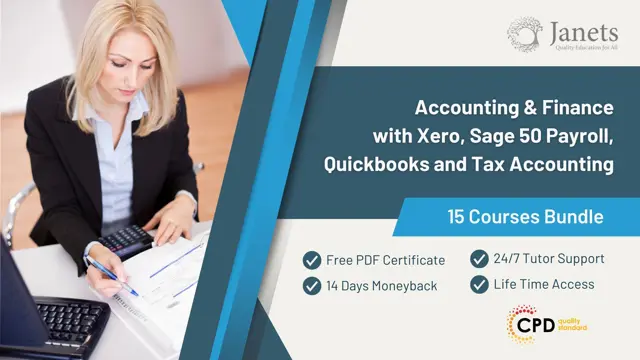

Accounting and Finance with Xero, Sage 50 Payroll, QuickBooks and Tax Accounting

15 Courses Bundle | CPD Certified | 150 CPD Points | Free PDF & Hardcopy Certificate | Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

In the sprawling landscape of financial management, there's often a gnawing frustration that transcends the confines of any spreadsheet or ledger. It's the constant battle with numbers, the unrelenting complexity of financial transactions, and the ever-evolving tax codes that seem to speak a language of their own. For those who aspire to master Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting, it's about breaking free from the shackles of financial intricacies, conquering the chaos and gaining control over the monetary world.

Your role in this domain isn't just significant; it's pivotal. This is unsurprising as financial expertise is the backbone of every successful business. So how can our Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting course help? Well, our Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle course will help you gain the knowledge and skills needed to conquer the complex world of finance. You will also unearth the secrets of Xero Accounting, unravel the complexities of bookkeeping, and master the intricacies of payroll management. Dive deep into VAT returns and taxation, cultivate financial analysis skills, and explore the world of financial investigation and forensic accounting. Lastly, you will get a thorough introduction to internal audit skills, UK internal audit standards and control risks.

It's time to take control of your financial future by unlocking the power of numbers. Enrol today, empower yourself with the knowledge to transform chaos into clarity, and let your financial expertise shine!

Learning Outcome

By the end of this Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle, you will be able to:

- Proficiently manage financial records using Xero Accounting and Bookkeeping.

- Develop skills in accounting and finance, enabling you to make informed financial decisions.

- Gain the expertise to perform accurate bookkeeping and financial accounting tasks with precision.

- Successfully navigate the intricacies of Value Added Tax (VAT) with confidence.

- Master the principles and practices of Tax Accounting in compliance with UK tax laws.

- Develop proficiency in managing pension schemes and related financial aspects.

- Attain mastery in using Sage 50 Accounts software for effective financial management.

- Learn to manage a Purchase Ledger efficiently, streamlining financial transactions.

- Enhance your financial analysis skills, allowing you to interpret and communicate financial data effectively.

- Develop expertise in Forensic Accounting, including fraud detection and investigation techniques.

Standout features of studying Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle with Janets:

- The ability to complete the Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle at your own convenient time

- Online free tests and assessments to evaluate the progress

- Facility to study Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle from anywhere in the world by enroling

- Get all the required materials and documentation after getting enrolled in the Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle

- Get a free E-certificate, Transcript, and Student ID with Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle

- Expert-designed Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle with video lectures and 24/7 tutor support

CPD

Course media

Description

This Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting Bundle is a comprehensive program designed to equip you with a diverse range of skills in accounting, finance, and business management. Throughout this Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle, you will delve into various aspects of accounting and bookkeeping, mastering tools like Xero and Sage 50 Accounts. You will gain a solid foundation in financial accounting, bookkeeping, and taxation, enabling them to handle HR, payroll, PAYE, and tax-related tasks efficiently. Furthermore, you will become proficient in VAT, tax accounting, pension management, and financial analysis, acquiring the knowledge required to make informed financial decisions.

This Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle also covers critical topics such as financial management fundamentals, forensic accounting, internal audit skills, and financial investigation techniques, making you adept at safeguarding financial integrity and uncovering irregularities. By the end of this Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle course, you will be well-prepared to excel in various financial and accounting roles, with a comprehensive skill set that meets the demands of today's business world.

The Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting Bundle comes with one of our best-selling Accounting and Finance courses with a FREE hardcopy certificate along with 14 additional CPD Certified courses:

- Course 01: Xero Accounting and Bookkeeping Training

- Course 02: Bookkeeping and Financial Accounting

- Course 03: HR, Payroll, PAYE, TAX

- Course 04: Introduction to VAT

- Course 05: Tax Accounting

- Course 06: Pension

- Course 07: Sage 50 Accounts

- Course 08: Purchase Ledger

- Course 09: Financial Analysis

- Course 10: Financial Management Fundamentals

- Course 11: Forensic Accounting

- Course 12: Internal Audit Skills

- Course 13: Financial Investigator

- Course 14: Quickbooks Online Training

Method of Assessment

To complete the Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting bundle, students will have to take an automated multiple-choice exam for all the courses. These exams will be online, and you must score 60% or above to pass. After passing the exams, you will be able to apply for the certificates.

Who is this course for?

This Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting Bundle course is for:

- Aspiring finance professionals seeking a comprehensive education in accounting and finance.

- Individuals aiming to enhance their career prospects by gaining expertise in financial management.

- Anyone interested in understanding the intricacies of financial transactions and taxation in the UK.

- Recent graduates looking to build a strong foundation in financial management.

- Employees in the finance and accounting sector wishing to expand their skillset.

- Mid-career professionals exploring opportunities for career advancement in finance.

- Business owners and entrepreneurs looking to manage their finances effectively.

Requirements

No prior qualifications are needed for learners to enrol on this Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting Bundle.

Career path

Here are a few careers you can opt for after completing the Accounting and Finance with Xero, Sage 50 Payroll, Quickbooks and Tax Accounting Bundle:

- Accountant: £30,000 - £60,000

- Financial Analyst: £35,000 - £70,000

- Tax Advisor: £35,000 - £70,000

- Payroll Manager: £35,000 - £60,000

- Forensic Accountant: £40,000 - £75,000

- Internal Auditor: £40,000 - £70,000

- Financial Investigator: £40,000 - £70,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.