Business Accounting Diploma

Accredited by CPD & iAP | FREE PDF Certificate Included | Unlimited Access for 365 Days | Quality Study Materials

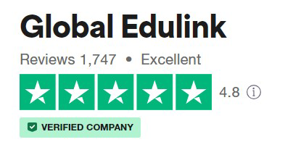

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Business Accounting Diploma

Accounting has become an essential part of business life, and the knowledge and skills that you will learn during this Business Accounting Diploma (USA standards) will give you a broader and more experienced view of business life.

For a business, nothing is more important than its finances. This Business Accounting Diploma course will provide you with a good understanding of business accounts, essential knowledge if you run a small business; are considering setting one up or need to learn more about company accounts for your current or future role.

Whether you are starting your own business or supplementing your understanding of accounting, this course will help you understand accounting basics and give you meaningful financial tools to understand business.

Understanding the four basic financial statements, Income Statement, Balance Sheet, Statement of Retained Earnings, and Statement of Cash Flows, is a key to evaluating companies for your investment decisions. But this business course goes beyond just understanding these financial statements. Business Accounting Basics takes you through the building blocks and accounting cycles that create each statement. In addition, this course will give you the fundamentals needed to project profitability and break your costs down to help analyse any company.

It’s not easy deciding on a career path with so much uncertainty in the market place. One thing is for sure: with this qualification on your CV, you can offer financial expertise to countless businesses crying out for your skills.

Our online program is so well designed that you will feel as if you are in the classroom! The course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests and exams. All delivered through a system that you will have access to 24 hours a day, 7 days a week for 365 days (12 months). An effective support service, and study materials (including step by step guided tutorial videos) enable you to study effectively and guide you to secure your qualification.

Please Note: This Course is Based on USA Standards

* Free e-certificate (No additional cost for e-certificates)

CPD

Course media

Description

COURSE CURRICULUM

Module 01 : Bookkeeping and Payroll Management

- Introduction to Bookkeeping and Payroll

- Transactions

- Internal Controls and Control Concepts

- Working with Ledgers

- Reconciliation

- Correcting Entries

- Sales Tax, Rules and Filing

- Budgeting & Strategic Plan

- Types of Budgets

- Merchandising Income Statement

- Sales and Purchase Discounts

- Petty Cash

- Cash Controls – The Bank Reconciliation

- The Payroll Process

- Payroll Process – Earnings Record

- The Partnership & Corporations

- Accounts Receivable and Bad Debts

- Preparing Interim Statements

- Year End – Inventory

Module 02 : Module Handouts - Bookkeeping and Payroll Management

Module 03 : Business Accounting

- Introduction to Bookkeeping

- Defining a Business

- Ethics and Accounting Principles

- Accounting Equation & Transactions

- Financial Statements

- The Accounting Equation and Transactions

- Transactions – Journalizing

- Posting Entries and The Trial Balance

- Finding Errors Using Horizontal Analysis

- The Purpose of the Adjusting Process

- Adjusting Entries

- Vertical Analysis

- Preparing a Worksheet

- The Income Statement

- Financial Statements- Definitions

- Temporary vs. Permanent Accounts

- Accounting Cycle

- Financial Year

- Spreadsheet Exercise

Module 04 : Additional Study Materials

- Additional Study Materials- Business Accounting

Course Duration:

You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. This course has been designed for 20 guided learning hours.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice question test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded Level 3 Diploma in Business Accounting.

Benefits you will gain:

By enrolling in to this course, you’ll get:

- High quality e-learning study materials and mock exams.

- Tutorials/materials from the industry leading experts.

- Includes step-by-step tutorial videos and an effective, professional support service.

- 24/7 Access to the Learning Portal.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Who is this course for?

- This Diploma course will be of great interest to business owners and business professionals who would like to better understand the transactions and controls used in business, and to any learner who is interested in accounting as a future career.

Requirements

- This course requires no formal prerequisites and this certification is open to everyone

Career path

- Finance Controller – £46,887

- Accountant – £28,599

- Finance Manger – £38,059

- Payroll Administrator – £20,010

- Account Clark – £17,205

- Bookkeeper – £20,729

- Office Manager - £24,398

- Accounts Receivable Clerk – £20,228

- Payroll Clerk – £18,528

- Staff Accountant – £23,858

Per Annum

Questions and answers

As an absolute beginner, will I be able to thoroughly understand the course?

Answer:Yes, We can assure that with the given materials and support as a beginner for accounting, this diploma course will help you to understand accounting basics and give you meaningful financial tools to understand the course in depth.

This was helpful.Can I purchase this on behalf of another person and still ensure that their name is shown on the certificate?

Answer:Yes, Kindly note that you can purchase the course and send us an E-mail with the details of the learner and we can create the logins accordingly. Kindly make sure to send us the correct name and the required details.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.