Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax

25-in-1 Career Bundle | CPD Accredited | Free 25 PDF Certificate, Transcript, Student ID & Exam | Lifetime Access

Apex Learning

Summary

- Certificate of completion - Free

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Accounting and Finance is the language of business. It is essential for understanding how businesses operate and make decisions. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course will teach you the fundamentals of accounting and finance, including financial statements, budgeting, financial markets, and risk management. You will also learn how to use popular accounting software such as Xero, Sage 50, Quickbooks, and Payroll & Vat-Tax.

Learning Outcomes of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle:

- Understand the basic concepts of accounting and finance.

- Apply accounting principles to record and analyze financial transactions.

- Prepare financial statements, such as balance sheets and income statements.

- Analyze financial statements to assess the financial health of a business.

- Develop budgets and manage financial resources.

- Understand the financial markets and how to invest money.

- Manage financial risk.

- Audit financial statements.

This 20-in-1 Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle consists of the following Courses:

- Course 01: Accounting and Finance Diploma

- Course 02: Applied Accounting

- Course 03: Managerial Accounting Masterclass

- Course 04: Changes in Accounting: Latest Trends Encountered by CFOs in 2022

- Course 05: Level 3 Tax Accounting

- Course 06: Introduction to VAT

- Course 07: Level 3 Xero Training

- Course 08: QuickBooks Online Bookkeeping Diploma

- Course 09: Diploma in Sage 50 Accounts

- Course 10: Cost Control Process and Management

- Course 11: Learn to Read, Analyse and Understand Annual Reports

- Course 12: Financial Statements Fraud Detection Training

- Course 13: Finance Principles

- Course 14: Financial Management

- Course 15: Financial Modelling Course – Learn Online

- Course 16: Improve your Financial Intelligence

- Course 17: Financial Analysis

- Course 18: Banking and Finance Accounting Statements Financial Analysis

- Course 19: Financial Ratio Analysis for Business Decisions

- Course 20: Budgeting and Forecasting

Additionally, you will get 5 other career-guided courses in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle:

- Course 01: Career Development Plan Fundamentals

- Course 02: CV Writing and Job Searching

- Course 03: Interview Skills: Ace the Interview

- Course 04: Video Job Interview for Job Seekers

- Course 05: How to Create a Professional LinkedIn Profile

So, stop scrolling down and procure the skills and aptitude with Apex Learning to outshine all your peers by enrolling in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle.

CPD

Course media

Description

This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course is designed to provide you with a comprehensive understanding of accounting and finance, including the latest accounting software. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course covers a wide range of topics, from the basic concepts of accounting to the more advanced topics of financial statement analysis and financial risk management.

The Course curriculum of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle:

Course 01: Accounting and Finance Diploma

Module: 01

- Accounting

- Introduction

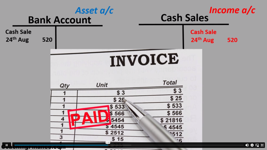

- First Transactions

- T Accounts introduction

- T-Accounts conclusion

- Trial Balance

- Income Statement

- Balance Sheet

Module: 02

- Balance Sheet Variations

- Accounts in practise

- Balance Sheets what are they

- Balance Sheet Level 2

- Income Statement Introduction

- Are they Expenses, or Assets

- Accounting Jargon

Module: 03

- Accruals Accounting is Fundamental

- Trial Balance 3 days ago More

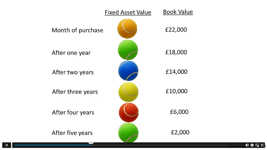

- Fixed Assets and how it is shown in the Income Statement

- Stock movements and how this affects the financials

- Accounts Receivable

- How to calculate the Return on Capital Employed

- Transfer Pricing – International Rules

= = = > > > and 24 more courses = = = > > >

Certification of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle:

- PDF Certificate: Free for all 25 courses

- Hard Copy Certificate: Free (For The Title Course: Previously it was £10)

Enrol in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course today and take your career to the next level!

Who is this course for?

This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course is perfect for anyone who wants to learn about accounting and finance, or who wants to improve their skills in these areas. It is also a great choice for anyone who wants to learn how to use Xero, Sage 50, Quickbooks, Payroll & Vat-Tax.

Requirements

This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course has been designed to be fully compatible with tablets and smartphones.

Career path

Become a skilled Accountant with our Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax Training and explore your opportunities in sectors such as:

- Accountant: £25,000 - £50,000

- Financial analyst: £30,000 - £60,000

- Investment banker: £40,000 - £100,000

- Chartered accountant: £50,000 - £120,000

- Financial controller: £60,000 - £150,000

- Chief financial officer: £100,000 - £200,000

Questions and answers

when does the course start? or the lessons are already available?

Answer:Dear Olena, Thanks for your query. There's no specific date to start the course. It's an online self-paced course. You can do the course at your own convenient time.

This was helpful.tell me please how the classes are going? is it online at the specified time or is it video lessons at any available time?

Answer:Dear Olena, Thanks for your query. It's an online self-paced course. You can do the course at your own convenient time.

This was helpful.I am really interested in this course, I would like to know if there is any discount on enrolling in this course?

Answer:Dear Brenda, Thanks for your query. This is a bundle of 25 courses, and it is already discounted at £119 inc VAT. You will get free PDF certificates and transcripts for all the courses included.

This was helpful.

Certificates

Certificate of completion

Digital certificate - Included

Certificate of completion

Hard copy certificate - Included

You will get the Hard Copy certificate for the title course (Accounting and Finance) absolutely Free! Other Hard Copy certificates are available for £10 each.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.