UK VAT & Tax Accounting Diploma

Summer Flash Deal | 14 in 1 Exclusive Bundle| 140 CPD Points|Gifts: Hardcopy + PDF Certificate - Worth £160

Apex Learning

Summary

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

***Don't Spend More; Spend Smart***

The UK VAT & Tax Accounting Diploma course provides students with the scientific information they need to understand and apply VAT, tax accounting, and bookkeeping in the UK. The course covers a wide range of topics, from the basics of VAT to more advanced topics such as VAT registration, invoicing, and records. Students will also learn about the different types of VAT rates and how to apply them to different goods and services.

Learning Outcomes:

- Understand the basics of VAT, including its purpose, rates, and exemptions.

- Calculate VAT on goods and services.

- Identify VAT-taxable persons and register for VAT.

- Maintain accurate VAT records.

- Apply VAT to goods, services, and vehicles.

- Prepare VAT returns and make payments to HMRC.

This UK VAT & Tax Accounting Diploma Bundle Consists of the following Premium courses:

- Course 01: Essentials of UK VAT

- Course 02: Level 3 Tax Accounting

- Course 03: Level 3 Xero Training

- Course 04: Diploma in Accounting and Bookkeeping

- Course 05: Commercial Law 2021

- Course 06: Applied Economics

- Course 07: Professional Personal Finance Course

- Course 08: Basic Business Finance

- Course 09: Business Analysis Level 3

- Course 10: Financial Investigator

- Course 11: Fraud Management & Anti Money Laundering Awareness Complete Diploma

- Course 12: Information Management

- Course 13: GDPR Data Protection Level 5

- Course 14: Risk Management

If you are interested in learning more about VAT, tax accounting, and bookkeeping, then this UK VAT & Tax Accounting bundle course is perfect for you. Enroll today and start your journey to a successful career in accounting!

Certificates

Certificate of completion

Digital certificate - Included

CPD

Course media

Description

This UK VAT & Tax Accounting Diploma bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your VAT & TAX expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes.

Course Curriculum :

Course 01: Introduction to VAT

- Module 01: Understanding VAT

- Module 02: Terminology and Calculation

- Module 03: Taxable Persons

- Module 04: Registration

- Module 05: Rates

- Module 06: Invoicing and Records

- Module 07: VAT Application in Goods, Services and Vehicles

- Module 08: Supply

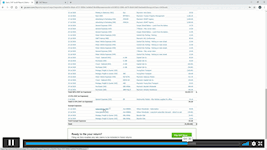

- Module 09: The VAT Return

- Module 10: Tips on VAT Compliance

- Module 11: Exemptions and Zero-Rated VAT

- Module 12: Miscellaneous

- Module 13: Making Tax Digital

and 13 more courses...

Certification:

- PDF Certificate: Free (Previously it was £6*11 = £66)

- Hard Copy Certificate: Free (For The Title Course: Previously it was £10)

Who is this course for?

The UK VAT & Tax Accounting Diploma is perfect for:

- Business owners who want to understand and apply VAT correctly

- Employees who work in accounting or finance and need to know about VAT

- Students who want to pursue a career in accounting or finance

- Anyone who wants to learn about VAT, tax accounting, and bookkeeping

Requirements

This UK VAT & Tax Accounting Diploma course has been designed to be fully compatible with tablets and smartphones.

Career path

The UK VAT & Tax Accounting Diploma can help you advance your career in accounting or finance. With this qualification, you could qualify for jobs such as:

- Accountant

- Bookkeeper

- Tax Advisor

- Finance manager

- Financial controller

The average salary for these roles in the UK is £25,000 to £50,000 per year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.