Understanding the PAYE System Certificate - CPD Certified

Student Discount Card Eligible | Lifetime Access | Online certified training |Online certificate and exam included

Be-a.co.uk

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

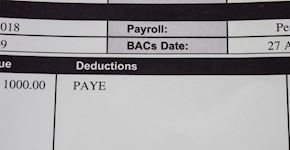

Understanding the PAYE System Certificate

All workers and employers in the UK, including the self-employed, are part of the PAYE system. Introduced in 1944 by HMRC, it is designed to make the process of paying tax, National Insurance, and other deductions much simpler.

In this course, you will learn about how the PAYE system works, how tax codes ensure employers deduct the correct amount of tax from their employees’ pay, how self-employed people pay taxes, and the importance of using appropriate software to submit payment submissions.

** When purchasing this course you will be eligible to apply for the XO Student Discount Card!! You can save on brands such as New Look, Disney, ASOS, Hotels, Miss Selfridge , Domino’s and many more.**

CPD

Course media

Description

You Will Learn:

- How the UK PAYE system works

- How tax codes work, and what the various tax codes mean

- How and when you need to send information to HMRC

- How to choose the best software to use to help manage your payroll

- How self-employed people navigate the PAYE system

Benefits of Taking This Course:

- If you are responsible for overseeing the payroll at work, this course will help you navigate the PAYE system

- If you are self-employed, this course will help you ensure that you meet your obligations under the law with regards to paying tax and National Insurance

- - If you are choosing a new piece of payroll software for your company, this course will give you valuable guidance

- - If you are an employee, this course will help you make sure that your tax code is correct

Course Modules/Lessons

- Module 01: Introduction to PAYE

- Module 02: What are Tax Codes and why are They Important

- Module 03: PAYE Software and HMRC

- Module 04: How Does the PAYE System Differ to the System in Place for Self-employed People?

Who is this course for?

There is no experience or previous qualifications required for enrolment on this course. It is available to all students, of all academic backgrounds.

Requirements

Our Course is fully compatible with PC’s, Mac’s, Laptop, Tablet and Smartphone devices. Now more than ever people are using the internet while on the move so our course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G.

There is no time limit for completing this course, it can be studied in your own time at your own pace.

All tests are online and are taken either during or after the course, these are included in the price.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.