Value Added Tax (VAT) Fundamentals

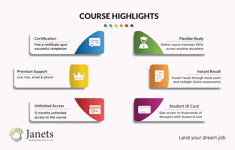

CPD Certified Diploma | FREE Exam | 24/7 Tutor Support | Lifetime Access | 100% Success Rate

Janets

Summary

- Certificate of completion - £9.99

- Certificate of completion - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Did you know that in the UK, Value Added Tax (VAT) is the third-largest source of government revenue, after income tax and national insurance? In fact, according to recent statistics, the government collected £132 billion in VAT in 2020 alone. With such a significant contribution to the economy, it's no wonder that VAT compliance is essential for businesses of all sizes.

Whether you're a business owner, accountant, or simply interested in the world of finance, our VAT Fundamentals course is the perfect way to gain a comprehensive understanding of this complex tax.

Learning outcomes

- Understand the basics of VAT and its application in goods, services, and vehicles

- Learn the terminology and calculation methods, including rates and taxable persons

- Know the registration process and requirements

- Understand the importance of invoicing and record-keeping in VAT compliance

- Become familiar with the VAT return and tips for staying compliant

- Understand VAT exemptions and zero-rated VAT

- Gain knowledge of miscellaneous issues and penalties, and learn about Making Tax Digital

CPD

Course media

Description

If you're a business owner, accountant, or anyone looking to gain a comprehensive understanding of Value Added Tax (VAT), our VAT Fundamentals course is perfect for you. This course is designed to provide you with an understanding of VAT, covering all aspects of the tax, from basic principles to more complex issues such as exemptions, zero-rated VAT, and penalties.

Our course consists of 13 modules, each focusing on a specific aspect. You'll begin by learning the basics of VAT and its application in goods, services, and vehicles. From there, you'll delve into the terminology and calculation methods of VAT, including rates and taxable persons. You'll also learn about the registration process, invoicing and record-keeping requirements, and tips for staying compliant with regulations. In addition, you'll gain knowledge about exemptions, zero-rated VAT, and miscellaneous issues and penalties, and discover the benefits of Making Tax Digital.

By the end of this course, you'll have a thorough understanding of VAT and the skills needed to comply with regulations, helping you to manage your business more effectively. So why wait? Join our course today!

Course Curriculum:

Essentials of UK VAT

- Module 1: Understanding VAT

- Module 2: VAT Terminology and Calculation

- Module 3: VAT Taxable Persons

- Module 4: VAT Registration

- Module 5: VAT Rates

- Module 6: Invoicing and Records

- Module 7: VAT Application in Goods, Services and Vehicles

- Module 8: Supply

- Module 9: The VAT Return

- Module 10: Tips on VAT Compliance

- Module 11: VAT Exemptions and Zero-Rated VAT

- Module 12: Miscellaneous VAT Issues and Penalties

- Module 13: Making Tax Digital

Who is this course for?

This course is particularly useful for:

- Business owners who need to manage compliance

- Accountants who want to enhance their knowledge of VAT

- Anyone who wants to gain an understanding of VAT

- Individuals who are planning to start their own business

Career path

- VAT Administrator - £18,000 - £25,000 per year

- VAT Assistant - £22,000 - £28,000 per year

- VAT Analyst - £28,000 - £40,000 per year

- Manager - £40,000 - £70,000 per year

- Consultant - £45,000 - £90,000 per year

- VAT Director - £80,000+ per year (depending on company size and experience)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - £9.99

Receive a digital copy of your certificate as a PDF file for only £9.99.

Certificate of completion

Hard copy certificate - £15.99

A Physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.