Accounting Masterclass: Decoding Financial Insights for Effective Decision Making

Sale On Going | 20-in-1 Premium Bundle | CPD Accredited | 20 PDF Certificates + 1 Hard-Copy Certificate| Lifetime Access

Skill Up

Summary

- Certificate of completion - Free

- Certificate of completion - £9.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

[Updated 2024]

In the UK, the demand for skilled accounting professionals is consistently high, with an average salary of £40,000 per annum. The Accounting: Accountancy Training course provides a comprehensive overview of the fundamental principles of accounting and financial statements.

This bundle course has been specially designed to help learners gain a good command of Introduction to Accounting, providing them with a solid foundation of knowledge to become qualified professional.

This training has covered all the latest topics to keep you better prepared for your Accounting profession.

Enrol now for a successful career!

This Accounting Masterclass Bundle Consists of the Following Courses:

- ➽ Course 01: Introduction to Accounting

- ➽ Course 02: Managerial Accounting Masterclass

- ➽ Course 03: UK Tax Accounting

- ➽ Course 04: Xero Accounting Diploma

- ➽ Course 05: Theory of Constraints, Throughput Accounting and Lean Accounting

- ➽ Course 06: Introduction to Internal Audit

- ➽ Course 07: Business Analysis

- ➽ Course 08: Payroll Management Course

- ➽ Course 09: Sage 50 Payroll Intermediate Level

- ➽ Course 10: Microsoft Excel Training: Depreciation Accounting

- ➽ Course 11: GDPR Training

- ➽ Course 12: Online Bookkeeping and Quickbooks Course

- ➽ Course 13: Microsoft Excel Complete Training

- ➽ Course 14: Business Accounting Training

- ➽ Course 15: Applied Accounting

- ➽ Course 16: Charity Accounting

- ➽ Course 17: Understanding Financial Statements and Analysis

- ➽ Course 18: Financial Statements Fraud Detection Training

- ➽ Course 19: Financial Controller

- ➽ Course 20: Anti-Money Laundering (AML) Training

Learning Outcomes of Accounting Masterclass:

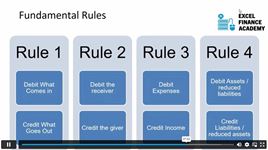

- Understand the basic principles of financial accounting and the double-entry system.

- Learn about the financial accounting process and the generation of financial statements.

- Understand the chart of accounts and how to classify accounts.

- Learn about external and internal transactions with companies.

CPD

Course media

Description

Experts with years of Accounting expertise have created the curriculum for this bundle. This bundle is lively and well-paced to assist you in quick learning.

Here is the course curriculum for the primary Title Course in this bundle:

➽ Course 01: Introduction to Accounting Course Curriculum:

- Lecture 1: What is Financial Accounting

- Lecture 2: Accounting Double Entry System and Fundamental Rules

- Lecture 3: Financial Process and Financial Statements Generation

- Lecture 4: Basic Accounting Equation and Four Financial Statements

- Lecture 5: Define Chart of Accounts and Classify the Accounts

- Lecture 6: External and Internal Transactions with Companies

- Lecture 7: Short Exercise to Confirm Learning

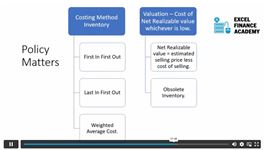

- Lecture 8: Major Accounting Policies Decided by Companies

- Lecture 9: Depreciation Policies

- Lecture 10: Operational Fixed Asset Controls

- Lecture 11: Inventory Controls

- Lecture 12: Revenue Controls

- Lecture 13: Expenses and Working Capital

----------and 19 more Courses----------

Assessment

After completing all the modules of the Accounting, your learning will be assessed by an assignment or multiple-choice based exam. You may choose to participate in a Mock Exam before attending the bundle completion Final Exam with no extra cost.

Who is this course for?

This Accounting Masterclass training is open to anyone with an interest in Accounting.

- Individuals seeking to enhance their understanding of financial statements.

- Small business owners looking to gain insight into basic principles.

- Professionals aiming to expand their knowledge of financial controls and policies.

If you want to excel in this field and stand out in your future job, grab this bundle NOW!

Requirements

Since no prior knowledge or experience is required.

Take your time to finish this Accounting Masterclass bundle and there is no deadline for the Bundle.

Career path

- Accountant - £24,000 - £60,000 per annum

- Auditor - £18,000 - £50,000 per annum

- Financial Analyst - £24,000 - £60,000 per annum

- Tax Accountant - £20,000 - £50,000 per annum

- Management Accountant - £28,000 - £55,000 per annum

- Accounts Payable/Receivable Clerk - £16,000 - £25,000 per annum

- Certified Public Accountant (CPA): £40,000 - £80,000 per annum

- Bookkeeper: £20,000 - £25,000 per annum

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

This Accounting Bundle comes with FREE CPD Accredited PDF certificates, making this bundle an excellent value for money.

Certificate of completion

Hard copy certificate - £9.99

Receive a free CPD Accredited Hard Copy certificate just for the Introduction to Accounting course. The CPD Accredited Hard Copy certificate for additional courses can be ordered separately for £9.99 per copy. The delivery fee for the hardcopy certificates, however, is free for UK residents, whereas it costs £10 for international students as delivery charge.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.