Sage UK Certified Sage 50c Computerised Payroll Course (Level 3)

Free PDF Certificate Included | Unlimited Access for 365 Days | No Additional Fees | LEVEL 3

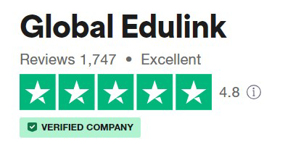

Global Edulink

Summary

'ENQUIRE NOW' for more information!

- Exam(s) / assessment(s) is included in price

- TOTUM card available but not included in price What's this?

Add to basket or enquire

Overview

Sage UK Certified Sage 50c Computerised Payroll (Level 3)

Sage courses focus on accounts and Payroll, and could help you to pursue the career you want, and this Sage UK Certified Sage 50c Computerised Payroll Level 3 Course is no different. This level 3 qualification is ideal for those who are already employed in payroll or have similar job roles or run their own business. If you hope to enhance your existing skills and knowledge performing advanced routine and non-routine tasks using a computerised payroll package.

Studying with Global Edulink has many advantages. The course material is delivered straight to you, and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 6 months. An effective support service and study materials will build your confidence to study efficiently and guide you to secure your qualification.

Course media

Resources

- Brochure -

Description

Course Objectives

Learn to:

- Enter voluntary and statutory additions and deductions

- Process the payroll for different periods including the correction of errors

- Produce reports to enable reconciliation of payments and deductions to external agencies including HMRC and pension providers

- Operate national insurance for directors

- Maintain payroll data and system security

- Process period and year end information and produce all required reports

COURSE CURRICULUM

Module 01 : Revision Of The Syllabus Of Level 2 Computerised Payroll

Module 02 : Level 2 Learning Outcomes And Summary Of Assessment Criteria

Module 03 : Introduction - Computerised Payroll Level 3

Module 04 : Sage 50 Payroll Installation Instructions

Module 05 : Screenshots, Tasks And Activities

Module 06 : Creating A New Company In Sage Payroll

Module 07 : Computerised Payroll Administration

Module 08 : Pension Schemes

Module 09 : The Government Gateway

Module 10 : Real Time Information (Rti)

Module 11 : Processing The Payroll Under Rti

Module 12 : Period End – The P32

Module 13 : The Employer Payment Submission (Eps)

Module 14 : Starters, Leavers, Salary Sacrifice And Net Payments

Module 15 : The Cost Of Wages

Module 16 : Payroll Verification And Reconciliation

Module 17 : Advance Pay, Holiday Schemes And Statutory Adoption Pay

Module 18 : Error Corrections And The Fps

Module 19 : Data Security

Module 20 : Termination Of Employment

Module 21 : Year End Processing

Module 22 : Glossary Of Payroll Terms

Method of Assessment

At the end of the course learners will complete self-assessments and a practice test, followed by a final online assessment.

Certification

Those who successfully complete this course will be awarded with the Sage 50c Computerised Payroll Level 3 Certificate from Sage UK

Course Description

- This online training course is comprehensive and designed to cover the topics listed under the curriculum.

- PLEASE NOTE: We do not provide tutor support for this course

Requirements

Learners must be age 16 or over and should have a basic understanding of English, Maths, and ICT.

Career path

- Account Manager – £26,912 per annum

- Auditor – £28,849 per annum

- Benefits Specialist – £25,569 per annum

- Bookkeeper – £20,767 per annum

- Finance Officer – £22,643 per annum

- Payroll Officer – £22,185 per annum

- Payroll Manager – £30,759 per annum

Questions and answers

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.