Charity Accounting Courses

Summer Sale Now On | 14-in-1 Bundle| CPD Certified| 145 CPD Points| Gifts: Hardcopy + PDF Certificate + SID - Worth £180

Apex Learning

Summary

- Certificate of completion - Free

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

♕ 14 in 1 "Charity Accounting" Bundle only at £79 ♕

Get Hard Copy + PDF Certificates + Transcript + Student ID Card + e-Learning App as a Gift - Enrol Now

Tired of browsing and searching for a Charity Accounting course you are looking for? Can't find the complete package that fulfils all your needs? Then don't worry as you have just found the solution. Take a minute and look through this extensive bundle that has everything you need to succeed.

After surveying thousands of learners just like you and considering their valuable feedback, this all-in-one Charity Accounting bundle has been designed by industry experts. We prioritised what learners were looking for in a complete package and developed this in-demand Charity Accounting course that will enhance your skills and prepare you for the competitive job market.

Also, our experts are available for answering your queries on Charity Accounting and help you along your learning journey. Advanced audio-visual learning modules of these Charity Accounting courses are broken down into little chunks so that you can learn at your own pace without being overwhelmed by too much material at once.

Furthermore, to help you showcase your expertise in Charity Accounting, we have prepared a special gift of 1 hardcopy certificate and 1 PDF certificate for the title course completely free of cost. These certificates will enhance your credibility and encourage possible employers to pick you over the rest.

This Charity Accounting Bundle Consists of the following Premium courses:

- ⇒ Course 01: Charity Accounting

- ⇒ Course 02: Fundraising

- ⇒ Course 03: Double Your Donations & Succeed at Fundraising

- ⇒ Course 04: Financial Analysis

- ⇒ Course 05: Budgeting and Forecasting

- ⇒ Course 06: Introduction to Accounting

- ⇒ Course 07: Key Account Management Course

- ⇒ Course 08: Professional Bookkeeping Course

- ⇒ Course 09: Microsoft Excel Training: Depreciation Accounting

- ⇒ Course 10: Certificate in Compliance

- ⇒ Course 11: Certificate in Anti Money Laundering (AML)

- ⇒ Course 12: Introduction to Data Analysis

- ⇒ Course 13: GDPR Data Protection Level 5

- ⇒ Course 14: Human Rights

Enrol now in Charity Accounting to advance your career, and use the premium study materials from Apex Learning.

How will I get my Certificate?

After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement.

- ➽PDF Certificate: Free (For The Title Course )

- ➽Hard Copy Certificate: Free (For The Title Course )

CPD

Course media

Description

The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Charity Accounting expertise and essential knowledge, which will assist you in reaching your goal.

Curriculum of Bundle

⇒ Course 01: Charity Accounting

- Module 01: The Concept of Charity Accounting

- Module 02: Accounting Standards, Policies, Concepts and Principles

- Module 03: Fund Accounting

- Module 04: Charity Reporting and Accounts

- Module 05: Trustees’ Annual Report

- Module 06: Balance Sheet

- Module 07: Statement of Financial Activities

- Module 08: Understanding the Income Streams and Expenditure of Charity

- Module 09: Statement of Cash Flows

- Module 10: Taxation for Charities and External Scrutiny

- Module 11: Things to Look Out for in Post Covid Situation

⇒ Course 02: Fundraising

- Module 01: Introduction to Fundraising

- Module 02: Hiring and Training Development Staff

- Module 03: The Fundraising Cycle

- Module 04: Establishing Governance

- Module 05: Managing Budget, Taxes and Accounting

- Module 06: Fundraising Sources

- Module 07: Arranging Successful Fundraising Events

- Module 08: Marketing, Public Relations and Communications

- Module 09: Tools and Resources that Can Help in Fundraising

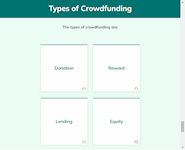

- Module 10: Crowdfunding

- Module 11: The Organisation and Use of Volunteers

- Module 12: Risk Management

- Module 13: Legal Responsibilities

⇒ Course 03: Double Your Donations & Succeed at Fundraising

- Module 01: Week 01 Why Should Anyone Donate To Your Organization?

- Module 02: Week 02 How To Use Emotion To Be More Effective.

