Be A Financial Accountant

**Biggest Winter Sale: Up To 98% OFF** 11-in-1 Bundle | FREE PDF Certificate + Transcript + Student ID | Video Tutorials

Course Cloud

Summary

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Overview

♧♧ Winter Warm Up Sale Is Live ♧♧

Take advantage of this exceptional bundle of Specialisation courses and learn how to Be A Financial Accountant in one complete learning curve. Take video lessons with industry-led accounting professionals who'll guide you in each step from basic to advanced.

Not only will you be given full access to expertly designed tutorials on business accountancy, but you will get Career guidance support as well as free PDF certificates for each and every course completed! This is a learning package like no other, packed with every aspect of professional accounting you could wish for, along with expert guidance and the full support of the Course Cloud network.

This Accountant Training Bundle has been meticulously crafted to include all of our best-selling accountant courses, all of which cover the essential elements of business and company finances in the market today. You will learn everything needed to excel in this sector, from the fundamentals of finance to effective budgeting, and tips for using QuickBooks and Microsoft Excel in your work. The addition of the free career guidance and the complementary 11 PDF certificates will have you trained, ready, and able to shine in this lucrative profession. Enrol now and achieve absolute accountancy excellence with just one payment.

What will you learn from this Be A Financial Accountant Specialisation bundle:

- Discover the principles of corporate finance and administration

- Understand how to produce and interpret critical financial analysis

- Know how to manage company cash flows and budgetary constraints

- Learn how to calculate and distribute organisational payrolls and expenses

- Explore the laws and legislation that governs tax accounting and declaration

- Gain new skills with QuickBooks Bookkeeping and Microsoft Excel

Courses are included in this Be A Financial Accountant Complete Bundle:

- Course 01: Understanding Corporate Finance

- Course 02: Corporate Finance Level 3

- Course 03: Financial Analysis: Finance Reports

- Course 04: Introduction to Business Finance

- Course 05: Finance and Cash Management

- Course 06: Complete Banking and Finance Accounting Statements Financial Analysis

- Course 07: Finance and Accounting for Beginners to Intermediate

- Course 08: Payroll Management

- Course 09: Tax Accounting

- Course 10: Quickbooks Online Bookkeeping

- Course 11: Microsoft Excel from A-Z: Beginner To Expert

Learn at your own pace from the comfort of your home, as the rich learning materials of these courses are accessible from any place at any time. The advanced course curriculums are divided into tiny bite-sized video modules by industry specialists with years of experience behind them. Throughout your learning journey with Course Cloud, you'll receive expert tutor support, and our friendly customer service is available 24/7 to answer any questions you may have.

This Be A Financial Accountant bundle is CPD accredited, and upon completion, you'll be awarded a CPD accredited certificate to showcase your expertise. Boost your resume and stand out in the crowd by adding these valuable skills & kickstart your career in the right direction.

CPD

Course media

Description

The curriculum of Be A Financial Accountant Bundle

Course 01: Understanding Corporate Finance

- Module 01: An Overview of the Course

- Module 02: An Introduction to the Foundations of Financial Management

- Module 03: The Financial Markets and Interest Rates

- Module 04: Understanding Financial Statements and Cash Flows

- Module 05: Evaluating a Firm’s Financial Performance

- Module 06: The Time Value of Money

- Module 07: The Meaning and Measurement of Risk and Return

- Module 08: The Valuation and Characteristics of Bonds

- Module 09: The Valuation and Characteristics of Stock

- Module 10: The Cost of Capital

- Module 11: Capital-Budgeting Techniques and Practice

- Module 12: Cash Flows and Other Topics in Capital Budgeting

- Module 13: Determining the Financing Mix

And many more...

Course 02: Corporate Finance Level 3

- Learn More About This Course!

