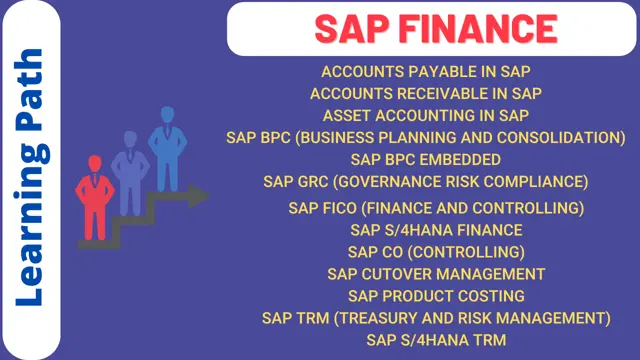

Learning Path - SAP Finance

Program with full self-paced courses on all SAP Finance related modules. Study Material. Course Completion Certificate.

Uplatz

Summary

- Uplatz Certificate of Completion - Free

Add to basket or enquire

Overview

Uplatz provides this comprehensive Learning Path program on SAP Finance. It is a program covering all SAP modules related to SAP Finance domain in the form of self-paced video tutorials. You will be awarded Course Completion Certificate at the end of the course.

Learning Path - SAP Finance consists of the following courses:

- Accounts Payable in SAP

- Accounts Receivable in SAP

- Asset Accounting in SAP

- SAP BPC (Business Planning and Consolidation)

- SAP BPC Embedded

- SAP GRC (Governance Risk Compliance)

- SAP FICO (Finance and Controlling)

- SAP S/4HANA Finance

- SAP CO (Controlling)

- SAP Cutover Management

- SAP Product Costing

- SAP TRM (Treasury and Risk Management)

- SAP S/4HANA TRM

The SAP Finance Learning Path will help you prepare for SAP Finance Certifications and become a successful SAP Finance Consultant.

Course media

Description

SAP Finance, also known as SAP Financials, is a suite of software solutions and modules designed to manage an organization's financial processes, accounting, and financial reporting effectively. SAP Finance is a critical component of SAP's Enterprise Resource Planning (ERP) system and plays a central role in an organization's financial management. Here are some key aspects and modules of SAP Finance:

SAP Financial Accounting (SAP FI):

- SAP FI is the core module of SAP Finance, and it focuses on financial accounting processes. It helps organizations record and manage financial transactions, track financial data, and generate financial statements such as balance sheets and income statements.

SAP Controlling (SAP CO):

- SAP CO complements SAP FI by providing tools for internal cost accounting and controlling. It allows organizations to manage costs, budgets, and profitability analysis. This module helps in monitoring and optimizing the financial performance of various business units or projects.

SAP Asset Accounting (SAP AA):

- SAP AA is used for managing an organization's fixed assets. It tracks the acquisition, depreciation, and disposal of assets, ensuring accurate asset valuation and compliance with accounting standards.

SAP Treasury and Risk Management (SAP TRM):

- SAP TRM helps organizations manage their treasury operations, including cash and liquidity management, debt and investment management, and risk management. It provides tools for managing financial risks such as foreign exchange and interest rate risks.

SAP Cash Management (SAP Cash):

- SAP Cash Management focuses on optimizing an organization's cash flow. It helps organizations monitor and forecast cash positions, manage bank relationships, and improve liquidity management.

SAP In-House Cash (SAP IHC):

- SAP IHC is used for managing in-house banking operations, including centralized payment and collection processing within a group of affiliated companies.

SAP Real Estate Management (SAP RE-FX):

- SAP RE-FX is used for managing real estate portfolios, leases, and rental agreements. It helps organizations track and manage real estate assets and related financial transactions.

SAP Lease Accounting (SAP Lease):

- SAP Lease Accounting assists organizations in complying with lease accounting standards (e.g., IFRS 16 and ASC 842) by tracking and reporting on lease contracts and related financial data.

SAP Funds Management (SAP FM):

- SAP FM is used by public sector organizations and institutions to manage budgets and funds. It helps in budget planning, commitment accounting, and monitoring of funds.

SAP Grants Management (SAP GM):

- SAP GM is designed for organizations that receive grants and funding. It helps in managing grants, budgets, and compliance with grant-specific requirements.

SAP Bank Communication Management (SAP BCM):

- SAP BCM enables organizations to manage bank communications efficiently, including electronic payments, bank statements, and reconciliation processes.

SAP Revenue Accounting and Reporting (SAP RAR):

- SAP RAR is used for revenue recognition in compliance with accounting standards like ASC 606 and IFRS 15. It helps organizations manage complex revenue recognition scenarios.

SAP Finance modules are highly configurable and can be tailored to meet the specific financial management needs of different industries and organizations. They provide a comprehensive solution for financial planning, transaction processing, reporting, and compliance. Efficiently managed financial processes are crucial for organizations to make informed decisions, ensure regulatory compliance, and achieve financial stability.

Who is this course for?

Everyone

Requirements

Passion and determination to achieve your goals!

Career path

- SAP FICO Consultant

- SAP S/4HANA Finance Consultant

- Chartered Accountant

- SAP Financial Analyst

- SAP Financial Consultant

- SAP Financial Controller

- SAP Financial Accountant

- SAP Cost Accountant

- SAP Treasury Analyst

- SAP Asset Accountant

- SAP Revenue Accountant

- SAP Financial Reporting Analyst

- Tax/Budget Analyst

- SAP Auditor

- SAP Finance Manager

- SAP Project Manager (Finance)

- SAP Solution Architect (Finance)

Questions and answers

Hi is this learning path fnance sap course suitable for new end users in sap finance system thanks

Answer:Hi Richard This learning path is suitable for both - consultants and end users. Team Uplatz

This was helpful.

Certificates

Uplatz Certificate of Completion

Digital certificate - Included

Course Completion Certificate by Uplatz

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.