- Module 03: Week 03 How to Create Headlines and Subject Lines That Bring In Money

- Module 04: Week 04 a Welcome Mat Could Save Your Back

- Module 05: Week 05 How to Tell Stories That People Remember

- Module 06: Gems to Remember

- Module 07: How to Attract Major Gifts – Part 1 Of 2

- Module 08: How to Attract Major Gifts – Part 2 Of 2

⇒ Course 04: Financial Analysis

- Section-1. Introduction

- Section-2. Profitability

- Section-3. Return Ratio

- Section-4. Liqudity Ratio

- Section-5.Operational Analysis

- Section-6. Detecting Manipulation

⇒ Course 05: Budgeting and Forecasting

- Unit-1. Introduction

- Unit-2. Detail Budget Requirement

- Unit-3. Process of Making Budget

⇒ Course 06: Introduction to Accounting

- Section 01: Accounting Fundamental

- Section 02: Accounting Policies

⇒ Course 07: Key Account Management Course

- Module 1: Introduction to Key Account Management

- Module 2: Purpose of Key Account Management

- Module 3: Understanding Key Accounts

- Module 4: Elements of Key Account Management

- Module 5: What Makes a Good Key Account Manager

- Module 6: Building and Delivering Value to Key Accounts

- Module 7: Key Account Planning

- Module 8: Business Customer Marketing and Development

- Module 9: Developing Key Relationships

- Module 10: The Importance of Record Keeping for Key Account Management

- Module 11: Internal KAM Aspects

- Module 12: The Value Proposition

⇒ Course 08: Professional Bookkeeping Course

- Section 01: Introduction

- Section 02: Basic Accounting Terms

- Section 03: Common Transactions

- Section 04: Practice

⇒ Course 09: Microsoft Excel Training: Depreciation Accounting

- Introduction

- Depreciation Amortization and Related Terms

- Various Methods of Depreciation and Depreciation Accounting

- Depreciation and Taxation

- Master Depreciation Model

- Conclusion

⇒ Course 10: Certificate in Compliance

- Module 1: Introduction to Compliance

- Module 2: Compliance Management System

- Module 3: Basic Elements of Effective Compliance

- Module 4: Compliance Audit

- Module 5: Compliance and Ethics

- Module 6: Introduction to Risk and Basic Risk Types

- Module 7: Further Risk Types

- Module 8: Introduction to Risk Management

- Module 9: Risk Management Process

- Module 10: Risk Assessment and Risk Treatment

- Module 11: Types of Risk Management

⇒ Course 11: Certificate in Anti Money Laundering (AML)

- Module 01: Introduction to Money Laundering

- Module 02: Proceeds of Crime Act 2002

- Module 03: Development of Anti-Money Laundering Regulation

- Module 04: Responsibility of the Money Laundering Reporting Office

- Module 05: Risk-based Approach

- Module 06: Customer Due Diligence

- Module 07: Record Keeping

- Module 08: Suspicious Conduct and Transactions

- Module 09: Awareness and Training

⇒ Course 12: Introduction to Data Analysis

- Module 01: Introduction

- Module 02: Agenda and Principles of Process Management

- Module 03: The Voice of the Process

- Module 04: Working as One Team for Improvement

- Module 05: Exercise: The Voice of the Customer

- Module 06: Tools for Data Analysis

- Module 07: The Pareto Chart

- Module 08: The Histogram

- Module 09: The Run Chart

- Module 10: Exercise: Presenting Performance Data

- Module 11: Understanding Variation

- Module 12: The Control Chart

- Module 13: Control Chart Example

- Module 14: Control Chart Special Cases

- Module 15: Interpreting the Control Chart

- Module 16: Control Chart Exercise

- Module 17: Strategies to Deal with Variation

- Module 18: Using Data to Drive Improvement

- Module 19: A Structure for Performance Measurement

- Module 20: Data Analysis Exercise

- Module 21: Course Project

- Module 22: Test your Understanding

⇒ Course 13: GDPR Data Protection Level 5

- Module 01: GDPR Basics

- Module 02: GDPR Explained

- Module 03: Lawful Basis for Preparation

- Module 04: Rights and Breaches

- Module 05: Responsibilities and Obligations

⇒ Course 14: Human Rights

- Module 1: Basic Concept of Freedom and Human Rights

- Module 2: Classification of Human Rights

- Module 3: Women’s and Children’s Right

- Module 4: Various Aspects of Freedom

- Module 5: Various International Human Rights Organisations

Who is this course for?

Anyone from any background can enrol in this Charity Accounting bundle.

Requirements

Our Charity Accounting course is fully compatible with PCs, Macs, laptops, tablets and Smartphone devices.

Career path

Having this Charity Accounting expertise will increase the value of your CV and open you up to multiple job sectors.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

Certificate of completion

Hard copy certificate - Included

P.S. The delivery charge inside the UK is £3.99, and the international students have to pay £9.99.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.