QLS Endorsed VAT and Tax Bundle Course

Level 5 & 5 Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 5 CPD Courses | Lifetime Access

One Education

Summary

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Taxes - the very mention of this word is enough to give anyone a headache. But what if we told you that there's a way to not only understand the complexities of taxes but to also master them? Yes, you heard that right! We're excited to present to you our QLS Endorsed VAT and Tax Bundle Course.

The two QLS-endorsed courses included in this bundle are Introduction to VAT and UK Tax Accounting. These courses provide a detailed overview of VAT and tax accounting in the UK, covering key topics such as VAT registration, compliance, VAT returns, and tax accounting for businesses. Upon completion of these courses, you will receive a hardcopy certificate endorsed by QLS, confirming your expertise in VAT and UK taxation.

In addition to these two courses, the bundle also includes five CPD QS-accredited courses, which cover a range of topics related to accounting and taxation. These courses include Accounting Essentials and UK Taxation, HR, Payroll, PAYE, TAX, Tax Manager, Tax Accounting Diploma, and Microsoft Excel & Accounting Training. These courses provide you with the skills and knowledge needed to manage finances and accounts and to understand the different tax implications for businesses.

Learning Outcomes:

- Understanding of the basic concepts and principles of VAT and Taxation.

- Familiarity with the UK Taxation system and its regulations.

- Knowledge of accounting essentials and their application in Taxation.

- Proficiency in HR, Payroll, PAYE, and TAX.

- Expertise in Tax Management and Accounting.

- Advanced skills in Microsoft Excel and Accounting.

- Comprehensive understanding of Tax Accounting and its various aspects.

QLS Endorsed Courses:

- Course 01: Diploma in Introduction to VAT at QLS Level 5

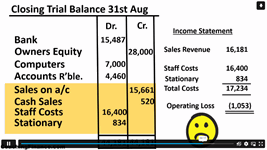

- Course 02: Diploma in UK Tax Accounting at QLS Level 5

CPD QS Accredited Courses:

- Course 03: Accounting Essentials and UK Taxation

- Course 04: HR, Payroll, PAYE, TAX

- Course 05: Tax Manager

- Course 06: Tax Accounting Diploma

- Course 07: Microsoft Excel & Accounting Training

Achievement

CPD

Course media

Description

Taxes and VAT can be a headache for anyone, but with our QLS Endorsed VAT and Tax Bundle Course, you'll gain the knowledge and skills to navigate the complexities of Taxation with ease. This bundle consists of two QLS-endorsed courses, Introduction to VAT and UK Tax Accounting, as well as five relevant CPD QS accredited courses that cover accounting essentials, HR and payroll, tax management, and more. Upon completion, you'll receive a hardcopy certificate for each QLS-endorsed course, demonstrating your mastery of these fundamental topics.

Certification

Learners will qualify for the highly sought-after QLS Endorsed Certificate after successfully passing the assessment at the conclusion of each endorsed course.

The Quality Licence Scheme is a credible and renowned endorsement that marks high quality and excellence in the UK. It is well accepted and sought after by industry experts and recruiters.

Learners who purchase this bundle will receive TWO Hardcopy QLS Certificates at their door!

Who is this course for?

- Anyone who wants to gain a comprehensive understanding of VAT and Taxation.

- Accounting professionals who want to enhance their skills and knowledge.

- Business owners who want to manage their finances effectively and efficiently.

Individuals who want to pursue a career in Taxation and Accounting.

Career path

This course is beneficial for anyone looking to build their career as:

- Tax Accountant - £24,000 to £62,000 per year

- Tax Manager - £35,000 to £85,000 per year

- Financial Analyst - £24,000 to £54,000 per year

- Accounting Manager - £28,000 to £66,000 per year

- Auditor - £20,000 to £54,000 per year

- Finance Director - £50,000 to £150,000 per year

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Hard copy certificate - Included

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.