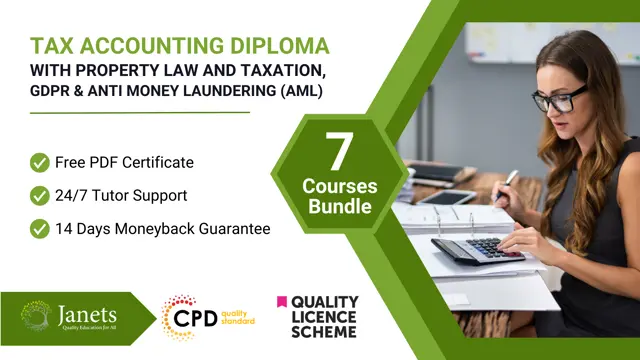

Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML)

4 QLS Endorsed Courses + 3 CPD Certified Courses | 7 FREE PDF Certificate | 4 FREE QLS Endorsed Hardcopy Certificate

Janets

Summary

- CPD PDF Certificate of Completion - Free

- QLS PDF Certificate of Completion - Free

- Hard Copy Certificate of Completion - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Tired of feeling lost in a sea of tax forms and financial jargon? Want to sail smoothly through the complexities of tax accounting? Look no further than our Tax Accounting Diploma Course - your compass to success!

Become a seasoned tax expert with our comprehensive Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) Course. We've packed seven courses that will empower you with the knowledge you need to navigate the ever-changing tax landscape. From mastering property law and taxation to understanding the ins and outs of GDPR, we've got you covered.

Explore the world of taxes with our Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) Course - because when it comes to financial matters, we're the captain of the ship you can trust!

Learning outcomes

- Gain comprehensive knowledge of Tax Accounting principles and practices.

- Understand the legal aspects of taxation and property law.

- Develop expertise in Anti-Money Laundering (AML) procedures.

- Acquire knowledge of the General Data Protection Regulation (GDPR).

- Master fundamental accounting principles and financial management.

- Utilise management accounting tools for effective decision-making.

This Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) Course has covered a total of 7 courses.

QLS Endorsed Courses -

- Course 01: Diploma in Tax Accounting at QLS Level 5

- Course 02: Certificate in Property Law And Taxation at QLS Level 3

- Course 03: Diploma in Anti-Money Laundering (AML) at QLS Level 5

- Course 04: Advanced Certificate in GDPR at QLS Level 3

CPD QS Accredited Courses -

- Course 05: Introduction to Accounting

- Course 06: Accounting and Finance

- Course 07: Management Accounting Tools

Don't miss the chance to secure your future in this dynamic field. Enrol today to unlock your potential and pave the way for a successful financial career!

Achievement

CPD

Course media

Description

Welcome to the world of Tax Accounting! Unlock your potential and embark on a rewarding journey with our Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) Course. With a comprehensive curriculum encompassing seven diverse courses, you'll gain an in-depth understanding of tax accounting, property law, anti-money laundering, GDPR, and vital accounting and finance concepts. In the UK, the demand for tax accountants is ever-growing, and this course equips you with the essential skills to excel in this field. Join us to explore tax accounting and secure a prosperous future in finance.

Discover the vast opportunities that await in the world of tax accounting and finance. In the UK, the financial industry is thriving, and the demand for skilled tax professionals is ever-increasing. Our Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) courses equip you with comprehensive knowledge of tax principles, legal frameworks, and financial management. With the expertise gained from our endorsed and accredited courses, you'll be prepared to embark on a rewarding career in tax accounting.

Course Curriculum:

Tax Accounting

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamentals of Income Tax

- Module 06: Advanced Income Tax

- Module 07: Payee, Payroll and Wages

- Module 08: Capital Gain Tax

- Module 09: Value Added Tax

- Module 10: Import and Export

- Module 11: Corporation Tax

- Module 12: Inheritance Tax

- Module 13: Double Entry Accounting

- Module 14: Management Accounting and Financial Analysis

- Module 15: Career as a Tax Accountant in the UK

Property Law and Taxation Training

- Module 1: The Property Law and Practice

- Module 2. Ownership and Possession of the Property

- Module 3. Co-Ownership in Property

- Module 4: Property Taxation on Capital Gains

- Module 5: VAT on Property Taxation

- Module 6: Property Taxation Tips for Accountants and Lawyers

- Module 7: Changes in the UK Property Market

Anti-Money Laundering (AML) Training

- Module 01: Introduction to Money Laundering

- Module 02: Proceeds of Crime Act 2002

- Module 03: Development of Anti-Money Laundering Regulation

- Module 04: Responsibility of the Money Laundering Reporting Officer

- Module 05: Risk-based Approach

- Module 06: Customer Due Diligence

- Module 07: Record Keeping

- Module 08: Suspicious Conduct and Transactions

- Module 09: Awareness and Training

GDPR

- Module 01 - GDPR Basics

- Module 02 - GDPR Explained

- Module 03 - Lawful Basis for Preparation

- Module 04 - Rights and Breaches

- Module 05 - Responsibilities and Obligations

Introduction to Accounting

- Section 01: Accounting Fundamental

- Section 02: Accounting Policies

Accounting and Finance

- Module 01: Introduction to Accounting and Finance

- Module 02: The Role of an Accountant

- Module 03: Accounting Process and Mechanics

- Module 04: Introduction to Financial Statements

- Module 05: Financial Statement Analysis

- Module 06: Budgeting and Budgetary Control

- Module 07: Financial Markets

- Module 08: Financial Risk Management

- Module 09: Investment Management

- Module 10: Auditing

Management Accounting Tools

- Module 01: Introduction to Management Account

- Module 02: Manufacturing Costs and Financial Statements

- Module 03: Traditional Costing System – Job and Process

- Module 04: Activity Based Costing System

- Module 05: Activity Based Management

- Module 06: Cost Behaviour and the Contribution Margin

- Module 07: Cost Volume Profit

- Module 08: Cost Volume Profit Analysis

- Module 09: Incremental Analysis in Decision Making

- Module 11: Budget Control And Responsibility Accounting

- Module 10: Budget Planning

- Module 12: Control Using Standard Costs and the Balanced Scorecard

Method of Assessment

To successfully complete the course, students will have to take an automated multiple-choice exam. This exam will be online, and you will need to score 60% or above to pass the course.

After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Who is this course for?

This Tax Accounting Diploma with Property Law and Taxation, GDPR & Anti Money Laundering (AML) courses are ideal for individuals aspiring to pursue a career in finance, taxation, or accounting. It is suitable for recent graduates, accounting professionals seeking to specialise in taxation, or those aiming to enhance their knowledge in this domain. The course caters to individuals who seek a deep understanding of tax laws, financial compliance, and accounting practices to excel in the industry.

Requirements

No prior qualifications are needed for Learners to enrol on this bundle.

Career path

- Tax Accountant - £30K to 50K/year.

- Financial Analyst - £35K to 55K/year.

- Compliance Officer - £25K to 45K/year.

- Accounting Manager - £40K to 60K/year.

- Financial Controller - £45K to 70K/year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD PDF Certificate of Completion

Digital certificate - Included

QLS PDF Certificate of Completion

Hard copy certificate - Included

Hard Copy Certificate of Completion

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.