Sage Business Training: Accounting and Bookkeeping using Sage 50

Accounting and Bookkeeping using Xero and Sage with an Financial Expert | PDF Certificate

Course Central

Summary

- Certificate of completion - Free

- Tutor is available to students

Add to basket or enquire

Overview

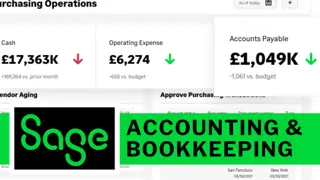

To track your business transactions and have a sound understanding of your business health, you need to know the fundamentals of Accounting, bookkeeping and popular software like Sage to keep all data digitally structured. This Course Offers all the above over three courses for any business of any size.

This Accountancy 2 courses bundle consists of the following courses:

- Course 1: 60 Minutes to Fundamental Accounting Skills

- Course 2: Sage Training

The Accountancy 2 courses bundle starts with the basic knowledge of accessing, accounting and bookkeeping, sage, and gradually shares expertise knowledge. Upon course completion, you will get a complete idea of this subject, wcritical key concepts, strategies regarding its use and in-depth knowledge. Thisultimatelytely an online co,urse so you can access this Course from any part of the world with a smart device and the internet.

By the end of this Course, you will get complete knowledge and marketable skills. The Course also comes with a certificate, adding extra value to your resume and helping you stand out in the job market. Enrol on this Course today and fast-track your career!

What you will learn from the Accountancy bundle course?

- Enter the opening balances

- Add new customer and supplier details

- Post supplier invoices and credit notes to the purchase ledger

- Post-Petty Cash transactions

- Reconcile the bank

- Post adjustments to the accounts and produce month-end reports

- In this course, you will learn how to:

- Amend the nominal ledger

- Post customer invoices and credit notes to the sales ledger

- Enter the supplier cheques and record the customer receipts

- Prepare the VAT return

- Post the wages journal

- Describe and recognize the accounting underlying financial statements.

- Prepare journal entries for common business transactions.

- Prepare the income statement, the statement of changes in equity, and the balance sheet.

- Analyze business transactions to determine which are reportable, and of those, which are on account of income and which are on account of capital.

- Post entries to create a general ledger and a trial balance using a spreadsheet.

Why Choose this course?

- The course is developed and delivered by an Industry expert

- Get Instant E-certificate

- Entirely online

- Self-paced learning and laptop, tablet, and smartphone-friendly

And you will also get the following:

Free PDF Certificate

12 Months Course Access

Description

Course Curriculum

*** Course 1: 60 Minutes to Fundamental Accounting Skills ***

- Introduction

- Debits And Credits

- Preparing Journal Entries

- Posting Entries

- Preparing Financial Statements

- Supporting Materials

*** Course 2: Sage Training ***

- Getting Prepared - Access the software and course materials

- Getting Started

- Setting Up The System

- Nominal Ledger

- Customers

- Suppliers

- Sales Ledger

- Purchases Ledger

- Sundry Payments

- Sundry Receipts

- Petty Cash

- VAT - Value Added Tax

- Bank Reconciliation

- Payroll / Wages

- Reports

- Conclusion

Certificates

Course Central is proud to offer a Certificate of Completion to all who complete courses successfully. Course Central tracks the learner’s course progress. However, the learner is responsible for validating the completion and understanding of the course. All Certificates of Completion can be validated from the Course Central website using the validation code.

Transcripts

A Transcript for the course with completed module details can be requested from the Course Central website. Please note that all course Certificates and Transcripts will be titled as published on the Course Central platform.

Who is this course for?

This course is ideal for those who work in or aspire to work in the following professions:

- Bookkeepers and Accountants who need to increase their skills set

- Students who are going for jobs where the requirement is working knowledge of Sage Accounts

- Those who have studied accounting but want practical knowledge of how to use popular accounting software which will help them find employment

- Previous knowledge of accounting is not presumed or required.

Requirements

Existing qualification level: No specific previous qualification is required. However, a basic understanding of accounts and English would benefit understanding the content.

Existing skill levels: Minimum ICT skills to operate any computer system is beneficial. No skill in working with Accounting is essential.

Technical requirements: Access to any computer or laptop would benefit from practising and following the instructions.

Career path

Sage will benefit a range of roles for anyone but would particularly enhance careers in a bookkeeper, data entry specialist, accounts assistant, financial accountant, senior accounting specialist, accounting manager, finance officer, payroll officer, finance administrator, and not limited to this.

The salary expectation can grow from £20,000 per annum to £40,000 per annum.

Questions and answers

Is it a mock exam or if not what final exam it is?

Answer:The multiple-choice exams are done at the end of the course, and it assesses the relevant skills required for the job role. Passing the end of the course exam allows you to have an accredited certificate in the relevant area. Any qualified accountant needs to complete a minimum of 35+ hours compulsory CPD each year (of which at least 21 hours must be structured CPD) - this depends on the organisation you are working for. There are no mock exams as this is not a CII exam.

This was helpful.

Certificates

Certificate of completion

Digital certificate - Included

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.