Accounting Diploma Bundle

Earn a splendid world-class qualification in Accounting | Accredited by CPD & iAP | **FREE PDF Certificate**

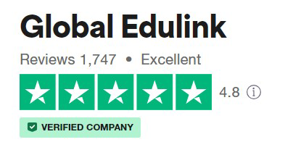

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

- TOTUM card available but not included in price What's this?

Overview

Accounting Diploma Course Bundle

Emerge as a highly sought after individual with the right skills and knowledge to become successful accountant.

This course bundle from Global Edulink could be the perfect opportunity and has been designed so you can get qualified and achieve the career you want, it’s simple.

We have tailor made the course and included everything you will need. Upon completing this course bundle successfully you will have the ability to excel in accounting and will be highly desirable to prospective employers. You are only as good as your CV, so give yourself a huge advantage over your competition.

Why Choose This Course Bundle?

Not only will you be saving money by buying the courses together, the package has been crafted by our expert teachers, so we can assure you it is the perfect stepping stone to a profitable career in accountancy. Don’t just take our word for it, have a look at what the course provides…

- The Diploma in Bookkeeping and Payroll Management is designed to teach you the basic to advanced rules of book-keeping and payroll management, which are essential for an accountancy career.

- The Advance Accounting & Bookkeeping Diploma looks in-depth at the transactions, processes, and controls used to record typical transactions in a business. In addition, candidates will learn management and financial accounting theories and techniques, including bookkeeping techniques.

- The Sage 50 Accounts & Payroll Management will enable you to accurately manage your process invoices, sales, supplier’s details, produce financial reports and manage the VAT records using Sage, which is used by over 400,000 businesses.

- The Diploma in Small Business Accounting provides small business owners, bookkeepers, and management with the information they need to create an effective and reliable accounting and bookkeeping system in their businesses.

- The Business Accounting Diploma will provide you with a good understanding of business accounts, essential knowledge if you run a small business, are considering setting one up or need to learn more about company accounts for your current or future role.

As you can see, once qualified, you will be a master of accounting, with all of the essential skills necessary for a fruitful career in finance. This is an excellent path to choose, as accountants are in high demand at the moment and receive frequent promotions once they have 1 or 2 years of experience.

Once qualified you will have huge earning potential and can go into different areas such as financial, management, auditing, and taxes. It’s a diverse sector with many opportunities, you could work for the government, a private institution, a company, and could eventually establish your own firm.

Studying with Global Edulink has many advantages. The course material is delivered straight to you and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand. Also, a tutor will be on hand to support you through the process.

**PLEASE NOTE: Sage 50 Software is not provided with this package. All learners are required to have purchase software separately and this Course Bundle is Based on USA Standards.

Benefits of studying with Global Edulink

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- 24/7 Access to the Learning Portal.

- Recognised Accredited Qualification

- Excellent customer service and administrative support.

- Learners will be Eligible for TOTUM Discount Card

CPD

Course media

Description

COURSE CURRICULUM

--------- Diploma in Bookkeeping And Payroll Management ----------

Module 01 :

- Introduction to Bookkeeping and Payroll

- Transactions

- Internal Controls and Control Concepts

Module 02 :

- Working With Ledgers

- Reconciliation

- Correcting Entries

Module 03 :

- Sales Tax, Rules and Filing

- Budgeting & Strategic Plan

- Types of Budgets

Module 04 :

- Merchandising Income Statement

- Sales and Purchase Discounts

- Petty Cash

Module 05 :

- Cash Controls – The Bank Reconciliation

- The Payroll Process

- Payroll Process – Earnings Record

Module 06 :

- The Partnership & Corporations

- Accounts Receivable and Bad Debts

Module 07 :

- Preparing Interim Statements

- Year End – Inventory

--------- Advance Accounting & Bookkeeping Diploma ----------

Module 01 : Advanced Accounting

- Type Of Business Ownership

- Accounting Concepts

- Accounting Journals And Ledgers

- Formulas & Equations

- Financial Statements

- Analysing Of Financial Statements

- Inventory Management

- Accounting For Depreciation

- Accounting For Compensation, Taxes & Liabilities

- Closing And Adjusting Entries

- Corporate Accounts

Module 02 : Financial Accounting

- Introduction To Accounting

- What Are Financial Statements In Accounting

- The Accounting Cycles

- Preparing Financial Statements

- Control In Accounting

- Inventory Management In Accounting

- Accounts Receivable

- Operating Cycle In Accounting

- Asset Management Section 02

- Liabilities In Accounting

- Equity In Accounting- Section 2

- Cash Flow Statement Patterns

- Analysing Financial Statements In Accounting

Module 03 : Bookkeeping Training Manual

- Bookkeeping Training Manual

--------- Sage 50 Accounts & Payroll Diploma -----------

Module 01 :

- Introduction To Sage 50

- Using Menu Bar And Common Business Terms

- Creating A Sage 50 Company

- The Payroll Set Up

- Making A Backup

Module 02 :

- Setting Up Security And Creating Users

- Adding And Deleting Accounts

- Adding General Journal Entries

- Entering Account Budgets

- Using Sales Tax

Module 03 :

- Entering Records

- Entering Inventory

- Accounts Receivable – Setting Statement And Invoice

- Accounts Receivable – Quotes

- Accounts Receivable – The Sales Orders

- Accounts Receivable -Credits Memos And The Receive Money

Module 04 :

