Sage 50 : Sage 50 Accounts and Payroll

Accredited by CPD & IAP | FREE Digital Certificate | Premium Quality Video Lessons | No Hidden Fees

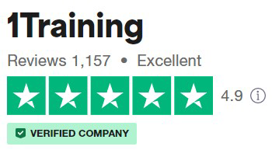

1 Training

Summary

- Exam(s) / assessment(s) is included in price

Add to basket or enquire

Overview

Sage 50 Accounts and Payroll

Need to get to grips with Sage 50?

Do you need to get to grips with Sage 50 for Accounts and Payroll? This Sage 50 Accounts and Payroll course is the perfect option, and will help you to master the software for work or personal use. Sage 50 is the world’s most popular accounting software and is used by many businesses worldwide, so it is a must for accountants and bookkeepers.

Our learning material is available to students 24/7 anywhere in the world, so it’s extremely convenient. These online courses are open to everyone, all you need is an interest in learning! We provide world-class learning led by IAP, so you can be assured that the material is high quality, accurate and up-to-date.

PLEASE NOTE: Sage 50 Software is not provided with this package. All learners are required to have purchase software separately

What skills am I going to get from this Sage 50 Accounts and Payroll course?

- Get to know all of the features and functions of Sage 50

- Learn to navigate the program and to create and set up a new company

- Understand the settings and their effect on automated features and functions

- This Sage 50 Accounts and Payroll course will teach you to record daily business

- Record revenues and sales invoices

- Understand how to keep your data secure with Sage 50 Accounts and Payroll

- Learn how to un-do or adjust transactions using the course Sage 50 Accounts and Payroll.

- Develop your knowledge of financial and other reports using this Sage 50 Accounts and Payroll course

PLEASE NOTE: We do not provide tutor support for this course

CPD

Course media

Description

COURSE CURRICULUM

➽ (Module 01)

- Introduction to Sage 50

- Using Menu Bar and Common Business Terms

- Creating a Sage 50 Company

- The Payroll Set Up

- Making a Backup

➽ (Module 02)

- Setting up Security and Creating Users

- Adding and Deleting Accounts

- Adding General Journal Entries

- Entering Account Budgets

- Using Sales Tax

➽ (Module 03)

- Entering Records

- Entering Inventory

- Accounts Receivable – Setting Statement and Invoice

- Accounts Receivable – Quotes

- Accounts Receivable – The Sales Orders

- Accounts Receivable -Credits Memos and The Receive Money

➽ (Module 04)

- Accounts Payable – The Purchase Orders

- Accounts Payable -The Payment Window

- Managing Inventory – Making Inventory Adjustments

- Creating Payroll – Adding Employees

- Creating Payroll – Paying Employees

➽ (Module 05)

- Account Management – Writing Cheques

- Account Management – Reconciling Bank Accounts

- Job Tracking – Setting up a Job

- Job Tracking – Making a Purchases for Jobs

- Job Tracking – Invoicing for Job Purchases

➽ (Module 06)

- Time and Billing – Entering Activity Items

- Time and Billing – Entering Expense Tickets

- Changing System Settings – Posting Methods

- Changing System Settings – Memorised Transactions

➽ (Module 07)

- Reporting – The Cash Manager

- Reporting – Find on Report

- Reporting – Modifying Reports

- The Internal Accounts Review

- Action Items – Events and Alerts

- Options – Changing Global Options

➽ (Module 08)

- Assets and Liabilities – Creating Current Assets Account

- Assets and Liabilities – Creating a Fixed Assets Account

- Assets and Liabilities – Liability Accounts

- Using the Index

Method of assessment

- At the end of the Sage 50 Accounts and Payroll course learners will take an online multiple choice question assessment test. This online multiple choice question test is marked automatically so you will receive an instant grade and know whether you have passed the course.

- Those who successfully pass this Sage 50 Accounts and Payroll course will be awarded a free e-certificate, and only need to pay £19 for your printed certificate.

Certification

Upon the successful completion of this Sage 50 Accounts and Payroll course, you will be awarded the “Diploma in Sage 50 Training – Accounts & Payroll”

Who is this course for?

- Job hunters & School leavers

- College or University student & graduates

- Account assistant, Account clerk or Bookkeeping assistant

- Payroll administrator or Payroll clerk

- Accounts manager or Office manager

- Office clerk or Administration Assistant

- Finance controller

Requirements

- You must be 16 or over

- You should have a basic understanding of English, Maths and ICT

- You will need a computer or tablet with internet connection (or access to one)

- You will need to have access to a computer with Sage 50 installed on to it

Career path

With this Sage 50 Accounts and Payroll diploma, you are able to fulfil various roles, such as:

- Accountant – £28,571 per annum

- Payroll Manager – £30,713 per annum

- Office Manager – £24,447 per annum

- Office Administrator – £17,472 per annum

Questions and answers

I need to learn SAGE 50 accounts for my new job and it needs to be V26 - can you confirm this is it please?

Answer:Dear Anna, Thank you very much for your query. This Sage 50 Diploma is accredited by CPD & IAP, Kindly note the v26 is the version of the software with the features update that you need have installed in your computer but the theory explained in this course is same for all versions. Regards, Student Support Team.

This was helpful.Which sage 50 do we need for this course Sage 50 essential,professional or standard..??

Answer:Dear Albert Thank you very much for your query. Generally the standard is enough, However please contact the service provider for more information. Hurry up ! as the discount ends soon. Regards, Student Support Team.

This was helpful.Hi, will l need to purchase a Sage licence myself to install on my laptop or is it provided for/included in the course cost advertised on reed.

Answer:Dear Chris, Thank you for your query. You’ll need a computer or tab with an internet connection and Sage 50 software installed in it. Also, it’s better to have a notepad and a pen with you. Regards, Student Support team

This was helpful.

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.