CIMA : Management Accounting - P1

Awarded by CIMA | Globally Recognised | *FREE Business Ethics Diploma* | Unlimited Access for 365 Days

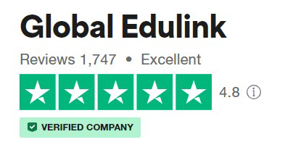

Global Edulink

Summary

- Exam(s) / assessment(s) not included in price, and must be purchased separately

- Tutor is available to students

Add to basket or enquire

Overview

Management Accounting - P1

The ideal course for anyone interested in pursuing a career in management accountancy!

This unit Management Accounting (P1) which is part of CIMA qualification in diploma in Management Accounting provides you an in-depth understanding of the management activities and principles associated with Accounting. Costing factors as well as risks and uncertainties engrained in accounting entities are covered with this course P1.

With Management being one of the key components in accounting arena you will learn all the skills necessary to not just pass the exam but also the skills and knowledge required for hands on industrial experience in the work place.

As this is the final unit to your pathway to CIMA qualification in diploma in Management Accounting you are one step away from the final qualification.

With our 100% support we can assure you that you will successfully complete this unit Management Accounting (P1) as well as the certification.

---LIMITED TIME OFFER---LIMITED TIME OFFER---LIMITED TIME OFFER---

Sign up for this CIMA : Management Accounting - P1 course, and get FREE access to the CPD accredited Business Ethics Diploma : LEVEL 3 Course

Hurry! Don’t Delay

GET STARTED NOW!

Certification

CIMA Diploma in Management Accounting

Course media

Description

WHAT WILL I LEARN?

- Learn about costing methods and techniques, why costing is done and where digital costing can be applied.

- Why it is important to collect data and upon Understand budgets, how they are prepared and implemented within an organisation.What is the impact of budgets? examination learn how it creates value for the organisation.

- Understand the types of short-term decisions made by an organisation, and learn the techniques to support these short-term decisions

- Learn to apply risk management tools in the short term decision making process

COURSE CURRICULUM

P1: Management Accounting

Chapter 1 - Accounting For Management

- Introduction

- The Definition Of Management Accounting

- Objectives Of Management Accounting

- Nature And Scope Of Management Accounting

- Limitations Of Management Accounting

- The Global Management Accounting Principles

- Data And Information

- What Makes Good Information?

- The Main Managerial Processes

- The Different Levels Of Planning

- Comparison Of Management Accounting With Financial Accounting

Chapter 2 - Cost Classification And Behaviour

- Cost Classification

- Cost Behaviours

Chapter 3 - Semi Variable Costs

- High-Low Method

- Regression

- The Correlation Coefficient

- Coefficient Of Determination

Chapter 4 - Accounting For Overheads

- Introduction

- Absorption Of Overheads

- Reapportionment Of Service Cost Centre Overheads

Chapter 5 - Absorption Costing

- Introduction

- Absorption Costing Income Statement

- The Effect Of Absorption And Marginal Costing On Inventory Valuation And Profit Determination

- Calculation Of Fixed Manufacturing Overhead Absorption Rate (OAR)

