Sage 50 Payroll 2017 Training + Microsoft Excel Diploma Level 3 (21 units+3.6 review sage)

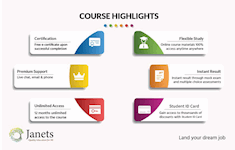

CPD Approved Training II Instant Access II Flexible Study II Free e-certificate included

Janets

Summary

- Certificate of completion - Free

Overview

Improve your skills in Sage 50 Payroll and Microsoft Excel Diploma at the same time with two most popular courses for the price of one.

Sage 50 Payroll includes everything you need to process a payroll. In this Sage 50 Payroll 2017 Training course, you will master the features and functions of using the program confidently to process your payroll. You will learn how to save time and reduce the risk of payroll tax penalties at year-end. The course teaches you to create multiple pay rates on-the-fly, create custom taxable and non-taxable benefits, and prepare payroll cheques or issue, and more.

It is impossible to find an office that does not use Microsoft Excel- the world’s leading spreadsheet program. Throughout the Microsoft Excel Diploma Level 3 course, you will learn calculation, graphing tools, pivot tables usage and more. Other topics covered in the course are creating a basic worksheet, identifying elements and user interface in Excel, creating formulas, inserting functions, manipulating data, delete cells, search and replace data, modify fonts, add borders and colours, align cell contents and many more.

The award winning Sage 50 Payroll 2017 Training and Microsoft Excel Diploma Level 3 are our most popular online courses for anyone looking to start a career or gain skills in relevant industry. The Sage 50 Payroll 2017 Training and Microsoft Excel Diploma Level 3 are taught entirely online by expert instructors. Modules are delivered through accessible, informative video lessons, online study materials, practical exercises, mock exams and multiple-choice assessments.

More key features of the courses:

- Earn free e-certificates upon successful completion of each course.

- Accessible, informative modules taught by expert instructors

- Study in your own time, at your own pace, through your computer tablet or mobile device

- Benefit from instant feedback through mock exams and multiple-choice assessments

- Get 24/7 help or advice from our email and live chat teams

Course media

Description

Course Curriculum

Sage 50 Payroll for Beginners

Module 1: Payroll Basics – Setting up payroll, tax codes, month end reports, keeping records, licence limitations and links to an accounts program

Module 2: Company Settings – Details, bank & coinage, absence, analysis, tax funding, statutory funding, HMRC payments, documents

Module 3: Legislation Settings – Legislation setting dialog box, PAYE, NI bands & rates, SSP, SMP/SAP/SPP/ShPP, car details, student, AEO rates, minimum wage, childcare, automatic enrolment

Module 4: Pension Scheme Basics – Pensions schemes dialog box, setting up pension scheme, pensions regulator website and the sage 50 payroll pensions module

Module 5: Pay Elements – Pay elements settings dialog box, managing payment and deduction types, loans, net payments, salary sacrifice

Module 6: The Processing Date – Changing the processing date

Module 7: Adding Existing Employees – Using quick employee, adding multiple employees, changing their status, updating year-to-date values

Module 8: Adding New Employees –Adding new employees in a variety of ways

Module 9: Payroll Processing Basics – Payroll process view, change processing dates

Module 10: Entering Payments – Entering payment window, checking and editing payments

Module 11: Pre-Update Reports – Employer costs report, payslips, BACS payments reports, figures for accounts

Module 12: Updating Records – Updating records, period end P32 report

Module 13: e-Submissions Basics – e-submissions settings, EAS, FPS, EPS

Module 14: Process Payroll (November) – Entering payments, pre-update reports, updating records, P32 reports, full payment submission

Module 15: Employee Records and Reports – Using employee record window, tabs and to find employee and their reports

Module 16: Editing Employee Records – Editing different records for employees, creating new factored pay elements, applying pay elements to employees

Module 17: Process Payroll (December) – Processing the payroll, entering payments, pre-update reports, updating records, P32 report and Full payment submission

Module 18: Resetting Payments – Introduction to reset payments wizard

Module 19: Quick SSP – Processing the payroll with SSP, entering payments, pre-update reports, updating records, P32 report and full payment submission

Module 20: An Employee Leaves – Entering payments, updating records, lever wizard, P32 report, full payment submission, rejoining employees

Module 21: Final Payroll Run – Entering payments, pre-update reports, updating records, P32 report, full payment submissions

Module 22: Reports and Historical Data – Reports window, employee, company, legislation and historical reports, historical data settings, printing historical payslips and history report by employee

