Sage 50 Accounting & Payroll

All about Sage, Boost CV, Save Up To 98%, FREE PDF Certificate & Tutor Support, 4 Career-Oriented Courses

StudyHub

Summary

- Certificate of completion - Free

- Hard copy certificate - £8

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Sage Accounting is a cloud-based software that helps businesses manage their financial transactions, invoices, and reports. It offers features such as:

- Invoicing

- Bank Reconciliation

- Expense Tracking &

- Financial Reporting.

The Sage Accounting Online Course includes a range of topics that will help you learn the software from scratch. It will teach you how to use the software effectively and efficiently, saving you time and reducing the risk of errors.

- ➥ Course 01: Sage 50 Accounting & Payroll

- ➥ Course 02: Xero Accounting and Bookkeeping Online

- ➥ Course 03: Charity Accounting Course

- ➥ Course 04: Advanced Tax Accounting

Learning Outcome

- Understand the basics of the Sage 50 Accounts software

- Set up the Sage 50 Accounts system and customize it according to business needs

- Create and manage customer and supplier accounts, as well as create and manage projects

- Process supplier invoices and credit notes, as well as customer invoices and credit notes

- Manage and account for fixed assets within the Sage 50 Accounts software.

- Troubleshoot issues and errors that arise while using the Sage 50 Accounts software

- Know how to manage different types of accounting tasks and activities with the Sage 50 Accounts software

Key Features of the SageCourse :

- CPD Accredited Sage course

- Instant e-certificate available with Sage bundle

- Fully online, interactive Sage course with audio voiceover

- Self-paced Sage course using smart devices, from anywhere in the world

CPD

Course media

Description

This Sage Bundle resources were created with the help of industry experts, and all subject-related information is kept updated on a regular basis to avoid learners from falling behind on the latest developments.

Course Curriculum :

➥ Course 01: Sage 50 Accounting & Payroll

**Sage 50 Accounts**

- Sage 50 Bookkeeper – Coursebook

- Introduction and TASK 1

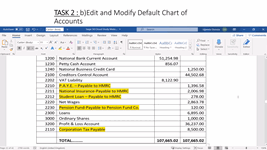

- TASK 2 Setting up the System

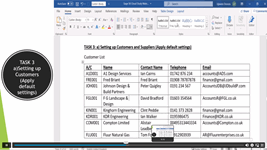

- TASK 3 a Setting up Customers and Suppliers

- TASK 3 b Creating Projects

- TASK 3 c Supplier Invoice and Credit Note

- TASK 3 d Customer Invoice and Credit Note

- TASK 4 Fixed Assets

- TASK 5 a and b Bank Payment and Transfer

- TASK 5 c and d Supplier and Customer Payments and DD STO

- TASK 6 Payroll Petty Cash

- TASK 7 a Bank Reconnciliation Current Account

- TASK 7 b Bank Reconciliation Petty Cash

- TASK 7 c Reconciliation of Credit Card Account

- TASK 8 Payroll Aged Reports

- TASK 9 a Payroll

- TASK 9 b Payroll

- TASK 10 Value Added Tax – Vat Return

- Task 11 Entering opening balances

- TASK 12 a Year end journals – Depre journal

- TASK 12 b Prepayment and Deferred Income Journals

- TASK 13 a Budget

- TASK 13 b Intro to Cash flow and Report Design

- TASK 13 c Preparation of Accountants Report & correcting Errors (1)

Who is this course for?

This training is suitable for —

- Students

- Recent graduates

- Job Seekers

- Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise.

Requirements

To participate in this course, all you need is —

- A smart device

- A secure internet connection

Career path

According to data from PayScale, the average salary for a Bookkeeper in the UK is around £22,000 to £26,000 per year and Bookkeepers with more experience, especially those with over 10 years of experience, can earn up to £30,000 per year

- Bookkeeper

- Financial analyst

- Management accountant

- Auditor

- Finance manager

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

Hard copy certificate

Hard copy certificate - £8

Hard Copy certificates must be bought separately for an extra £8.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.