- Financial Analysis

- Cash Forecast

- Present Value

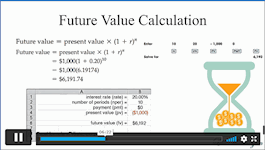

- Future Value

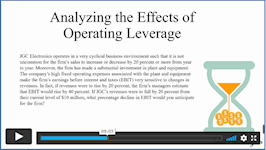

- Rate of Return and Adding Debt

- Risk Management

- Finance in Practice

Course 03: Financial Analysis: Finance Reports

- Welcome to the Course! Get the Overview of What You’ll Learn

- What is a 10-K?

- Evaluating Profitability by Analyzing the Income Statement

- Evaluating Operations: Tying Operating Metrics to Financial Results

- Evaluating Financial Strength: Balance Sheet Analysis

- Evaluating Cash Flow Generation

- Performing Investment Analysis

Course 04: Introduction to Business Finance

- Module 01: What is Business Finance?

- Module 02: Why Businesses Fail

- Module 03: The Principles of Business Finance Part 1

- Module 04: The Principles of Business Finance Part 2

- Module 05: The Balance Sheet

- Module 06: The Income Statement

- Module 07: The Cashflow Statement

- Module 08: A Business Finance Exercise

And many more...

Course 05: Finance and Cash Management

Fundamental and Understanding Concepts

- Introduction and Basis of Projections

- Making future plans and potential revenue-generating activities

- Operational Plans that need to be looked at

- Cost management Practices at hotel and ABC system

- Other Matters before practical exercise

Financial Model and Working on Financial Model

- Room Revenue Budget Template

- F&B Revenue Budgeting Template

- Banquet and Other operating Depts

- Headcount Budget

- Payroll and Other Cost Budgeting

- Other hotel operational Expenses

- Cash Budgeting Excercise

Course 06: Complete Banking and Finance Accounting Statements Financial Analysis

Section 01: Introduction and Welcome to the Course

- Introduction to Financial Statement Analysis

- Why are Financial Statements Important?

Section 02: Introduction to Accounting

- What do we mean by Financial Accounting?

- Accounting Standards and why they are important

- The Concepts and Principles Underlying Accounting

- Single Entry vs Double Entry Book Keeping

- Understanding The Accounting Equation

- The Accounting Cycle

- Financial Statements

Section 03: Introduction to Financial Statements

- Section Introduction – Understanding Financial Statements

- Overview of Financial Statements

- GAAP: Accruals and Cash Accounting

- Income Statement or Profit and Loss Account

- Introduction to the Balance Sheet

And many more...

Section 04: Understanding Working Capital

- What is Working Capital?

- What is the Working Capital Cycle?

- Why is Working Capital Management Important

- Working Capital Analysis

And many more...

Section 05: Introduction to Financial Analysis

- Section Introduction: Strategic Financial Analysis

- What is Financial Analysis?

- Measures of Profitability Financial Analysis

- Balance Sheet Ratio Analysis

- Cash Flow Statement Analysis

- Valuation Ratios

Section 06: Financial Analysis - Case Study and Assignment

- Section Introduction: Financial Analysis – Case Study and Assignment

- Case Study Assignments Apple Inc Financial Analysis

- Apple Inc Financial Analysis – Solution

- Discussion of Measurements of Growth Analysis

- Discussion of Measures of Profitability Analysis

- Discussion of Trading Performance Analysis

- Discussion of Working Capital (Liquidity and Efficiency) Analysis

Section 07: Financial Ratio Analysis in Corporate Finance

- What do we mean by Corporate Finance?

- Financial Ratios in Corporate Finance

- Liquidity Ratios in Corporate Finance

- Operational Risk Ratios in Corporate Finance

- Profitability Ratios in Corporate Finance

- Efficiency Ratios in Corporate Finance

Section 08: Financial Modelling for Mergers and Acquisitions

- Why is Modelling so Critical in Mergers and Acquisitions?

- Three Models You Will Need

- Understanding the Integrated Financial Statements Model

- The Integrated Financial Statements Model Example

And many more...