Chapter 6 - Marginal Costing

- Introduction

- The Contribution Concept

Chapter 7 - Activity Based Costing

- Introduction

- ABC Cost Hierarchy

- Strengths / Weaknesses Of ABC Costing

Chapter 8 - Limiting Factor Analysis And Throughput Accounting

- Limited Factor Analysis

- Six-Step Approach

- Limitations

- Theory Of Constraints And Throughput

- Throughput Accounting

- Formula And Ratios

- TPAR –Throughput Accounting Ratio

- Benefits And Drawbacks

Chapter 9 - Joint Product Costing

- Definition And Meaning Of Joint Products

- Accounting Treatment For Joint Products

- Accounting Treatment For By-Products

- Physical Unit Basis

- Market Value Basis

- Net-Realisable Value Approach

Chapter 10 - Other Costing Issues

- Introduction

- Costing Of Digital Products

- CGMA’s Cost Transformation Model

- Digital Costing Systems

Chapter 11 - Linear Programming

- Introduction

- Linear Programming

- Slack

- Shadow (Or Dual) Prices

Chapter 12 - Standard Costing And Basic Variance Analysis

- Introduction

- Standard Costs

- Uses Of Standard Costing

- Limitations Of Standard Costing

- McDonaldisation

- Variance Analysis

- Analysis Of Variances

Chapter 13 - Advanced Variances

- Introduction

- Planning And Operational Variances

- Sales Mix Variances

- Activity Based Costing Variances

Chapter 14 – Budgeting

- Introduction

- Functional Budgets

- Cash Budget

- Fixed Budget

- Flexible Budget

- Flexed Budget

- Behavioral Aspects

- Methods Of Budgeting

- Budgeting In A Digital Age

Chapter 15 - Forecasting Techniques

- Introduction

- Semi Variable Costs

- High-Low Method

- Regression Analysis

- Time Series Analysis

Chapter 16 - Risk And Uncertainty

- Introduction

- Risk Vs. Uncertainty

- Risk Profiles

- Decision Making Techniques (Risk And Uncertainty)

- Expected Values

- Decision Rules

- Decision Trees

- Sensitivity Analysis

- Standard Deviation

Chapter 17 - Relevant Costing

- Introduction

- Relevant Costing

- Relevant Costs And Irrelevant Costs

- Shutdown Problems

- Make Or Buy Decisions

Chapter 18 - Cost Volume Profit Analysis

- Introduction

- Components Of Break-Even Analysis

- Calculation Of Break-Even Analysis

- Margin Of Safety

- Contribution To Sales Ratio

- Target Profit

- Break-Even Chart

- Profit-Volume Chart

- Multi Product CVP Analysis

- Limitations of CVP Analysis

Syllabus Structure

- Cost Accounting for decision and control

- Budgeting and budgetary control

- Short term commercial decision making

- Risk and uncertainty in the short term

Assessment

This is an objective test. The objective test must be passed in order for learners to complete the syllabus module. Additionally, learners who wish to progress to the CIMA Operational Level qualification should also successfully pass this test.

Exam Details

This is an entry level finance exam that will allow the learner to demonstrate if they have acquired the relevant skills, techniques and knowledge to be displayed in that role. The exam will comprise of a computer-based objective test and 1 case study exam.

Objective Test

- Format – Computer-Based

- Duration – 90 Minutes

- Results – Provisional results available followed by confirmation within 48 hours

(A score out of 150 is given, with 100 representing a Pass)

Operational level objective tests - GBP110 (Tier 1 per exam)

Please Note : Official Exam is not provided, It should be purchased separately

Please note that the prices are subject to change by the The Chartered Institute of Management Accountants (CIMA) at any given time. The above price mentioned per objective test are at the time of writing only. You may check with the official CIMA website for latest updates in prices.

Access Duration

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Certification

Upon the successful completion of the unit Management Accounting - P1, learners can advance to the next unit of the Certificate in Business Accounting (CIMA Cert BA)

Or

If the learner has already completed other units, can apply to the final exam of Diploma in Management Accounting (CIMA Dip MA).

Who is this course for?

- School leavers

- Students or members of other professional bodies

- Undergraduates and graduates

- Anyone with an interest in pursuing a career in management accountancy

Requirements

Learners must be over the age of 16 and be competent in Mathematics, ICT and English Language.

Career path

Upon completing this module syllabus, you will be one step closer to having a career in business and finance. This module does not give you direct access to gain employment, you have the opportunity to take the rest of the modules in the CIMA Operational Level Certificate. A career in management accounting is waiting for you, and will provide a clear path to progress in your desired employment.

Questions and answers

I have a level 7 diploma in Management accounting not Cima recognized. What level of the cima qualification should i start, having already some study?

Answer:Dear Wesley, Thank you for your query. Kindly note that you are required to start from CIMA Foundation since the level 7 Diploma in Management Accounting you have completed is not CIMA recognised. Hope this helps. Please feel free to contact if you have any further clarifications, we will be happy to assist. Regards, Student Support Team

This was helpful.Does the course come with practice test/exam questions?

Answer:Dear N, Thank you for your query. This is an entry level finance exam that will allow the learner to demonstrate if they have acquired the relevant skills, techniques and knowledge to be displayed in that role. The exam will comprise of a computer-based objective test and 1 case study exam. Objective Test Format – Computer-Based Duration – 90 Minutes Results – Provisional results available followed by confirmation within 48 hours. Regards, Student support team

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.