- Accounts Payable – The Purchase Orders

- Accounts Payable -The Payment Window

- Managing Inventory – Making Inventory Adjustments

- Creating Payroll – Adding Employees

- Creating Payroll – Paying Employees

Module 05 :

- Account Management – Writing Cheques

- Account Management – Reconciling Bank Accounts

- Job Tracking – Setting Up A Job

- Job Tracking – Making A Purchases For Jobs

- Job Tracking – Invoicing For Job Purchases

Module 06 :

- Time And Billing – Entering Activity Items

- Time And Billing – Entering Expense Tickets

- Changing System Settings – Posting Methods

- Changing System Settings – Memorised Transactions

Module 07

- Reporting – The Cash Manager

- Reporting – Find On Report

- Reporting – Modifying Reports

- The Internal Accounts Review

- Action Items – Events And Alerts

- Options – Changing Global Options

Module 08 :

- Assets And Liabilities – Creating Current Assets Account

- Assets And Liabilities – Creating A Fixed Assets Account

- Assets And Liabilities – Liability Accounts

- Using The Index

--------- Diploma In Small Business Accounting ---------

Module 01 : Introduction To Accounting

Module 02 : Financial Statements

Module 03 : Assets And Liabilities

Module 04 : Accounting Transactions

Module 05 : Inventory And Cost Methods

Module 06 : Stakeholders And Equity

Module 07 : Managerial Accounting

Module 08 : Cost Accounting

Module 09 : Costs And Expenses

Module 10 : Budgetary Control

Module 11 : Analysis And Decision Making

--------- Business Accounting Diploma ---------

Bookkeeping And Payroll Management

Module 01 : Introduction To Bookkeeping And Payroll

Module 02 : Transactions

Module 03 : Internal Controls And Control Concepts

Module 04 : Working With Ledgers

Module 05 : Reconciliation

Module 06 : Correcting Entries

Module 07 : Sales Tax, Rules And Filing

Module 08 : Budgeting & Strategic Plan

Module 09 : Types Of Budgets

Module 10 : Merchandising Income Statement

Module 11 : Sales And Purchase Discounts

Module 12 : Petty Cash

Module 13 : Cash Controls – The Bank Reconciliation

Module 14 : The Payroll Process

Module 15 : Payroll Process – Earnings Record

Module 16 : The Partnership & Corporations

Module 17 : Accounts Receivable And Bad Debts

Module 18 : Preparing Interim Statements

Module 19: Year End - Inventory

Business Accounting

Module 01 : Introduction to Bookkeeping

Module 02 : Defining a Business

Module 03 : Ethics and Accounting Principles

Module 04 : Accounting Equation & Transactions

Module 05 : Financial Statements

Module 06 : The Accounting Equation and Transactions

Module 07 : Transactions – Journalizing

Module 08 : Posting Entries and the Trial Balance

Module 09 : Finding Errors Using Horizontal Analysis

Module 10 : The Purpose of the Adjusting Process

Module 11 : Adjusting Entries

Module 12 : Vertical Analysis

Module 13 : Preparing a Worksheet

Module 14 : The Income Statement

Module 15 : Financial Statements- Definitions

Module 16 : Temporary vs. Permanent Accounts

Module 17 : Accounting Cycle

Module 18 : Financial Year

Module 19 : Spreadsheet Exercise

Method of assessment:

At the end of each course included in the package, learners will take an online multiple choice question assessment test. The online multiple choice tests are marked automatically so you will receive your grade instantly.

Certification:

Successful candidates will be awarded the following Diplomas each course separately:

Bookkeeping and Payroll Management, Advance Accounting & Bookkeeping, Sage 50 Accounts & Payroll, Small Business Accounting, and Business Accounting.

Who is this course for?

This course is suitable for candidates who hope to get certified and obtain a career in accountancy in which they can progress to higher levels.

Requirements

- This course requires no formal prerequisites and this certification is open to everyone

Career path

Listed as follows are some of the job roles this course will benefit you in,

- Payroll Administrator – £20,010

- Accounting Clark – £17,475

- Bookkeeper – £20,729

- Account Assistant – £20,341

- Office Administrator – £17,448

- Office Manager - £24,398

- Accounts Payable Clerk – £19,766

- Accounts Receivable Clerk – £20,228

- Payroll Clerk – £18,528

- Staff Accountant – £23,858

Per Annum

Questions and answers

is there a time limit on completing the course?

Answer:Dear Harsimon, Thank you for your query. Please note that the Accounting Diploma Course Bundle course is an online, self-paced course learners have the access to course materials over a 12 month period so learners can decide on how fast or slow the course should be completed within the 12-month access period. Regards, Student Support Team

This was helpful.will the diploma be recognised by ofqual?

Answer:Dear Harsimon, Thank you for your query. Please note that the Accounting Diploma Course Bundle course is a CPD course yielding 16 CPD points upon successful completion. This is a stand-alone qualification which is certified by CPD only. Regards, Student Support Team

This was helpful.Do i get a certificate after completion, if yes what kind of certificate do i get (awarding body)?

Answer:Successful candidates will be awarded the following Diplomas each course separately: Bookkeeping and Payroll Management, Advance Accounting & Bookkeeping, Sage 50 Accounts & Payroll, Small Business Accounting, and Business Accounting.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.