Section 09: Course Summary and Wrap Up

- Course Summary and Wrap Up

Course 07: Finance and Accounting for Beginners to Intermediate

Module: 01

- Chris Moore – Accounting for Beginners Promo

- Chris Moore – 1. Introduction

- Chris Moore – 2. First Transactions

- Chris Moore – 3. T Accounts introduction

- Chris Moore – 4. T-Accounts conclusion

- Chris Moore – 5. Trial Balance

- Chris Moore – 6. Income Statement

- Chris Moore – 7. Balance Sheet

Module: 02

- Chris Moore – 8. Balance Sheet Variations

- Chris Moore – 9. Accounts in practise

- Chris Moore – 10. Balance Sheets what are they

- Chris Moore – 11. Balance Sheet Level 2

- Chris Moore – 12. Income Statement Introduction

- Chris Moore – 13. Are they Expenses, or Assets

- Chris Moore – 14. Accounting Jargon

Module: 03

- Chris Moore – 15. Accruals Accounting is Fundamental

- Chris Moore – 16. Trial Balance 3 days ago More

- Chris Moore – 17. Fixed Assets and how it is shown in the Income Statement

- Chris Moore – 18. Stock movements and how this affects the financials

- Chris Moore – 19. Accounts Receivable

- Chris Moore – 20. How to calculate the Return on Capital Employed

- Chris Moore – 21. Transfer Pricing – International Rules

Handout - Finance and Accounting for Beginners to Intermediate

- Handout – Finance and Accounting for Beginners to Intermediate

Course 08: Payroll Management

- Module 01: Payroll System in the UK

- Module 02: Payroll Basics

- Module 03: Company Settings

- Module 04: Legislation Settings

- Module 05: Pension Scheme Basics

Course 09: Tax Accounting

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamental of Income Tax

- Module 06: Advanced Income Tax

- Module 07: Payee, Payroll and Wages

- Module 08: Value Added Tax

- Module 09: Corporation Tax

- Module 10: Capital Gain Tax

And many more...

Course 10: Quickbooks Online Bookkeeping

- Getting Prepared - access the software

- Getting started

- Setting up the system

- Nominal ledger

- Customers

- Suppliers

- Sales ledger

- Purchases ledger

- Sundry payments

- Sundry receipts

- Petty cash

- VAT - Value Added Tax

- Bank reconciliation

- Payroll / Wages

- Reports

- Tasks

Course 11: Microsoft Excel from A-Z: Beginner To Expert

- Unit 01: Excel from A-Z Course Introduction

- Unit 02: Getting Started With Excel

- Unit 03: Values, Referencing and Formulas

- Unit 04: Intro to Excel Functions

- Unit 05: Adjusting Excel Worksheets

- Unit 06: Visually Pleasing Cell Formatting

- Unit 07: How to Insert Images and Shapes!

And many more...

Certification

Once you have successfully completed the Be A Financial Accountant course, you will be awarded a PDF certificate for FREE as evidence of your achievement. Hardcopy certificates are £9.99 each, and other PDF certificates are available for just £6 apiece.

Note: Delivery of the hardcopy certificates inside the UK is £4.99 each; international students have to pay a total of £14.99 to get a hardcopy certificate.

Who is this course for?

The Be An Accountant Bundle is primarily for motivated learners looking to add a new skill to their CV and stand head and shoulders above the competition. Anyone of any academic background can enrol on this Be An Accountant. However, this course is preferable for:

- Students

- Finance and Accounting personnel

- Anyone who wants a career in the accounting or accountancy sector.

Requirements

There is no prior requirement or experience needed to enrol in our Be A Financial Accountant. You only need the willingness to learn new skills and eagerness to practise. You can access the course materials at any time with any internet-enabled device and keep developing new skills. So enrol today & do your best! As what you plant now, you will harvest later. Become the person who would attract the results you seek. Grab this opportunity and start learning!

Career path

Successful completion of this Be A Financial Accountant bundle will give you a thorough understanding of accountancy and the ability to pursue a variety of rewarding work prospects, such as —

- Financial Accountant

- Accounting Manager

- Auditor

- Budget Analyst

- Chartered Accountant

- Stockbroker

- Tax Adviser

In the United Kingdom, the typical yearly income for these vocations is between £20,000 - £60,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.