Financial Banking Diploma

Free E - Certificate Included | CPD & IAP Accredited | Access for 365 days | No Hidden Fee

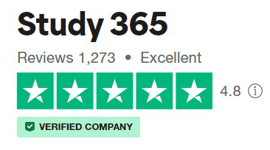

Study365

Summary

- Exam(s) / assessment(s) not included in price, and must be purchased separately

- TOTUM card available but not included in price What's this?

Overview

Diploma in Financial Banking - Level 3

This Diploma in Financial Banking – level 3 explores all about financial banking and banks as a whole and hence, is a great learning opportunity for individuals aspiring to get into or make some progress within the banking industry. Not just within the banking industry, this course also poses a great advantage for individuals aspiring to get into or already working in the accounting or finance industry.

With clear cut modules, this course aims to teach you about the essence of banking and its operation. You will come to understand how banks operate in lending and depositing money and in controlling the money supply of a country. This course will also emphasise about the importance of international banks and its functions, all the while equipping you with the best banking practices.

This professionally narrated course program takes it a step further by discussing about money creation, the different bank models and the prudential requirements. Successfully completing this course will also demonstrate your knowledge in identifying risks in banking and managing them effectively to reduce its impact on the banks.

The course has been endorsed under the Quality Licence Scheme. This means that Global Edulink* has undergone an external quality check to ensure that the organisation and the courses it offers, meet defined quality criteria. The completion of this course alone does not lead to a regulated qualification* but may be used as evidence of knowledge and skills gained. The Learner Unit Summary may be used as evidence towards Recognition of Prior Learning if you wish to progress your studies in this subject. To this end the learning outcomes of the course have been benchmarked at Level 3 against level descriptors published by Ofqual, to indicate the depth of study and level of demand/complexity involved in successful completion by the learner.

The course itself has been designed by Global Edulink* to meet specific learners’ and/or employers’ requirements which cannot be satisfied through current regulated qualifications. the Quality Licence Scheme endorsement involves robust and rigorous quality audits by external auditors to ensure quality is continually met. A review of courses is carried out as part of the endorsement process.

*Study365 is an approved reselling partner for Quality Licence Scheme courses under Global Edulink

*Regulated qualification refers to those qualifications that are regulated by Ofqual / CCEA / Qualification Wales

Achievement

Course media

Description

Learning Outcomes

- Have a clear understanding of how the banking industry operates.

- Learn the best banking practices.

- Learn how international banks function.

- Introduction to the essence of banking.

- Learn the risk of banking.

- Learn how to forecast financial projections.

Course Curriculum

1: Introduction To Banking

2: Creation Of New Money

3: Identify Risks In Banking

4: Bank Models & Prudential Requirements

5: References

Access Duration

The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time.

Method of Assessment

This online course is assignment-based with learners being assessed upon the submission of a series of assignments. Once you successfully submit the assignments, students will gain a professional qualification. The assignments must be submitted to the instructor through the online learning portal. The assignments will be reviewed and evaluated, with feedback provided to the student on how well they have fared.

Please Note: Additionally, £79 is charged for assessment and certificate and you need to pay that when you are submitting your assessments only (It is not required to pay initially when you are registering). This payment can be paid into 02 installments when you are submitting your assessments.

Certification

At the end of this course successful learners will receive a Certificate of Achievement from the Quality Licence Scheme and a Learner Unit Summary (which lists the components the learner has completed as part of the course).

Accredited Body

Accredited body (Accreditation) the Quality Licence Scheme has long-established reputations for providing high quality vocational qualifications across a wide range of industries. the Quality Licence Scheme combines over 180 years of expertise combined with a responsive, flexible and innovative approach to the needs of our customers.

Renowned for excellent customer service, and quality standards, the Quality Licence Scheme also offer regulated qualifications for all ages and abilities post-14; all are developed with the support of relevant stakeholders to ensure that they meet the needs and standards of employers across the UK.

Who is this course for?

- Financial Officer

- Accountant, Finance Managers

- Students studying Finance

Requirements

- All learners should be over the age of 19 and have a basic understanding of Maths, English and ICT.

- A recognised qualification in level 2 or above in any discipline.

Career path

- Accountant – £28,612 per annum

- Banker – £24K per annum

- Relationship Banker – £29,703 per annum

- Accounts Executive – £22,196 per annum

- Staff Accountant – £25,261 per annum

Questions and answers

You say "Exam(s) / assessment(s) not included in price & must be purchased separately" What are these?

Answer:Dear p singh Thank you very much for your query. Additionally, £79 is charged for assessment and certificate and you need to pay that when you are submitting your assessments only (It is not required to pay initially when you are registering). This payment can be paid into 02 installments when you are submitting your assessments. Regards, Student Support Team.

This was helpful.does the section on capital adequacy a) discuss Basel III or Basel II ? b) does the course calculate a bank's capital adequacy?

Answer:Dear p singh Thank you for your query. This course teaches you from Introduction To Banking to Creation Of New Money, Identify Risks In Banking, Bank Models & Prudential Requirements And you will have a clear understanding of how the banking industry operates.Learn how international banks function,risk of banking & best banking practices. Also you will learn how to forecast financial projections.The offer ends today, so hurry up and get the discount. Regards, Student Support Team.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.