Money Laundering Awareness : NCFE Level 3

Awarded by NCFE | Globally Recognised | Official Exam + Certificate Included | Unlimited Access 365 Days

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

- TOTUM card available but not included in price What's this?

Overview

Level 3 Certificate in Money Laundering Awareness - NCFE

Do You Aspire To Learn About Anti-money Laundering And Its Practices?

Are you aspiring to learn about Anti-Money Laundering? Then the Level 3 Certificate in Money Laundering Awareness is a fantastic choice. This course is perfect for professionals who are working with a financial background and need an insight into the different ways of how money laundering could happen. They can also get educated on the Special Anti-Money Laundering Policies that are in place to help the institutes and companies to have protection from it. The course covers various topics relating to anti-money laundering.

- Provides the learner with up to date information on being aware of money laundering

- Clear step-by-step guidance on essential areas such as money laundering indications, audit indicators, tax returns examination, etc.

- The course summarises the main topics so that the learner can grasp the information with ease.

Why Follow The Certificate In Money Laundering Awareness?

- It is ideal for aspiring and existing professionals in financial compliance

- Provides the learner knowledge to understand the different stages of money laundering

- Helps to learn the most common money laundering indicators

- Prepares the learner to identify and report money laundering

- Gain a better understanding of suspicious activity and when to report it

- At this level, the learners get more progressive and advance stage of the qualification

GET STARTED TODAY!

Click on 'Enquire Now' for more information!

Why Choose Global Edulink As Your Study Partner?

Studying the Certificate in Money Laundering Awareness with Global Edulink (GEL) offers a range of benefits to the learner. Qualified tutors tested learning methods, interactive lessons, and self-paced studying are all part of the study experience. This is why studying with GEL has added benefits compared to other online learning platforms.

The benefits of studying the course with GEL are ample. Here are just a few,

- High-quality study material

- Expert tutors

- Flexible payment methods and no hidden costs

- Clear and concise presentations

- 24-hour online support

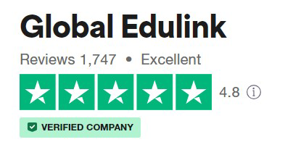

Global Edulink brings together years of experience to offer a range of courses that are designed to help you succeed. With multiple awards and accolades under our name, we have gone from strength to strength over the years. We are your trusted partner in the UK online education industry with plenty of ‘excellent’ ratings on Trust Pilot and thousands of successful students.

Why NCFE?

NCFE is the third largest professional qualification awarding body in the United Kingdom. NCFE aims to keep up with the constant changes in the industry and provide more sustainable solutions for the voids in technical education and practical courses that can facilitate the professionals to be more fortified with skills and knowledge.

Achievement

Course media

Description

Learning Outcomes

- An understanding of the possible money laundering activities

- Comprehending potential threats they cause to companies and the corporate sector

- Awareness of the regulations and policies related to money laundering

- How to regulate threats money laundering can cause

Course Curriculum

Module 01 : Introduction

Module 02 : Money Laundering

- Definition

- Why combat money laundering

- Legal context

- The money laundering process

- Money laundering trends

Module 03 : Role of Tax Examiners and Auditors

- Introduction

- Raising knowledge and awareness

- The importance of detecting unusual transactions

- International exchange of information

Module 04 : Money Laundering Indicators for Individuals

- Indicators

- Foreign Credit/ Debit cards

Module 05 : Tax Return Examination and Pre-Audit Indicators

- Indicators

- Non transparent ownership

Module 06 : Audit Indicators

- Introduction

- Indicators

- Significance increase in cash turnover sales and unusual turnover sales

- Fabricated Sales

Module 07 : Specific Indicators on Real Estate

- Introduction

- Indicators

- Example

Module 08 : Specific Indicators on Cash

- Introduction

- Indicators

- Example

- Countries of risk

Module 09 : Specific Indicators on International Trade

- Introduction

- Indicators

Module 10 : Specific Indicators on Loans

- Introduction

- Loan back

- Indicators

Module 11 : Specific Indicators on Professional Service Providers

- Introduction

- Financial service providers

- Trustor company service providers

- Indicators

Method of Assessment

All students are required to complete an assignment in order to successfully complete the Level 3 Certificate in Money Laundering Awareness.

Certification

Once the course is completed the learners get awarded the Level 3 Certificate in Money Laundering Awareness Certification.

Who is this course for?

- Professionals employed at companies related to finances

- Those who want a progressive understanding of the subject

- Those who need to pursue a career in the field of money laundering

Requirements

- Learners should be 16 years or older

Career path

- Anti-money laundering specialist - £33,615 (approximately)

- Financial crime intelligence specialist - £38,787 (approximately)

- Financial crime analyst - £29,502 (approximately)

Questions and answers

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.