Business Accounting Course

LEVEL 02 | Accredited by CPD & iAP | FREE Certificate Included | Unlimited Access for 365 Days | Quality Video Materials

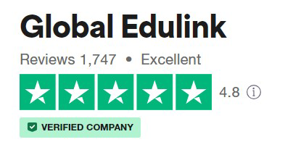

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

Overview

Business Accounting

Accounting has become an essential part of business life, and the knowledge and skills that you will learn in your studies will give you a broader and more experienced view of business life.

For a business, nothing is more important than its finances. This Business Accounting (USA standards) course will provide you with a good understanding of business accounts, and essential knowledge to those who run a small business; are considering setting one up or need to learn more about company accounts for your current or future role.

Whether you are starting your own business or supplementing your understanding of accounting, this course will help you understand accounting basics and give you meaningful financial tools in order to understand business.

Understanding the four basic financial statements, Income Statement, Balance Sheet, Statement of Retained Earnings, and Statement of Cash Flows, is a key to evaluating companies for your investment decisions. But this business course goes beyond just understanding these financial statements. Business Accounting Basics takes you through the building blocks and accounting cycles that create each statement. In addition, this Business Accounting course will give you the basic tools to project profitability and break your costs down to help analyse any company.

It’s not easy deciding on a career path with so much uncertainty in the market place. One thing is for sure: with this qualification on your CV, you can offer financial expertise to countless businesses crying out for your skills.

Our online programme is so well designed that you feel as if you are in the classroom. This Business Accounting course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 365 days (12 months). Effective support service, and study materials including step by step guided tutorial videos which build your confidence to study well and guide you to secure your qualification.

Please Note: This Course is Based on USA Standards

* Free E-certificate (No additional cost for E-certificates)

Enrol Now!!

CPD

Course media

Description

This online Business Accounting training course is comprehensive and is designed to cover the key topics listed under the curriculum.

✦COURSE CURRICULUM : Business Accounting ✦

➤(Module 01) : Introduction to Bookkeeping

- Professional Bookkeeper

- Potential careers

- Professional Bookkeeper Job Functions

- Required Traits

➤(Module 02) : Defining a Business

- Defining a Business

- Types of Business

- Role of Accounting

- Introduction - Role of Accounting

➤(Module 03) : Ethics and Accounting Principles

- Ethics in Accounting

- Generally Accepted Accounting Principles (GAAP)

