & Bookkeeping - Level 1

Interested in studying Computerised Accounting? Here’s your chance!

The Sage 50 Computerised Accounting & Bookkeeping – Level 1 course is an excellent start for beginners interested in learning accounting. This course covers the concepts of financial and administration duties and performing them with the use of computerised accounting software. Following this course will allow you to gain the most relevant and modern skills sought by employers. It will also improve your chances of employability and equip you with the qualifications and knowledge needed to run your own finances if you are a business owner.

The course is designed to provide learners with a solid foundation of learning functions in accounting systems required to manage their own finances. The knowledge of computerised accounting software functionality is extremely useful in financial management if you are working in the finance sector.

- Course covers the foundations of financial and administration concepts

- Includes professionally narrated e-learning modules along with theoretical and practical sessions

- Provides learners with the knowledge and skills necessary to manage own finances

Super Saver! Buy ONE course and get FIVE courses absolutely FREE!

- Course 1 : Accounting for Business

- Course 2 : Bookkeeping and Payroll Management

- Course 3 : Business Accounting

- Course 4 : Accounting Essentials

- Course 5 : Diploma in Small Business Accounting

**FREE Digital Certificates Included**

Hurry! Limited time offer! Grab now!

Why Choose Global Edulink?

Global Edulink provides flexible learning opportunities delivering all course material developed by industry professionals to you directly. Global Edulink (GEL) offers qualified tutors, tested learning methods, interactive lessons, and self-paced studying. This is why studying with GEL has added benefits compared to other online learning platforms.

The benefits of studying Sage 50 Computerised Accounting with GEL are ample. Here are just a few,

- Interactive and engaging teaching methods

- Highly experienced tutor

- High-quality study material

- Theory and practical knowledge session

- Trial version of the SAGE software for practice

- Flexible payment methods with no hidden costs

- Clear and concise presentations

CPD

Course media

Resources

- Sage 50 Computerised Accounting and Bookkeeping Brochure - download

Description

Why Follow Sage 50 Computerised Accounting?

This course makes it convenient for any business to carry out daily accounting related functions,

- Suitable for anyone who wants to start a career in finance

- Internationally recognised and reputed accreditation

- Improves efficiency in performing duties with the use of computerised accounting system

- Equips learner with the latest skills needed for employment in the finance sector or manage finances in their own business

COURSES CURRICULUM

Module 01 : Introduction to Sage 50 Accounts

- Task 1- Business Types, Financial Year and Accounting Dates

- Task 2- Nominal Codes, Chart of Accounts and The Double Entry Concept

- Task 3 & 4- Control Accounts: Debtors, Creditors and VAT

- Task 5 – Recording a Sales Invoice Following The Double Entry Concept

- Task 6- Recording a Purchase Invoice Following The Double Entry Concept

- Task 8 – Recording a Sales Credit Note Considering The Double Entry Concept

- Task 9 – Recording a Purchase Credit Note Considering The Double Entry Concept

- Task 10 – Recording Bank Transactions and Petty Cash Transactions Considering The Double Entry Concept

- Task 15 & 16 – End of Month Reports

Module 02 : John Carter DIY Products

- John Carter DIY Products – Workbook

- John Carter DIY Products – Workbook Solutions

- Task 1 – John Carter Company Set Up in SAGE

- Task 2 – How to Set Up Nominal Ledger Accounts in Sage 50

- Task 3 – How to Set Up a Customer Account in Sage 50

- Task 4 – How to Set Up a Supplier Account in Sage

- Task 5 – How to Record Customer Sales Invoices

- Task 6 – How to Record Supplier Invoices/ Purchase Invoices

- Task 7 – Customer Address List and Supplier Address List

- Task 8 – How to Record Sales Credit Notes

- Task 9 – How to Create Suppliers Credit Note

- Task 10 – Bank Receipts

- Task 11 – Customer Receipts

- Task 12 – Bank Payments

- Task 13 – Supplier Payments

- Task 14 – Edit a Transaction Recorded in Sage

- Task 15 – How to Record Additional Sales Invoices and Purchase Invoices

- Task 16– How to Generate Other Customers and Suppliers Reports

- Task 17 – Record Additional Bank Transactions in Sage 50 Accounts

- Task 18 – Bank Reconciliation and Statement

- Task 19 – Creating Month End Reports in Sage

Module 03 : Johnson’s Daily Repairs

- Johnson’s Daily Repairs – Workbook

- Johnson’s Daily Repairs – Workbook Solutions

- Task 1 – Johnson’s Daily Repairs Company Set Up in SAGE

- Task 2 – Setting Up Nominal Codes/ Nominal Ledger Accounts in Sage 50

- Task 3 – How to Set Up Customer Accounts in Sage 50

- Task 4 – Setting Up Supplier Accounts in Sage 50

- Task 5 – How to Record Customer Sales Invoices in Sage 50

- Task 6 – Recording Supplier Invoices in Sage 50

- Task 7 – Customer and Supplier Address List

- Task 8 – Recording Customer Sales Credit Note in Sage 50 Accounts

- Task 9 – Creating Supplier Credit Note

- Task 10 – How to Record Bank Transactions in Sage 50 Accounts

- Task 11 – Editing a Transaction/ Making a Correction in Sage 50 Accounts

- Task 12 – Recording Extra Additional Sales Invoices and Additional Purchase Invoices

- Task 13 – How to Record Petty Cash Transactions in Sage 50 Accounts

- Task 14 – Generate Different Reports For Customers and For Suppliers

- Task 15 – How to Do a Bank Reconciliation in Sage 50 Accounts and How To Generate a Bank Statement Using Sage 50 Accounts

- Task 16 – Generating End of Month Reports

PLEASE NOTE: Sage 50 Software is not provided with this package. All learners are required to have purchase software separately.

Method of assessment

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the assessment.

Certification

Successful learners will be awarded a Sage 50 Computerised Accounting & Bookkeeping - Level 1 Certificate.

Benefits you will gain:

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

About the tutor

Giada Baldi is a CIMA-qualified, highly-organised, creative, and proactive accounting tutor in the United Kingdom. She has a wealth of knowledge and expertise in finance and accounting tutoring and applies her extensive experience when teaching students. Additionally, she offers customisable CIMA classes for learners. Giada received a Bachelor’s Degree in Administration and Management from the University of Florence and is highly skilled in accounting software.

Awarding body

The CPD certification was established in 1996 as a leading accreditation organisation. It provides advice, support, and accreditations according to CPD standards. Thousands of CPD certified professionals are demonstrating their skills across the globe. Regardless of the industry CPD courses and seminars are a badge of honour for professionals to develop skills and stay ahead of time.

- Recognised approach to learning

- Become an accredited public speaker

- Look ahead to a brilliant career

- Achieve Continuing Professional Development standards and benchmarks

Who is this course for?

- Managers and team leaders interested in learning the accounting functions using a computerised software

- Anyone interested in learning the basics of accounting and its practice in real life

Requirements

This course requires no formal prerequisites and this certification is open to everyone

Career path

- Finance Assistant - £34,000 (Approximately)

- Junior Accountant - £37,000 (Approximately)

- Senior Accountant - £68,000 (Approximately)

- Finance Manager - £75,000 (Approximately)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.