Module 23: Year-End Procedures – Year end tasks, payroll year end wizard, post year-end tasks

Sage 50 Payroll Intermediate Level

Module 1: The Outline View and Criteria – View by department and payment method, payment period and payment method, and resetting criteria

Module 2: Global Changes – See the affects of global changes to pay period and pay method, tax codes, and pay rates

Module 3: Timesheets – Using and resetting timesheets, processing payroll and changing process dates

Module 4: Departments and Analysis – Focus on managing new and old departments and their employees, analysis in different platforms

Module 5: Holiday Schemes – Reviewing holiday schemes, adding new ones, arranging national holidays and managing employee holiday schemes

Module 6: Recording Holidays – Recoding holidays, removing absence days, checking holiday records, holiday scheme reports

Module 7: Absence Reasons – Customize absence reasons, recording absence, different examples, reducing pay for unauthorised absence and absence reports

Module 8: Statutory Sick Pay – Working with patterns and absence year, SSP qualifications, rates, reports, and utilizing quick SSP dialog box

Module 9: Statutory Maternity Pay – SMP rates, payment, managing maternity details, processing payroll, other parental leave, changing the processing date and more

Module 10: Student Loans – Setting up and processing student loan repayments for employees

Module 11: Company Cars – Adding new cars, keeping track of business trips, processing payroll, car reports and taxation

Module 12: Workplace Pensions – Payroll pension module, automatic enrolment, reviewing pension scheme details, reports and more

Module 13: Holiday Funds – Managing holiday fund payments, processing payroll, paying out from the holiday fund, holiday fund reports and more

Module 14: Roll Back – Mistakes and payroll processing, roll back the payroll for selected employees, correcting mistakes and processing required change

Module 15: Passwords and Access Rights –Setting up passwords, new users, testing admin profile, changing personal password, deleting user accounts

Module 16: Options and Links – Contacts, program options, WebLinks

Module 17: Linking Payroll to Accounts – Nominal link setting dialog box, linking data

**Microsoft Excel 2016 Beginner**

- Identify the Elements of the Excel Interface

- Activity – Identify the Elements of the Excel Interface

- Create a Basic Worksheet

- Activity – Create a Basic Worksheet

- Use the Help System

- Activity – Use the Help System

- Create Formulas in a Worksheet

- Activity – Create Formulas in a Worksheet

- Insert Functions in a Worksheet

- Activity – Insert Functions in a Worksheet

- Reuse Formulas

- Activity – Reuse Formulas

- And much more....

**Microsoft Excel 2016 Intermediate**

- Apply Range Names

- Use Specialized Functions

- Use Text Functions

- Use Logical Functions

- Use Lookup Functions

- Use Date Functions

- Use Financial Functions

- And much more.....

**Microsoft Excel 2016 Advanced**

- Update Workbook Properties

- Activity-Update Workbook Properties

- Create and Edit a Macro

- Activity-Create and Edit a Macro

- Apply Conditional Formatting

- Activity-Apply Conditional Formatting

- Add Data Validation Criteria

- Activity-Add Data Validation Criteriaty

- Trace Cells

- Activity-Trace Cells

- Troubleshoot Invalid Data and Formula Errors

- Activity-Troubleshoot Invalid Data and Formula Errors

- Watch and Evaluate Formulas

- Activity-Watch and Evaluate Formulas

- Create a Data List Outline

- Activity-Create a Data List Outline

- And much more.....

**Microsoft Excel 2016 VBA**

- Create a Macro Using the Macro Recorder

- Edit a Macro

- Debug a Macro

- Customize the Quick Access Toolbar and Hotkeys

- And much more....

**Microsoft Excel 2016 PowerPivot**

- Enable and Navigate

- Import Data from Various Data Sources

- Refresh Data from a Data Source

- Create Linked Tables

- Organize and Format Tables

- And much more....

Certification

Upon successful completion of the course, you can instantly download your e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99.

Questions and answers

Hi Please can you confirm the duration of this course and access. Thank you

Answer:Dear Jane, Thank you for contacting us. The estimated course duration is 21 hours of continuous study for the 'Sage 50 Payroll 2017 Training' course, and the expected course duration is 61 hours of constant study for the 'Microsoft Excel Diploma Level 3' course. However, you will get one year access to the courses after purchasing, and you can complete it anytime within a year. Thanks

This was helpful.

Certificates

Certificate of completion

Digital certificate - Included

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.