Payroll: Payroll

New Year Sale : [4 more courses as GIFT + 5 FREE PDF & Hard Copy Certificate] | CPD Accredited | Lifetime Access

Course Cloud

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Overview

♧♧ Excel your career by enhancing Payroll: Payroll skills with Course Cloud and get noticed by recruiters in this Hiring season! ♧♧

New Year Warm Up GIFTS from Course Cloud - We are offering 4 more courses including Quickbooks Bookkeeping, Leadership Skills, Hacks for Working from Home, and Time Management as Winter Warm Up GIFTS with this Payroll : Payroll course.

This payroll course will cover payroll topics, including payroll legislation, payroll calculations, and entering payroll journal entries. Because Payroll is becoming more complex and more of a specialised field, it isn't easy to find content that puts it all together in one spot like this course does.

So if you are aiming to become a Payroll Manager, Payroll Supervisor, or Payroll Administrator, this Payroll online course will help you learn everything you need to know as a Payroll professional in the UK.

The Payroll course provides you with the necessary skills to record financial payroll transactions in manual and computerised environments. This course is beneficial for those who want to work as a payroll administrator or expand their current knowledge and business owners who wish to set up their Payroll.

Paying is not just an upfront bank transfer anymore, especially in larger companies. Several processes are involved to ensure that every employee is paying the correct sum towards taxes, pensions, and national insurance. The Payroll course clarifies how PAYE, NI, and other statutory additions and deductions are calculated.

Our Payroll course's quality is guaranteed. And after completing the course, you will be awarded a certificate of completion for free!

Enrol today, and create new job opportunities, regardless of whether you intend to learn skills and techniques for professional or personal use.

What Will You Learn From This Payroll Course?

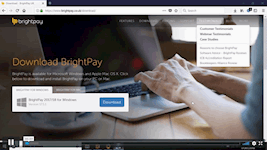

- Learn to complete various standard functions using free online UK payroll software.

- Learn how to process new starters and leavers.

- Know about the tax coding notifications and what different tax codes means.

- Learn to process monthly payments and understand how pensions are applied.

- Know how to process deductions, e.g. taxes, student loan repayments.

- Know how to process attachments of earnings (AOE) such as court fines repayments.

- Know the payroll journals and relevant accounts to debit and credit.

- Learn how to pay the HMRC and other relevant authorities and agencies.

- Learn how to perform Year-end processing.

- Learn how to register as an employer in the UK.

What you get from enrolling in this Payroll Course:

- Free PDF certificate & Hardcopy Certificates upon successful completion of the Payroll course

- Lifetime access to Payroll course materials

- Instant assessment results with Payroll course

- Full tutor support is available from Monday to Friday with the Payroll course

- Learn Payroll skills at your own pace from the comfort of your home

- Gain a complete understanding of Payroll

- Accessible, informative video modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Payroll course

- Study Payroll in your own time through your computer, tablet or mobile device.

- Improve your chance of gaining professional skills and better earning potential by completing the Payroll course

4 Additional Free Courses to Advance Your Skills

- Course 01: Quickbooks Bookkeeping

- Course 02: Leadership Skills

- Course 03: Hacks for Working from Home

- Course 04: Time Management

Supplementary Gifts:

- Free 5 Hardcopy Certificate

- Free 5 PDF Certificate

- Lifetime Access to Payroll : Payroll course materials from anywhere

CPD

Course media

Description

The Course Curriculum of the Payroll Bundle

Course module of Sage 50 Payroll for Beginners :

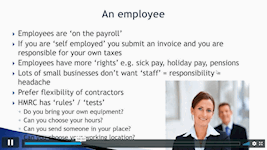

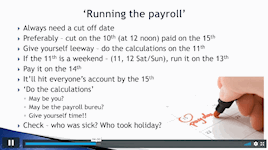

- Payroll - Payroll: UK Payroll 01: Payroll Basics

- Payroll - Payroll: UK Payroll 02: Company Settings

- Payroll - Payroll: UK Payroll 03: Legislation Settings

- Payroll - Payroll: UK Payroll 04: Pension Scheme Basics

- Payroll - Payroll: UK Payroll 05: Pay Elements

- Payroll - Payroll: UK Payroll 06: The Processing Date

- Payroll - Payroll: UK Payroll 07: Adding Existing Employees

- Payroll - Payroll: UK Payroll 08: Adding New Employees

- Payroll - Payroll: UK Payroll 09: Payroll Processing Basics

- Payroll - Payroll: UK Payroll 10: Entering Payments

- Payroll - Payroll: UK Payroll 11: Pre-Update Reports

- Payroll - Payroll: UK Payroll 12: Updating Records

- Payroll - Payroll: UK Payroll 13: e-Submissions Basics

- Payroll - Payroll: UK Payroll 14: Process Payroll (November)

- Payroll - Payroll: UK Payroll 15: Employee Records and Reports

- Payroll - Payroll: UK Payroll 16: Editing Employee Records

- Payroll - Payroll: UK Payroll 17: Process Payroll (December)

