Partnership Accounting Basics

CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

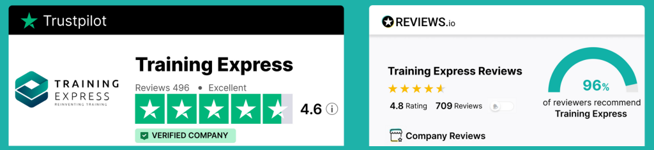

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Our comprehensive guide demystifies the complexities, providing you with a roadmap to navigate the intricate world of partners' capital accounts, profit distributions, and strategic financial decisions. In the opening chapters, we stroll through the enchanting world of partnership formations, where agreements bloom like contracts, shaping the very foundation of financial alliances.

Witness the birth of capital accounts and delve into the fascinating art of income allocation, as profits find their homes in the hands of deserving partners. As the narrative unfolds, we navigate the maze of financial statements, decoding the language of balance sheets and income statements with the finesse of a seasoned storyteller.

But the adventure doesn't end there. Brace yourself for the twists in the plot as we explore the dynamic realm of partnership changes—where financial tides ebb and flow, reshaping the landscape. And as we approach the climax, we unravel the mysteries of dissolution and liquidation, witnessing the bittersweet farewells and the settling of accounts.

Finally, we shed light on the essential coda of our tale—partnership taxation basics, demystifying the fiscal symphony that accompanies every successful financial partnership. Join us, as numbers transform into protagonists, and financial partnerships become epic sagas waiting to be written.

Key Features of Partnership Accounting Basics Course:

- This Partnership Accounting Basics Course is CPD Accredited

- FREE PDF + Hardcopy certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet and smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

CPD

Course media

Resources

- Training Express Brochure - download

Description

Course Curriculum of Partnership Accounting Basics

- Module 01: Introduction to Partnership Accounting

- Module 02: Partnership Agreement and Formation

- Module 03: Partnership Capital Accounts

- Module 04: Partnership Income Allocation

- Module 05: Partnership Financial Statements

- Module 06: Changes in Partnership

- Module 07: Dissolution and Liquidation of Partnership

- Module 08: Partnership Taxation Basics

Learning Outcomes of Partnership Accounting Basics Course:

- Analyze partnership agreements for sound financial foundations and strategic collaborations.

- Execute accurate financial calculations for partnership capital and income distributions.

- Construct comprehensive partnership financial statements demonstrating financial health and performance.

- Navigate changes within partnerships adeptly, ensuring financial continuity and adaptability.

- Facilitate dissolution and liquidation processes with precision and compliance.

- Demonstrate a nuanced understanding of partnership taxation essentials and their implications.

Accreditation

This Partnership Accounting Basics course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field.

Certificate

After completing this Partnership Accounting Basics course, you will get a FREE Digital Certificate from Training Express.

Who is this course for?

- Accounting professionals seeking a specialised understanding of partnership financial dynamics.

- Business owners aiming to enhance their Accounting management skills.

- Finance students desiring a practical grasp of partnership accounting fundamentals.

- Entrepreneurs involved in or considering establishing Partnership Accounting.

- Individuals keen on advancing their expertise in partnership taxation and accounting.

Career path

- Partnership Accountant

- Financial Analyst (Specialising in Partnerships)

- Tax Consultant for Partnerships

- Business Advisor with Focus on Financial Collaborations

- Partnership Financial Controller

- Auditor Specialising in Partnership Accounting

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.