- The Business Entity Principle

- Business Entity Principle

- The Matching Principle

- Other Principles

➤(Module 04) : Accounting Equation & Transactions

- The Accounting Equation

- Transactions - Knowledge Check

- Other Common Revenue & Expense Accounts

- Accounting Equation - Transactions

➤(Module 05) : Financial Statements

- Financial Statements

- Financial Statements - Income Statement

- Financial Statements - The Statement of Owner’s Equity

- Financial Statements - The Balance Sheet

- Financial Statements - The Cash Flow Statement

- Financial Statements - The Relationship

➤(Module 06) : The Accounting Equation and Transactions

- The Accounting Equation & Transactions

- Accounts

- T - Accounts

- Chart of Accounts

- Transactions - Double-Entry System

- Transactions - Normal balances

- Knowledge Check

- Transactions - Normal balance

- Knowledge Check

➤(Module 07) : Transactions – Journalizing

- Transactions - Journalizing

- Affect of Journals on the Accounts

- Transactions – Journalizing

➤(Module 08) : Posting Entries and the Trial Balance

- Posting Entries

- Entering information - Posting Entries

- Posting Entries

- The Trial Balance

- The Unadjusted Trial Balance

- Entering Information - Correcting Entry

➤(Module 09) : Finding Errors Using Horizontal Analysis

- Finding Errors Using Horizontal Analysis

➤(Module 10) : The Purpose of the Adjusting Process

- The purpose of the Adjusting Process

- Cash vs Accrual Basis

- Adjusting Process - Affected Accounts

- Depreciation Adjustment

➤(Module 11) : Adjusting Entries

- Adjusting Entries - Prepaid Expenses

- Impact of Adjusting Entries

- Adjusting Entries - Unearned Revenues

- Adjusting Process - Affected Accounts

- Adjusting Entries - Accrued Revenues

- Journal Entry - Accrued Revenues

- Posting Accounts - Accrued Revenues

- Adjusting Entries - Accrued Revenues

- Adjusting Entries - Accrued Expenses

- Journal Entry - Accrued Expenses

- Posting Accounts - Accrued Expenses

- Adjusting Entries - Accrued Expenses

- Adjusting Entries - Depreciation Expense

- Journal Entry - Depreciation Expense

- Posting Accounts - Depreciation Expense

- Adjusting Entries - Depreciation Expense

➤(Module 12) : Vertical Analysis

- Adjustment Summary - Review

- Check for Normal Balance & Debit = Credits

- Vertical Analysis

- preparing Vertical Analysis

- Vertical Analysis 13. Preparing a Worksheet

- Preparing a Worksheet

➤(Module 13) : Preparing a Worksheet

- Preparing a Worksheet

➤(Module 14) : The Income Statement

- Example Income Statement

- The Statement of Retained Earnings

- The Balance Sheet

➤(Module 15) : Financial Statements- Definitions

- Financial Statements - Definitions

➤(Module 16) : Temporary vs. Permanent Accounts

- Closing Entries - Journalizing & Posting

- Closing Entries – Post-Closing Trial Balance

➤(Module 17) : Accounting Cycle

- Accounting Cycle Illustrated – Step 1

- Accounting Cycle Illustrated – Step 2

- Accounting Cycle Illustrated – Step 3

- Accounting Cycle Illustrated – Step 4

- Accounting Cycle Illustrated – Step 5

- Accounting Cycle Illustrated – Step 6

- Accounting Cycle Illustrated – Step 7

- Accounting Cycle Illustrated – Step 8

- Accounting Cycle Illustrated – Step 9

- Accounting Cycle Illustrated – Step 10

➤(Module 18) : Financial Year

- Fiscal Year

- Working Capital and Current Ratio

➤(Module 19) : Spreadsheet Exercise

- Spreadsheet Exercise – Step 1

- Spreadsheet Exercise – Step 2

- Spreadsheet Exercise – Step 2 Answer

- Spreadsheet Exercise – Step 3

- Spreadsheet Exercise – Step 4

- Spreadsheet Exercise – Step 4 Answer

- Spreadsheet Exercise – Step 5

- Spreadsheet Exercise – Step 6

- Spreadsheet Exercise – Step 6 Answer

- Spreadsheet Exercise – Step 7

Access duration

You will have 12 months access to your online study platform from the date you purchased the course. The Business Accounting course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. This course has been designed for 10 guided learning hours.

Method of Assessment

At the end of this Business Accounting course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded Level 2 Certificate in Business Accounting.

What Will I Learn?

- Gain a good knowledge and understanding of business accounts which will be beneficial when working in a company

- Learn the essentials of accounting and the financial tools which will be utilised by businesses

- Understand the key 4 financial statements which are income statement, balance sheet, statement of retained earnings, and statement of cash flows thoroughly

- Learn how to evaluate different statements of organisations effectively to make good investment decisions

- Learn the building blocks of accounting and the accounting cycles

- Learn to project profitability and cost breakdown structures

Who is this course for?

- This Business Accounting course will be of great interest to business owners and business professionals who would like to better understand the transactions and controls used in business, and to any learner who is interested in accounting as a future career.

Requirements

- This Business Accounting course requires no formal prerequisites and this certification is open to everyone

Career path

- Accountant – £28,599

- Finance Manger – £38,059

- Payroll Administrator – £20,010

- Account Clark – £17,205

- Account Assistant – £20,341

- Office Administrator – £17,448

- Office Manager - £24,398

- Accounts Payable Clerk – £19,766

- Accounts Receivable Clerk – £20,228

- Payroll Clerk – £18,528

Per Annum

Questions and answers

Are there any exams included in this course or is it just assignment based?

Answer:Kindly note that at the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.