Sage Accredited Computerised Accounting

Awarded by SAGE | Free Accredited Certificate Included | Globally Recognised | Unlimited Access for 180 Days | LEVEL 3

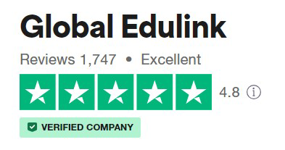

Global Edulink

Summary

'ENQUIRE NOW' for more information!

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

- TOTUM card available but not included in price What's this?

Overview

Sage Accredited Computerised Accounting - Level 3

Sage Accredited Computerised Accounting Level 3 – Global Edulink always strives to provide learners with the best possible experience, and we are proud to offer official Sage courses. These courses and qualifications are fully accredited by Sage, meaning you are receiving expert instruction, and recognised qualifications, all at an amazing price. In addition, you have access to our fantastic student portal and excellent customer service. What could be better?

Sage courses focus on accounts and payroll, and could help you to pursue the career you want, and this Computerised Accounting Level 3 Course is no different. If you have studied a level two course or above, or if you have experience using Sage in the workplace, then this course is perfect for you! Covering advanced functions in the accountancy of VAT returns and the government gateway, cash flow management, advanced credit control and final accounts for sole traders, charities, limited companies and partnerships the course will provide an excellent and detailed accountancy education.

Studying with Global Edulink has many advantages. The course material is delivered straight to you, and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 6 months. An effective support service and study materials will build your confidence to study efficiently and guide you to secure your qualification.

**PLEASE NOTE: Access to Sage 50c Payroll software for six months (06 months) – extensions to the software are available for a small extra fee.

Course media

Description

Course Objectives

Learn to:

- Control and produce month end and year end reports including accruals and prepayments, depreciation and year end adjustments.

- Prepare VAT Returns and understand how to submit returns online directly from the software via Government Gateway.

- Undertake the more advanced principles of preparing financial statements for sole traders and partnerships.

- Export and import information from spreadsheets using CSV files

- Use the advanced credit control features to find out how well the business is collecting their debts.

COURSE CURRICULUM

Module 01 : Introduction Unit

Module 02 : Use of the Journal

Module 03 : Prepare and Process Month End Routine

Module 04 : Contra Entries

Module 05 : The Government Gateway and VAT Returns

Module 06 : The Government Gateway and VAT Returns

Module 07 : The Government Gateway and VAT Returns

Module 08 : Prepare and Produce Final Accounts

Module 09 : Extended Trial Balance

Module 10 : Exporting Data including Linking to Other Systems

Module 11 : Management Information Reports

Module 12 : Making Decisions With Reports Using Sage

Module 13 : Prepare for Audit

Module 14 : Prepare and Process Year End Accounts and Archive Data

Module 15 : Final Accounts for Partnerships Including Appropriation Accounts

Module 16 : The Fixed Asset Register and Depreciation

Module 17 : Accruals and Prepayments

Module 18 : Not for Profit Organisations

Module 19 : Standard and Advanced Budgeting

Module 20 : Glossary of Accounting Terms

Method of Assessment

At the end of the course learners will complete self-assessments and a practice test, followed by a final online assessment.

Certification

Those who successfully complete this course will be awarded he Computerised Accounting Level 3 Certificate by Sage UK.

Course Description

This online training course is comprehensive and designed to cover the topics listed under the curriculum.

PLEASE NOTE: We do not provide tutor support for this course

System Requirements

Sage software is not compatible with Windows XP or Apple Macs - unless you are running Windows Vista or Windows 7 via Apple's Boot Camp utility. Sage 50 Accounts v27 - System Requirements

- Processor speed 2Ghz processor or higher.

- RAM (memory) 2 gigabytes (GB) or 4GB RAM if running a 64-bit operating system.

- Free disk space 5GB of free disk space.

- Internet connection

- Windows operating system

- Windows 10 (except Windows 10S), build 1709 or later

- Windows 8.1

- Windows 7

Requirements

- Learners must be age 16 or over and should have a basic understanding of English, Maths, and ICT.

Career path

This certificate will help improve your candidature for a range of job roles in the accounting industry. Listed below are some of the job roles this certificate will benefit you in, along with the average UK salary per annum.

- Financial Controller – £46,964 per annum

- Chartered Accountant – £35,118 per annum

- Finance Manager – £38,138 per annum

- Accountant – £28,580 per annum

Questions and answers

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.