- Payroll - Payroll: UK Payroll 18: Resetting Payments

- Payroll - Payroll: UK Payroll 19: Quick SSP

- Payroll - Payroll: UK Payroll 20: An Employee Leaves

- Payroll - Payroll: UK Payroll 21: Final Payroll Run

- Payroll - Payroll: UK Payroll 22: Reports and Historical Data

- Payroll - Payroll: UK Payroll 23: Year-End Procedures

***Gift Courses***

Payroll: UK Payroll Course 01: Quickbooks Online Bookkeeping

- Payroll - Payroll: UK Payroll - Getting Prepared - access the software

- Payroll - Payroll: UK Payroll - Getting started

- Payroll - Payroll: UK Payroll - Setting up the system

- Payroll - Payroll: UK Payroll - Nominal ledger

- Payroll - Payroll: UK Payroll - Customers

- Payroll - Payroll: UK Payroll - Suppliers

- Payroll - Payroll: UK Payroll - Sales ledger

- Payroll - Payroll: UK Payroll - Purchases ledger

- Payroll - Payroll: UK Payroll - Sundry payments

- Payroll - Payroll: UK Payroll - Sundry receipts

- Payroll - Payroll: UK Payroll - Petty cash

- Payroll - Payroll: UK Payroll - VAT - Value Added Tax

- Payroll - Payroll: UK Payroll - Bank reconciliation

- Payroll - Payroll: UK Payroll - Payroll / Wages

- Payroll - Payroll: UK Payroll : UK Payroll - Reports

- Payroll - Payroll: UK Payroll - Tasks

Payroll: UK Payroll Course 02: Leadership Skills

- Payroll - Payroll: UK Payroll : Introduction to the Course

- Payroll - Payroll: UK Payroll : The Principles of Good Leadership

- Payroll - Payroll: UK Payroll : The Six Styles of Leadership

- Payroll - Payroll: UK Payroll : The Underpinning Skills and Behaviours of the Leadership Styles

- Payroll - Payroll: UK Payroll : Increasing and Toning Down the Use of Each Leadership Style

- Payroll - Payroll: UK Payroll : Working with Leadership Styles - Course Review and Leadership Case Studies

Payroll: UK Payroll Course 03: Hacks for Working from Home

- Payroll - Payroll: UK Payroll 01: Introduction

- Payroll - Payroll: UK Payroll 02: 11 Productivity Hacks

Payroll: UK Payroll Course 04: Basic Time Management

- Payroll - Payroll: UK Payroll : Unit 01: Introduction

- Payroll - Payroll: UK Payroll : Unit 02: Specific Time Management Techniques

- Payroll - Payroll: UK Payroll : Unit 03: Conclusion

Certification

Once you have successfully completed the Payroll : Payroll Bundle, you will be awarded 5 Hardcopy Certificates and 5 PDF certificates for FREE as evidence of your achievement.

Note: Delivery of the hardcopy certificates inside the UK is £4.99 each; international students have to pay a total of £14.99 to get a hardcopy certificate.

Who is this course for?

The Payroll : Payroll Bundle is primarily for motivated learners looking to add a new skill to their CV and stand head and shoulders above the competition. Anyone of any academic background can enrol on this Payroll : Payroll bundle. However, this Payroll : Payroll bundle is preferable for:

- Bookkeepers and Accountants to get a better understanding of the UK payroll system.

- Students who are going for jobs.

- Accounting students who want practical knowledge of payroll.

Student's Testimonials on Our Payroll Bundle

Madison Doherty

"Well detailed course modules. Easy to understand. Got everything covered."

Sarah Pratt

"Fantastic, easy to follow. Great content, exactly what I was looking for."

Skye Howell

"What a good teacher! her speech just made the course more interesting. The lecture is also linked to resources. So there's no need to worry about the whole course being undetermined. Yeah, well done!"

Requirements

- Previous knowledge of accounting or payroll is not presumed or required.

- Only an internet-enabled device and a strong will to learn is required to excel in Payroll.

Career path

Anyone with an interest in Payroll will find our comprehensive course beneficial. Master the necessary skills to take a step closer to success with our Payroll bundle. Enhance your skills and explore opportunities such as —

- Accountant & Office Manager (£30K - £35K Per Annum)

- Payroll Manager (£35K - £50K Per Annum)

- Bookkeeper / Management Accountant (£45K - £50K Per Annum)

And many more!

Questions and answers

Are you able to sit mock exams for this course (and if so, how many can you sit). Also, if you fail the final exam, is there a cost to re-sit?

Answer:Good afternoon. You can take the mock exam three times and the final exam one. If you fail your final exam at the first attempt, you can retake the exam at an additional cost.

This was helpful.Can the MCQ assessment be taken online?

Answer:Hello Hayley, Yes, the whole exam will be conducted online. Thanks

This was helpful.

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.