CIMA Accredited Sage Higher Certificate

Awarded by SAGE | FREE Accredited Certificate Included | Globally Recognised | Unlimited Access for 180 Days

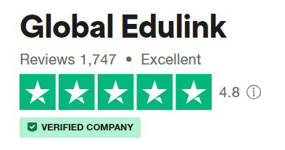

Global Edulink

Summary

'ENQUIRE NOW' for more information!

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

CIMA Accredited Sage Higher Certificate

Sage courses focus on accounts and payroll, and could help you to pursue the career you want, and this CIMA Accredited Sage Higher Certificate is no different. If you have used the Sage 50 suite before, this course is perfect for you, and will show you how to maximise the benefits of Sage 50 Accounts Professional.

This course has been carefully created in partnership with Sage UK with the Chartered Institute of Management Accountants (CIMA). The certificate will allow you to demonstrate a high level of skill, and could help you to establish your own business or progress in your current career.

Studying with Global Edulink has many advantages. The course material is delivered straight to you, and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 180 days (6 months). An effective support service and study materials will build your confidence to study efficiently and guide you to secure your qualification.

**PLEASE NOTE: Sage 50 Software is not provided with this package. All learners are required to have purchase software separately.

Course media

Description

Course Objectives

The course comprises two extended units that cover advanced knowledge of accounting software, including:

- Final accounts for sole traders, partnerships, limited companies, limited liability partnerships and not for profit orgnaisations.

- The importing and exporting data, advanced credit control and cash flow.

- The use of foreign trader accounts, and detailed departmental budgeting and forecasting.

COURSE CURRICULUM

Module 01

- Use of the Journal

- Prepare and Process Month End Routine

- Contra Entries

- The Government Gateway and VAT Returns

- Bad Debts and Provision for Doubtful Debts

- Stock Valuation, Stock Control, Work in Progress and Finished Goods

- Prepare and Produce Final Accounts

- Extended Trial Balance

- Exporting Data including Linking to Other Systems

- Management Information Reports

- Making Decisions with Reports Using Sage

- Prepare for Audit

- Prepare and Process Year End Accounts and Archive Data

- Final Accounts for Partnerships Including Appropriation Accounts

- The Fixed Asset Register and Depreciation

- Accruals and Prepayments

- Not for Profit Organisations

- Standard and Advanced Budgeting

- Glossary of Accounting Terms

Module 02

- Screenshots Tasks and Activities

- Working Through Unit Two

- Cash Flow Forecast Reports

- Advanced Credit Control

- Standard and Advanced Budgeting

- Advanced Searches

- E Payments

- Batch Reporting

- Multiple Contacts and Document Sending

- Event Logging and Log In Control

- Importing and Exporting Data

- Limited Liability Partnerships including Revaluation Accounts

- Limited Companies

- Consolidation – Multi Company Accounts

- Foreign Trader – Multi-Currency Trading

- Microsoft Outlook and the Integrated Diary Feature

- Excel Integration

- Glossary of Accounting Terms

Method of Assessment

The course is self-contained with self-assessments and practice tests, followed by a final online assessment.

Certification

Those who successfully complete this course will be awarded with the CIMA Accredited Sage Higher Certificate.

Course Description

This online training course is comprehensive and designed to cover the topics listed under the curriculum.

PLEASE NOTE: We do not provide tutor support for this course

Requirements

Learners must be age 16 or over and should have a basic understanding of English, Maths, and ICT.

Career path

This certificate will enhance your resume and help you land a rewarding job role in the accounting industry. Below mentioned are some of the job roles this certificate will help you land, along with the average UK salary per annum.

- Financial Controller – £46,964 per annum

- Chartered Accountant – £35,118 per annum

- Finance Manager – £38,138 per annum

- Accountant – £28,580 per annum

Questions and answers

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.